NVIDIA Company NVDA has delivered better-than-expected gross sales and earnings in its newest quarterly report because it continues to progress banking on the incessant demand for its synthetic intelligence (AI) chips.

Amid the latest information heart success, NVIDIA inventory stays attractively priced, reveals a bullish development, and is basically robust, making it purchase for buyers. Let’s see intimately –

NVIDIA Inventory – Constructive Q3 Knowledge Middle End result & Outlook

NVIDIA just lately reported fiscal third-quarter outcomes, by which its revenues jumped 94% to $35.1 billion from the identical interval a yr in the past. Earnings per share (EPS) got here in at $0.81, up 103% from a yr in the past.

The corporate’s revenues exceeded Wall Road expectations as a result of document positive factors from the information heart enterprise. Third-quarter revenues from the information heart got here in at $30.8 billion, up 112% from a yr in the past.

CEO Jensen Huang admitted that demand for its Superchips and associated {hardware} was strong, notably for its current Hopper chips. Huang expects continued excessive demand for Hopper chips into subsequent yr.

The superior H200 chips will probably be out there in a number of cloud companies, resembling Azure, Google Cloud and AWS. Past massive tech cloud operators, Denmark launched its AI supercomputer pushed by H100 Tensor Core graphic processing models (GPUs). The federal government’s demand for Hopper chips, past personal firms, fuels NVIDIA’s rising information heart enterprise within the data arms race.

Nevertheless it’s not all about Hopper chips, Huang clarified that the demand for the much-awaited next-generation Blackwell chips stays “staggering” for the fourth quarter and subsequent yr.

Corporations like Microsoft Company MSFT and Meta Platforms, Inc. META will possible undertake the Blackwell chips for greater AI throughput than the present Hopper chips. The Blackwell platform can improve AI coaching efficiency and practice giant language fashions cost-effectively.

In line with SoftBank Corp, NVIDIA’s Blackwell platform will construct Japan’s strongest AI supercomputer. Additionally, NVIDIA’s Blackwell platform might energy Taiwan’s quickest AI supercomputer. Subsequently, the information heart enterprise will drive NVIDIA’s success and enhance its share value, making it an attractive purchase.

NVIDIA Inventory is Much less Expensive Than Its Friends

NVIDIA’s robust third-quarter efficiency comes as no shock for the reason that firm has been delivering promising quarterly outcomes for fairly a while. NVIDIA is likely one of the high performers on the S&P 500 and is essentially the most precious firm.

Regardless of all of the success, shopping for NVIDIA inventory as of now will burn a smaller gap in your pocket than its friends. In spite of everything, per the worth/earnings, the NVDA inventory trades at 51.7X ahead earnings, lower than the Semiconductor – General trade’s 59.6X ahead earnings a number of.

Picture Supply: Zacks Funding Analysis

NVIDIA Inventory Has Bullish Chart Patterns

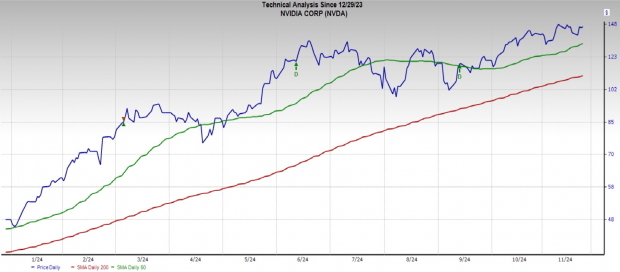

Regardless of NVIDIA’s commendable third-quarter efficiency, its share value dipped initially because the hype surrounding its earnings outcomes was insane. The inventory was in overbought territory and a short-term dip after the earnings launch was inevitable.

Nonetheless, the NVIDIA inventory is at present buying and selling above the short-term 50-day shifting common (DMA) and long-term 200-DMA, a tell-tale bullish development, making it a sound funding choice.

Picture Supply: Zacks Funding Analysis

NVIDIA Inventory is Basically Stable

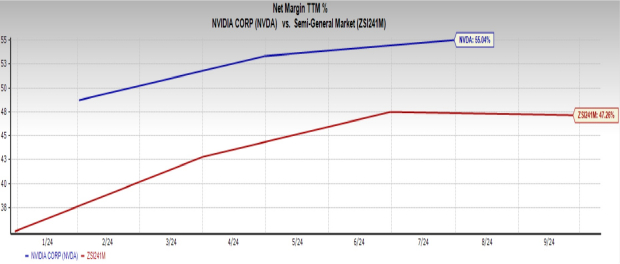

NVIDIA has been capable of handle its prices effectively and generate income persistently for a considerably very long time, which anyhow makes it the very best inventory to spend money on.

NVIDIA’s internet revenue margin is 55%, greater than the trade’s 47.3%. Any studying better than 20% signifies a excessive revenue margin.

Picture Supply: Zacks Funding Analysis

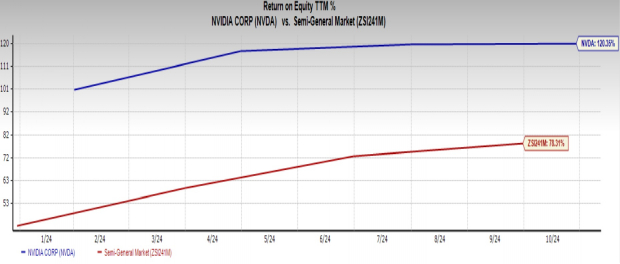

Equally, NVIDIA’s return on fairness (ROE) of 120.4% exceeded the trade common of 78.3%, showcasing that the web earnings surpassed fairness.

Picture Supply: Zacks Funding Analysis

NVIDIA, thus, rightfully has a Zacks Rank #1 (Sturdy Purchase) (learn extra: This Is Why NVIDIA Joined the Dow; And Why It’s Time to Buy). You possibly can see the complete list of today’s Zacks Rank #1 stocks here.

5 Shares Set to Double

Every was handpicked by a Zacks skilled because the #1 favourite inventory to achieve +100% or extra in 2024. Whereas not all picks will be winners, earlier suggestions have soared +143.0%, +175.9%, +498.3% and +673.0%.

Many of the shares on this report are flying underneath Wall Road radar, which supplies an ideal alternative to get in on the bottom flooring.

Today, See These 5 Potential Home Runs >>

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.