Taiwan Semiconductor Manufacturing Firm Restricted TSM, higher referred to as TSMC, noticed its shares scale northward after posting report fourth-quarter internet earnings, which topped analysts’ projections. The foundry behemoths’ fourth-quarter internet revenue soared 57% to $374.68 billion from a yr earlier, pushed by a surge in demand for synthetic intelligence (AI) chipsets.

However it’s not the most recent quarterly consequence that propelled its shares larger. The TSMC inventory has already gained 91% up to now yr with the appearance of AI. Nevertheless, can the TSMC inventory maintain this development and stay purchase? Let’s see –

3 Causes to be Bullish on TSMC Inventory

Whereas the present quarterly outcomes have boosted the TSMC inventory, the long-term development trajectory is dependent upon the long-term development prospects. TSMC’s first-quarter income steering of $25 billion to $25.8 billion is 6% larger than expectations, suggesting sturdy near-term development. Additionally, administration expects a 20% income CAGR over the subsequent five-year interval, pushed by development alternatives in AI, 5G smartphones, and high-performance computing.

The rising demand for TSMC’s customized AI chips from Broadcom Inc. AVGO and Marvell Know-how, Inc. MRVL has strengthened its future development. In the meantime, Apple Inc. AAPL has witnessed an increase in demand for its smartphones that require TSMC’s chips, a optimistic improvement for the latter. TSMC’s vivid future can be as a result of forthcoming launch of their extremely environment friendly 2-nanometer (nm) chips this yr, with pre-order demand exceeding 3 and 5nm.

TSMC’s dominant place within the world foundry market means the inventory is well-poised to make the most of the rising alternatives. In spite of everything, the semiconductor market worldwide is projected to generate $1.47 trillion in revenues in 2030 from $729 billion in 2022, per SNS Insider. Administration talked about that the U.S. authorities’s curb on chip gross sales to China is “manageable.”

Second, the brand new Stargate AI infrastructure program is anticipated to be a sport changer for the TSMC inventory. President Trump intends to allocate $500 billion for AI infrastructure, boosting AI shares. TSMC stands to profit as its superior chips are important for working AI information facilities.

Third, the TSMC inventory is more likely to rise as a result of the corporate generates income effectively, with a internet revenue margin of 40.52%, barely greater than the Semiconductor – Circuit Foundry trade’s 40.51%, indicating a excessive margin.

Picture Supply: Zacks Funding Analysis

Contemplate Shopping for TSMC Inventory

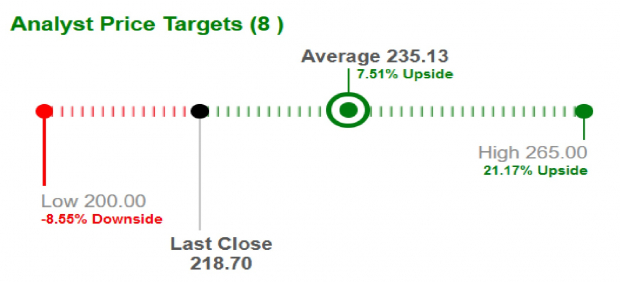

With the TSMC inventory poised to realize in the long run attributable to a number of development alternatives, a brand new Stargate AI infrastructure undertaking, and powerful fundamentals, it’s considered for traders to put their bets on the inventory now. Brokers additionally count on the TSMC inventory to rise and have raised its common short-term worth goal by 7.5% to $235.13 from the earlier $218.70. The very best short-term worth goal is $265, indicating an upside of 21.2%.

Picture Supply: Zacks Funding Analysis

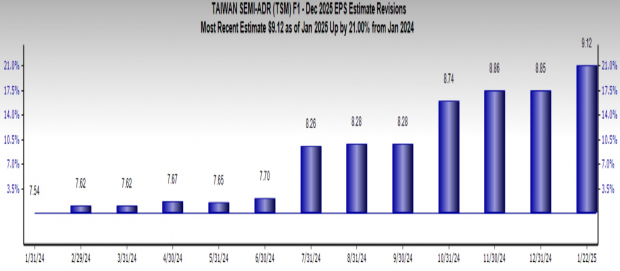

Moreover, TSMC’s earnings per share are estimated to extend by 21% from final yr. The Zacks Consensus Estimate is $9.12. TSMC, due to this fact, rightfully has a Zacks Rank #2 (Purchase). You’ll be able to see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Picture Supply: Zacks Funding Analysis

7 Greatest Shares for the Subsequent 30 Days

Simply launched: Specialists distill 7 elite shares from the present listing of 220 Zacks Rank #1 Sturdy Buys. They deem these tickers “Most Seemingly for Early Worth Pops.”

Since 1988, the total listing has overwhelmed the market greater than 2X over with a median acquire of +24.1% per yr. So you should definitely give these hand picked 7 your instant consideration.

Apple Inc. (AAPL) : Free Stock Analysis Report

Marvell Technology, Inc. (MRVL) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.