As we liquidate the initial quarter of 2023, many capitalists would certainly’ve stopped at the suggestion that homebuilders are up 30% off the bearishness bases. For most of in 2015, this team seriously underperformed the marketplace. Yet right here we are, with homebuilders remaining to rally in the New Year despite raised home loan prices as well as decreasing house rates.

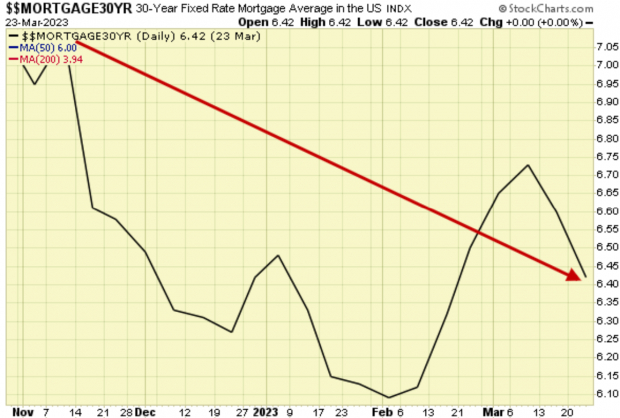

The Zacks Structure Products– Homebuilder sector has actually returned greater than 16% year-to-date, easily outmatching the marketplace. This sector is presently rated in the leading 20% out of about 250 sectors. Due to the fact that it is rated in the leading fifty percent of all Zacks Ranked Industries, we anticipate this team to surpass over the following 3 to 6 months. Have a look at exactly how this team has actually continuously exceeded this year:

Picture Resource: Zacks Financial Investment Research Study

Measurable study studies recommend regarding fifty percent of a supply’s future rate recognition is because of its sector group. Actually, the leading 50% of Zacks Ranked Industries outshines the lower 50% by an aspect of greater than 2 to 1. By targeting supplies consisted of within leading sector teams, we can substantially boost our probabilities of success.

Why are homebuilder supplies not just rallying, yet greatly exceeding the marketplace? Allow’s evaluate 3 prospective reasons that this holds true.

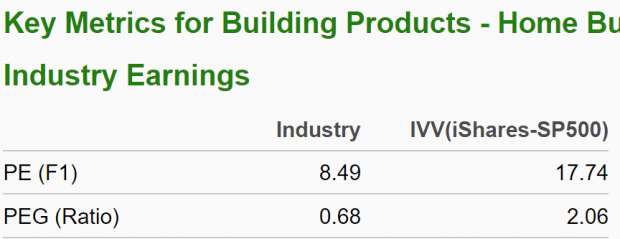

The Expectation for Home Loan Prices

Home loan prices rose in 2015, peaking simply over 7%, yet 30-year set prices have actually currently started to decrease:

Picture Resource: StockCharts

And also while home loan prices are not straight linked to the Fed’s decision-making concerning the series of the government funds price, even more assurance around Fed activities (consisting of a possible time out in May) will certainly assist maintain a few of the volatility we have actually seen in home loan prices in current months.

Inbound financial information will certainly additionally offer a function in the decrease in prices. Tomorrow’s launch of the Personal Usage Expenses (PCE) index is anticipated to reveal an ongoing slowdown in rate rises. Decreasing rising cost of living information need to assist home loan prices soften better. Reduced prices will certainly assist stimulate extra acquiring as well as thrust homebuilder supplies.

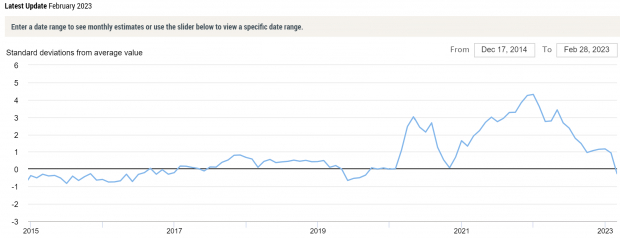

Homebuilder Assessments

Most of us recognize that the marketplace is positive. Possibly a widely-anticipated real estate recession just will not involve fulfillment as supply continues to be reduced, as well as price walks are more detailed to an end than a start. However a much deeper appearance discloses one more opportunity: assessment.

Homebuilder supplies dropped virtually 40% of their worth from top to trough throughout in 2015’s bearishness, as well as numerous private firms are still reasonably underestimated. This might be a modification to the advantage, with these supplies just going back to even more typical degrees after in 2015’s severe decrease.

Proceeding with our instance from earlier, an evaluation of the Zacks Structure Products– Homebuilder sector reveals that this team continues to be reasonably underestimated:

Picture Resource: Zacks Financial Investment Research Study

Reduced Prices to Construct

In 2014 saw a rise in rates in addition to supply chain disturbances that made it really challenging for homebuilders to full tasks promptly. However rates have actually currently boiled down, as well as supply chain problems have actually relieved dramatically. Lumber, which was trading at $1,329 per thousand board feet back in January of 2022, has actually currently gone down to about $375. This stands for an above 70% decrease in a vital part for building contractors.

The Worldwide Supply Chain Stress index incorporates transport expense information in addition to producing signs to offer a scale of supply chain problems. The index’s current motions recommend that worldwide supply chain problems have actually returned typical after experiencing significant troubles in 2015:

Picture Resource: Bureau of Labor Stats, New York City Fed

Private Homebuilder Supply Choose

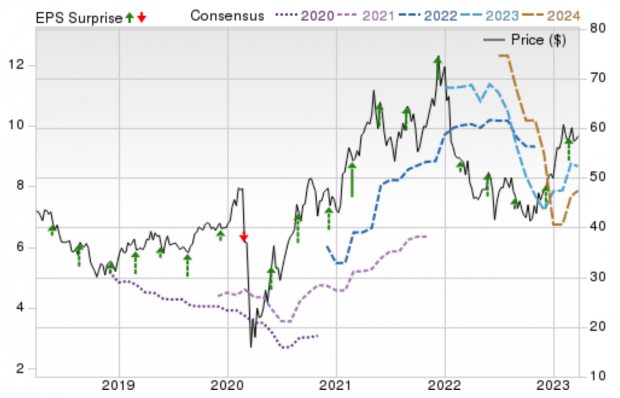

One popular homebuilder that has actually led the fee throughout the current rally is Toll Sibling TOL. Toll Sibling is based in Ft Washington, as well as constructs single-family separated as well as affixed house neighborhoods. TOL runs its very own design, building, home loan, title, house safety and security, as well as landscape subsidiaries. The business is additionally recognized for its city reduced, mid as well as skyscraper neighborhoods ashore it establishes as well as enhances.

TOL is presently a Zacks Ranking # 2 (Buy) supply as well as is rated positively by our Zacks Worth Design Rating classification, with a best-in-class ‘A’ ranking that suggests appealing assessment metrics. The supply professions reasonably underestimated at simply a 6.86 ahead P/E.

Toll Sibling has actually surpassed incomes price quotes in each of the previous 4 quarters, with an ordinary shock of 18.33%. The area house designer most lately reported financial Q1 incomes last month of $1.70/ share, a 24.1% shock over the $1.37 agreement price quote. Sales of $1.78 billion additionally went beyond price quotes by 2.16%.

Picture Resource: Zacks Financial Investment Research Study

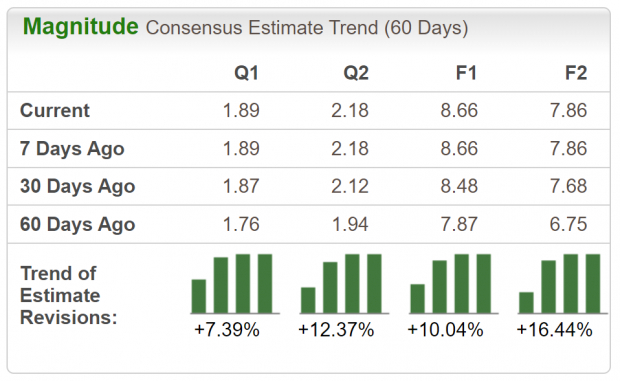

For the present quarter, experts have actually enhanced incomes price quotes by 7.39% in the previous 60 days. The financial Q2 Zacks Agreement Price quote currently stands at $1.89/ share, showing prospective development of 2.16% about the very same quarter in 2015.

Picture Resource: Zacks Financial Investment Research Study

This rally in homebuilders seems the actual bargain. There’s still lots of pessimism bordering this team, something that can likely sustain a lot more upside. One point’s for certain– homebuilders are a vital team to view as we near the 2nd quarter of the year.

Is THIS the Ultimate New Clean Power Resource? (4 Ways to Revenue)

The globe is progressively concentrated on removing nonrenewable fuel sources as well as increase use sustainable, tidy power resources. Hydrogen gas cells, powered by the most bountiful compound in deep space, might offer an unrestricted quantity of ultra-clean power for several sectors.

Our immediate unique record discloses 4 hydrogen supplies keyed for huge gains – plus our various other leading tidy power supplies.

Toll Brothers Inc. (TOL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints revealed here are the sights as well as viewpoints of the writer as well as do not always show those of Nasdaq, Inc.