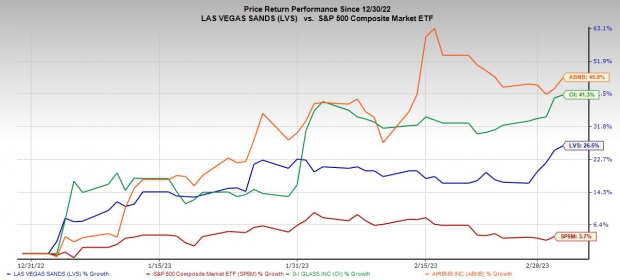

Today’s episode of Complete Court Financing at Zacks discovers the conflict taking place in between the bulls and also the bears in the very early days of March. Supplies rose once more via mid-afternoon trading on Friday to assist the S&P 500 take back a vital relocating typical once more. Provided this favorable background, we study 3 top-ranked Zacks supplies– O-I Glass, Airbnb, Las Las Vega Sands— that have all skyrocketed in 2023 and also seek to have a lot of lasting benefit left.

The defend control of the marketplace has actually been increase over the last couple of weeks, and also actually because very early February as even more warm financial information rolled in. Thursday’s pop and also Friday’s dive showed up to adhere to remarks from Atlanta Fed Head Of State Raphael Bostic where he articulated his assistance for increasing rates of interest at 0.25% increments. Wall surface Road suched as to listen to that the Fed likely will not consider treking by 50 basis factors or even more once more to attempt to run over sticking around rising cost of living.

Picture Resource: Zacks Financial Investment Research Study

A Lot Of the exact same unknowns continue to be in position such as what to get out of February CPI information, along with Q1 2023 revenues outcomes and also assistance. In spite of the current pop, the 2-year united state Treasury return rested near fresh highs at 4.87% on Friday mid-day, up from 4.1% on February 1 and also back to 2007 and also 2006 degrees. It deserves keeping in mind, however, that these are reduced by historic criteria and also Wall surface Road remained to get comprehending complete well where prices rest.

The Nasdaq is back well over its 200-day relocating typical once more to offer the bulls some breathing space. And also, the S&P 500’s current rebound has it back over its 50-day and also the bulls did not also allow it check the 200-day.

Financiers that do not intend to lose out on this rally must not thoughtlessly study any kind of lately rising supplies. Today we utilized the Zacks Ranking to discover business that increased their revenues assistance when faced with a slowing down economic climate. Every one of these supplies have actually likewise seen their appraisals enhance also as they skyrocketed to begin 2023.

Picture Resource: Zacks Financial Investment Research Study

O-I Glass, Inc. ( OI) is just one of the leading manufacturers of glass containers and also containers in the united state and also all over the world. O-I Glass collaborates with a few of the leading food and also drink brand names on earth. O-I Glass remains in the middle of sprucing up a few of its company procedures to assist unlock investor worth over the following numerous years.

O-I Glass is coming off a solid year and also it supplied positive assistance to assist it land a Zacks Ranking # 1 (Solid Buy) now. Its Glass Products sector remains in the leading 14% of over 250 Zacks sectors, and also OI has actually leapt 40% in 2023 as component of a 90% run throughout the in 2015. Yet it still trades 11% listed below its typical Zacks cost target and also at a virtually 50% discount rate to its sector at 9X ahead revenues.

Airbnb, Inc. ( ABNB), which went public in late 2020, gets on a substantial 45% go to begin 2023 as the post-covid traveling rebound verifies it has severe legs. Airbnb uploaded its initial yearly revenue in 2022 and also covered our Q4 approximates in mid-February. Its FY22 earnings skyrocketed 40% in addition to 77% growth in 2021, with even more double-digit development predicted in both FY23 and also FY24.

Airbnb’s higher EPS alterations assist it land a Zacks Ranking # 1 (Solid Buy) now. ABNB’s modified revenues are predicted to climb up by approximately 20% in 2023 and also 2024. The supply is up 10% in the last 6 months vs. technology’s sideways activity and also regardless of its rally, the supply still trades 40% listed below its tops. Airbnb has a strong annual report and also it is efficiently shocking a substantial international sector.

Las Las Vega Sands Corp. ( LVS) utilized to be a Las vega titan. Currently it is concentrated on Singapore and also Macau, with a profile that consists of Marina Bay Sands in Singapore and also The Venetian Macao, The Plaza and also 4 Seasons Resort Macao, The Londoner Macao, and also others. The business is predicted to publish 108% earnings development in FY23 as the Chinese economic climate begins its wonderful resuming to assist its revenues rise.

Las Las vega Sands is predicted to adhere to up its large 2023 with solid double-digit sales and also revenues growth following year. LVS lands a Zacks Ranking # 1 (Solid Buy) and also its Video gaming area remains in the leading 30% of over 250 Zacks sectors. LVS shares have actually risen approximately 70% in the previous 6 months yet they are presently trading 10% listed below their typical Zacks cost target.

7 Finest Supplies for the Following 1 month

Simply launched: Specialists boil down 7 elite supplies from the present checklist of 220 Zacks Ranking # 1 Solid Buys. They consider these tickers “More than likely for Very Early Rate Pops.”

Given that 1988, the complete checklist has actually defeated the marketplace greater than 2X over with an ordinary gain of +24.8% annually. So make sure to offer these carefully picked 7 your instant focus.

O-I Glass, Inc. (OI) : Free Stock Analysis Report

Las Vegas Sands Corp. (LVS) : Free Stock Analysis Report

Airbnb, Inc. (ABNB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints revealed here are the sights and also viewpoints of the writer and also do not always show those of Nasdaq, Inc.