Several leading supplies had a bumpy ride in 2015. Sometimes, their services experienced for factors unassociated to the economic climate. In various other instances, the financial atmosphere pressed financiers away. Therefore, business with record of development and also solid possible saw their share costs roll.

Eventually, however, these supplies must get better. Which time might be quickly. Why? Due to the fact that they have actually gotten to appealing appraisals and also have actually revealed stamina– or indications of stamina– in current incomes records. Allow’s have a look at 3 medical care supplies that are ripe for a rebound.

1. Teladoc Wellness

Teladoc Wellness ( NYSE: TDOC) shares are trading around their most affordable ever beforein relation to sales That wants the supply went down 74% in 2015. Why has the assessment dived? In 2015, the firm reported a number of billion-dollar a good reputation disability fees connected to its acquisition of persistent treatment expert Livongo. That enhanced financiers’ bother with Teladoc’s absence of productivity up until now.

Yet worries look exaggerated. In one of the most current incomes record, Teladoc didnt reportfurther disability fees. The firm’s loss tightened, and also united state and also worldwide earnings climbed up in the dual figures. As well as it is essential to keep in mind that general earnings and also gos to have actually continuously boosted in the dual figures– a pattern that began before the pandemic.

Teladoc offers majority of the Lot of money 500, so it currently has a solid customer base. Yet the firm still has space to expand. Teladoc claimed in a discussion in 2015 that of 298 million united state insured lives, regarding 92 million have accessibility to a Teladoc item.

All this implies that Teladoc– at a record-low assessment– resembles a shouting acquire today for lasting development financiers. A little bit a lot more development towards tightening the bottom line or expanding vital locations like persistent treatment can swiftly send out the shares greater.

TDOC PS Ratio information byYCharts PS Proportion = price-to-sales proportion.

2. User-friendly Surgical

Throughout particular minutes of the pandemic, the post ponement of surgical procedures amounted to the post ponement of earnings for User-friendly Surgical ( NASDAQ: ISRG) The firm creates a lot of its earnings with marketing tools and also devices required for treatments with its medical robotics. As well as in 2015, supply chain problems and also greater products prices likewise provided obstacles.

Yet it is essential to take a look at User-friendly with a lasting lens. The above headwinds are short-term. As Well As User-friendly has the strength to make it through challenging times and also flourish in the future. The firm had greater than $6.7 billion in money at the end of the 4th quarter and also bought greater than $1 billion of its supply in the quarter– a certain indication of self-confidence in its service.

User-friendly is the leader in robot surgical procedure, and also it’s most likely to maintain that setting. Surgical robotics are million-dollar financial investments, so medical facilities often tend to stick to what they have actually bought.

User-friendly’s current incomes record revealed that service is getting. Treatments utilizing Intuitive’s front runner Da Vinci robotic climbed up 18%, and also earnings boosted 7% to greater than $1.6 billion.

User-friendly shares have actually shed 17% over the previous year. Evaluation has actually been up to 45 times ahead incomes price quotes from around 60 a year back. If the firm remains to report development in treatment development and also general incomes, financiers might quickly load back right into this cutting-edge medical care supply.

3. Doximity

Doximity ( NYSE: DOCS) is an electronic system where medical professionals can get in touch with each various other, examine people, and also share clinical records and also records– it’s an on the internet expansion of their clinical method. Exactly how does Doximity create earnings? Drugmakers and also medical care systems are the firm’s customers, promoting their items to the clinical area.

In a setting of increasing inflation, financiers have actually fretted about advertisement costs and also its effect on Doximity. Yet up until now, this high-growth firm isn’t decreasing. Actually, in one of the most current quarter, its web earnings retention price got to 127%. This is throughout its leading 20 customers– that all have actually collaborated with Doximity for regarding 8 years. Doximity’s customers consist of the leading 20 pharma business and also the leading 20 healthcare facility systems.

This customer commitment is a factor to be positive regarding Doximity’s capacity to maintain earnings climbing. As well as with 80% of united state medical professionals utilizing Doximity, it’s clear these customers have a genuine factor to proceed marketing on the system.

Doximity pays– yearly earnings and also earnings have actually continuously gotten on the surge. As well as in one of the most current quarter, earnings, running capital, and also free cash flow each progressed in the dual figures.

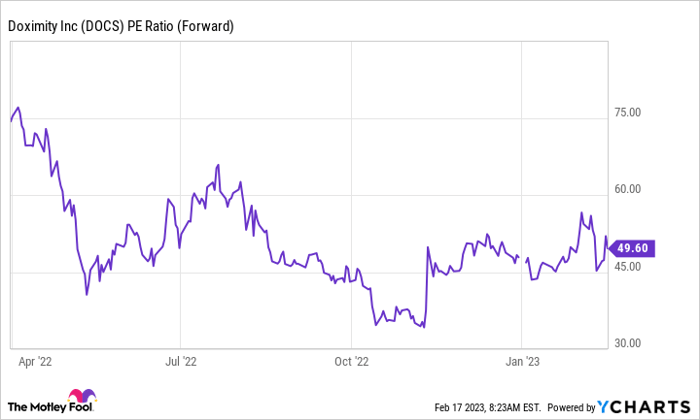

Doximity shares have actually shed almost 40% over the previous year, leaving them at a really practical assessment.

DOCS PE Ratio (Forward) information byYCharts PE Proportion = price-to-earnings proportion.

Thinking about the firm’s incomes stamina– also in a challenging financial atmosphere– the supply hasreason to rebound As well as also much better, Doximity has what it requires to succeed over the long-term.

10 supplies we such as far better than Teladoc Health and wellness

When our prize-winning expert group has a supply idea, it can pay to pay attention. Besides, the e-newsletter they have actually competed over a years, Supply Expert, has actually tripled the marketplace. *

They simply disclosed what they think are the ten best stocks for financiers to acquire today … and also Teladoc Health and wellness had not been among them! That’s right– they believe these 10 supplies are also much better purchases.

* Supply Expert returns since February 8, 2023

Adria Cimino has no setting in any one of the supplies stated. The has placements in and also advises Doximity, User-friendly Surgical, and also Teladoc Health and wellness. The has a disclosure policy.

The sights and also point of views shared here are the sights and also point of views of the writer and also do not always mirror those of Nasdaq, Inc.