Numerous capitalists know with cost targets, as they stand for experts’ assumptions of a supply’s future cost.

Naturally, experts analyze lots of aspects, consisting of basic and also technological, when computing these degrees.

Additionally, cost targets can be useful for capitalists, aiding to supply a much more organized profession with pre-determined departure degrees. Nevertheless, it’s vital to bear in mind that not all supplies get to experts’ forecasted degrees.

3 supplies– Ulta Appeal ULTA, Circus CCL, and also Occidental Oil OXY– have actually all lately obtained cost target upgrades. Below is a graph showing the efficiency of all 3 supplies in 2023, with the S&P 500 mixed in as a standard.

Photo Resource: Zacks Financial Investment Study

It elevates a legitimate inquiry– why have experts elevated their assumptions? Allow’s take a more detailed look.

Occidental Oil

Occidental Petroleumis an incorporated oil and also gas firm with considerable expedition and also manufacturing direct exposure.

Just Recently, TD Cowen relocated their cost target for OXY shares as much as $70 per share from $63 while updating the supply to surpass.

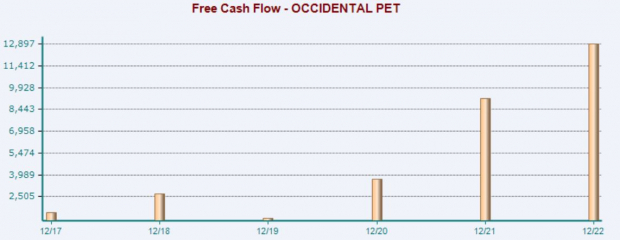

The firm’s cash-generating capacities were magnified throughout raised power rates, as seen in the graph below. Over the last twelve months, Occidental Oil has actually produced virtually $13 billion in totally free capital.

Photo Resource: Zacks Financial Investment Study

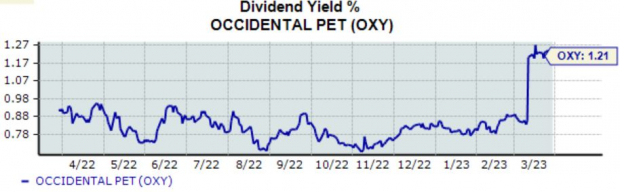

Simply on February 27 th, the firm raised its yearly reward payment to $0.72 per share ($ 0.18 per share quarterly), mirroring a virtually 40% boost from the previous yearly price of $0.52 per share.

Photo Resource: Zacks Financial Investment Study

Ulta Appeal

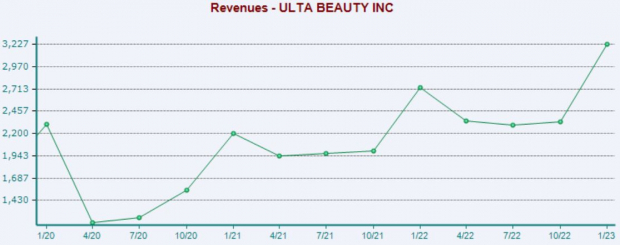

Ulta Appeal is a leading elegance merchant in the USA, with a huge item directory that consists of cosmetics, scents, skin care, hair treatment, bathroom and also body items, and also much more. Ulta Appeal’s cost target was elevated to $615 per share from $610 by Piper Sandler.

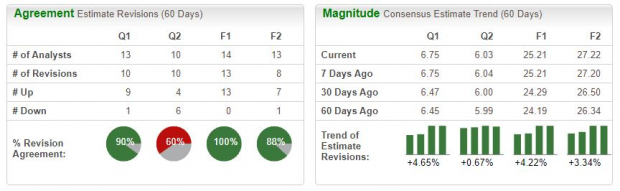

The firm’s incomes overview has actually boosted throughout all durations over the last 60 days, touchdown it right into a Zacks Ranking # 2 (Buy).

Photo Resource: Zacks Financial Investment Study

Outstanding quarterly outcomes certainly assisted in the cost target upgrade; ULTA has actually surpassed the Zacks Agreement EPS Quote by double-digit portions in 9 successive quarters.

Within one of the most current quarterly print, the elegance merchant supplied a 17% incomes beat and also reported income 6.2% in advance of assumptions.

Photo Resource: Zacks Financial Investment Study

Circus

Circus, a cruise ship and also holiday firm, is the globe’s leading recreation traveling company, bring virtually half the worldwide cruise ship visitors. Circus’s cost target was updated to $13 per share from $12 by Barclays.

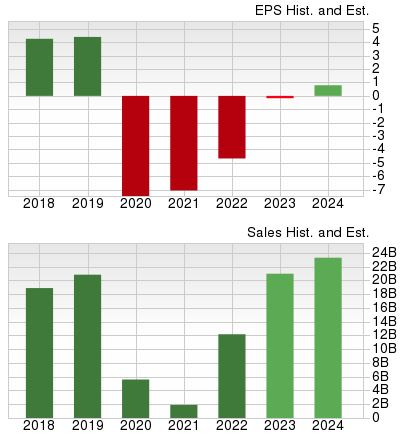

A recuperation in traveling need has actually profited the firm, with CCL going beyond incomes quotes in back-to-back quarters after a string of adverse shocks.

In its newest launch on March 27 th, the firm signed up an 11.3% EPS beat and also reported income virtually 2% in advance of assumptions.

Photo Resource: Zacks Financial Investment Study

The healing in traveling need is more shown by the firm’s solid anticipated development prices; incomes are anticipated to rise virtually 100% in its existing (FY23) and also an additional 570% in FY24.

Photo Resource: Zacks Financial Investment Study

Profits

Rate targets are frequently talked about on the market, providing capitalists a scale of existing belief bordering the supply.

And also lately, all 3 supplies above– Ulta Appeal ULTA, Circus CCL, and also Occidental Oil OXY– have actually obtained cost target upgrades.

Zacks Names “Solitary Best Select to Dual”

From hundreds of supplies, 5 Zacks professionals each have actually picked their preferred to increase +100% or even more in months to find. From those 5, Supervisor of Study Sheraz Mian hand-picks one to have one of the most eruptive advantage of all.

It’s an obscure chemical firm that’s up 65% over in 2015, yet still economical. With unrelenting need, skyrocketing 2022 incomes quotes, and also $1.5 billion for redeeming shares, retail capitalists might enter at any moment.

This firm might measure up to or go beyond various other current Zacks’ Supplies Ready To Dual like Boston Beer Business which skyrocketed +143.0% in little bit greater than 9 months and also NVIDIA which grew +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Carnival Corporation (CCL) : Free Stock Analysis Report

Occidental Petroleum Corporation (OXY) : Free Stock Analysis Report

Ulta Beauty Inc. (ULTA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints shared here are the sights and also viewpoints of the writer and also do not always mirror those of Nasdaq, Inc.