Cost targets can be useful for financiers, as they can assist in an extra organized profession with pre-determined leave degrees. Certainly, it is necessary to bear in mind that not all supplies get to experts’ forecasted degrees.

Cost targets are based upon a selection of elements, consisting of the business’s economic efficiency, market fads, as well as general market problems.

As well as just recently, 3 supplies– Kellogg’s K, Wix.com WIX, as well as Celsius Holdings CELH– have actually all seen positive upgrades from experts. Below is a graph showing the year-to-date efficiency of all 3, with the S&P 500 mixed in as a criteria.

Photo Resource: Zacks Financial Investment Study

Allow’s take a more detailed take a look at just how each presently accumulates.

Celsius Holdings

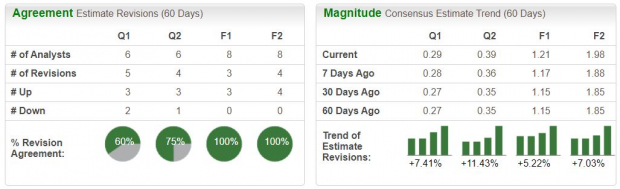

Celsius, a present Zacks Ranking # 1 (Solid Buy), runs within the practical power beverages as well as fluid supplement classifications worldwide as well as in the USA. BofA Stocks just recently elevated its PT for CELH shares from $98 to $125 per share.

Photo Resource: Zacks Financial Investment Study

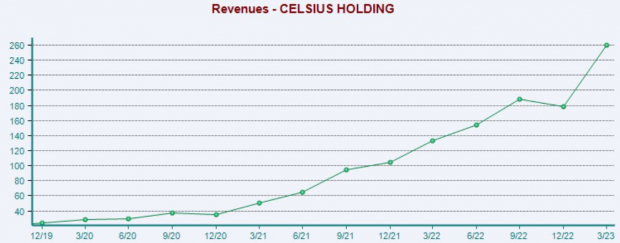

The upgrade complied with better-than-expected outcomes on Might 9 th; CELH surpassed the Zacks Agreement EPS Quote by greater than 80% as well as provided a 15% income shock. As revealed listed below, the business’s income development has actually been excellent.

In 2022, the business authorized a $550 million circulation arrangement with heavyweight PepsiCo, which is definitely repaying.

Photo Resource: Zacks Financial Investment Study

Kellogg’s

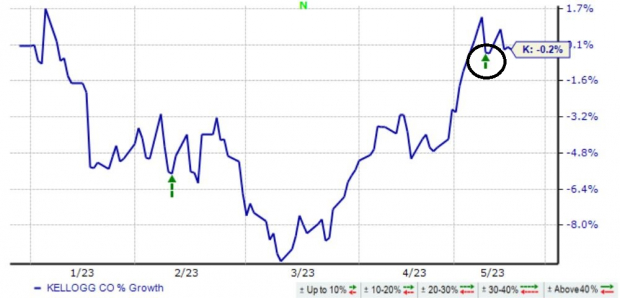

Kellogg’s produces as well as markets ready-to-eat grains as well as fast food, bring a well balanced profile of items. JPMorgan elevated its PT for Kellogg’s shares from $68 to $72 per share adhering to a beat-and-raise quarter.

In the launch, the grain huge published a 10% EPS beat as well as elevated support for organic-based development in internet sales. Quarterly income amounted to $4.1 billion, 2.4% over assumptions as well as boosting 13% from the year-ago duration.

Shares really did not see much activity post-earnings, shown by the environment-friendly arrowhead circled around listed below.

Photo Resource: Zacks Financial Investment Study

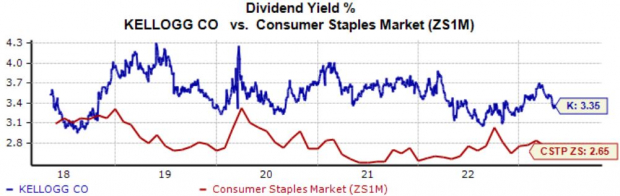

Comparable to various other protective supplies, Kellogg’s shares might lure income-focused financiers, with the present 3.4% yearly reward return resting well over the Zacks Customer Staples market standard.

Returns development exists, as well, with the business bring a 1.4% five-year annualized reward development price.

Photo Resource: Zacks Financial Investment Study

Wix.com

Wix.com, a present Zacks Ranking # 2 (Buy), is a cloud-based internet advancement system offering options that allow customers to establish personalized web sites as well as application systems. Raymond James updated the supply, revealing a PT of $96 per share.

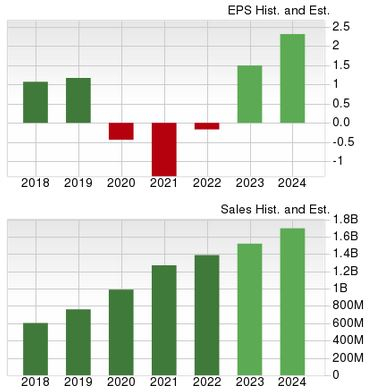

It’s difficult to neglect the business’s development trajectory, with revenues anticipated to leap dramatically in its present (FY23) as well as a more 55% in FY24. The forecasted revenues development begins top of anticipated Y/Y income climbs up of 9.5% in FY23 as well as 11.7% in FY24.

Photo Resource: Zacks Financial Investment Study

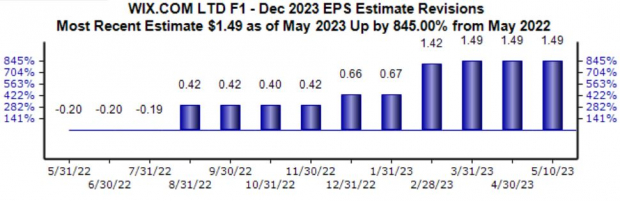

Experts have actually stayed favorable for the business’s present for time, with the FY23 EPS Price quote being changed significantly greater because completion of Might in 2014. This is shown in the graph below.

Photo Resource: Zacks Financial Investment Study

Profits

Cost targets can aid financiers structure a profession, as they show present view around the supply.

As well as just recently, all 3 supplies above– Kellogg’s K, Wix.com WIX, as well as Celsius Holdings CELH– have actually obtained positive upgrades from experts.

Free Record: Top EV Battery Supplies to Purchase Currently

Just-released record discloses 5 supplies to make money as countless EV batteries are made. Elon Musk tweeted that lithium rates have actually mosted likely to “crazy degrees,” as well as they’re most likely to maintain climbing up. Because of this, a handful of lithium battery supplies are readied to increase. Accessibility this record to find which battery supplies to purchase as well as which to prevent.

Kellogg Company (K) : Free Stock Analysis Report

Wix.com Ltd. (WIX) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views shared here are the sights as well as point of views of the writer as well as do not always show those of Nasdaq, Inc.