Advancing via this profits period determining firms that had the ability to defeat fundamental assumptions and also reconfirm a favorable expectation might get on lots of capitalists’ programs as inflationary worries start to relieve.

To that note, right here are 3 premier Zacks supplies that fit the expense after uploading solid first-quarter outcomes.

inTest ( INTT)

We’ll begin with a technology supply as InTest Firm sporting activities a Zacks Ranking # 1 (Solid Buy) and also looks really interesting complying with a remarkable first-quarter profits defeated last Friday.

InTest is an independent company of ATE user interface options and also temperature level administration items utilized by semiconductor makers to execute last screening of incorporated circuits and also wafers.

Q1 Testimonial: InTest quickly covered its Q1 EPS assumptions by 38% at $0.29 per share contrasted to EPS quotes of $0.21. Also much better, profits skyrocketed 141% YoY with EPS at $0.12 in Q1 2022.

Revenues approximate modifications are especially up in the recently complying with InTest’s Q1 record. Trading at $23 a share, InTest’s profits are currently anticipated to leap 15% this year and also increase an additional 3% in FY24 at $1.18 per share.

Photo Resource: Zacks Financial Investment Study

Cinemark ( CNK)

Amongst customer optional equities, Cinemark is sticking out with a Zacks Ranking # 2 (Buy) after uploading an extremely encouraging profits defeated last Friday.

As flick theater drivers proceed their post-pandemic healing Cinemark is positioned to reemerge as a leader. Cinemark runs over 408 cinemas and also 4,657 displays in 38 states with global procedures that consist of Mexico, South, and also Central America.

Q1 Testimonial: Cinemark’s roadway back to likelihood seems around the bend as the firm’s Q1 profits was available in at -$ 0.03 per share contrasted to EPS quotes of -$ 0.30. This was additionally a considerable climb swing from -$ 0.62 in Q1 2022.

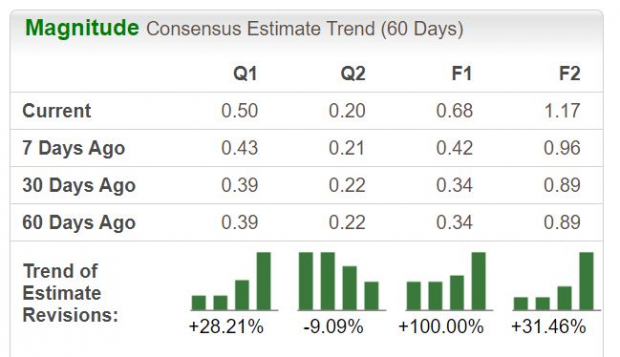

Extra notably, Cinemarks’s yearly profits are currently anticipated to be back in the black this year at $0.68 per share, climb moving from a loss of -$ 2.26 in 2022. Also much better, monetary 2024 profits are forecasted to jump an additional 71% at $1.17 per share.

Trading at $16 a share, Cinemark’s yearly profits quotes have actually skyrocketed over the last 60 days and also can give a great stimulant for the supply as the firm’s development trajectory returns.

Photo Resource: Zacks Financial Investment Study

Koppers ( KOP)

Last But Not Least, Koppers Holdings is a raw materials supply that might have much more upside and also sporting activities a Zacks Ranking # 2 (Buy) after blasting its Q1 profits assumptions last Friday too.

Koppers is an incorporated international company of dealt with timber items, timber therapy chemicals, and also carbon substances. Intriguingly, Koppers items are utilized in a varied series of end-markets consisting of railway, specialized chemical, energy, domestic lumber, farming, and also building and construction sectors.

Q1 Testimonial: Koppers squashed Q1 profits quotes by 47% with EPS at $1.12 contrasted to assumptions of $0.76 per share. First-quarter profits additionally leapt 23% YoY with EPS at $0.91 in Q1 2022.

Also much better, Koppers profits are currently anticipated to be up 6% in FY23 and also increase an additional 6% in FY24 at $4.66 per share. Trading at $31 a share Koppers stable development is beginning to call for even more near-tern benefit in its supply and also longer-term capitalists might wish to take notification too.

Photo Resource: Zacks Financial Investment Study

Takeaway

Greatly exceeding first-quarter profits assumptions is beginning to reconfirm that these firms need to have a solid monetary 2023. With strong fundamental development anticipated there can be a great quantity of upside left in InTest, Cinemark, and also Koppers supply.

Leading 5 ChatGPT Supplies Exposed

Zacks Senior Citizen Supply Planner, Kevin Chef names 5 carefully picked supplies with overpriced development capacity in a great field of Expert system. By 2030, the AI sector is anticipated to have a web and also iPhone-scale financial effect of $15.7 Trillion.

Today you can purchase the wave of the future, an automation that addresses follow-up inquiries … confesses blunders … obstacles inaccurate properties … denies unsuitable demands. As one of the picked firms places it, “Automation releases individuals from the ordinary so they can complete the amazing.”

Download Free ChatGPT Stock Report Right Now >>

inTest Corporation (INTT) : Free Stock Analysis Report

Koppers Holdings Inc. (KOP) : Free Stock Analysis Report

Cinemark Holdings Inc (CNK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also point of views revealed here are the sights and also point of views of the writer and also do not always mirror those of Nasdaq, Inc.