One method to stay clear of several of the volatility in the stock exchange is to purchase old firms, with a lengthy background of elevating returns. A few of these firms have actually been around for over 100 years as well as have actually seen all possible financial atmospheres. These are firms with legendary brand names, enduring items, as well as dedicated administration.

Their dedication to investors appears from long backgrounds of continually elevating returns. These firms have reputable service designs, with normal, gradually expanding capital, traditional reinvestment, as well as normal circulation of excess cash money.

Among these supplies has actually been elevating returns yearly for greater than half a century. Fail to remember reward aristocrat, this set is a returns king. An additional is popular for its 100-year-old sweets, as well as the last an insurance provider, popular for its pet mascot.

Hershey

Among one of the most legendary brand names worldwide, Hershey HSY has actually been paying returns considering that 1930. Established in 1894 Hershey makes as well as markets a wide variety of treats, sweet as well as confectionery foods with some 80 widely known brand names.

Although there were a couple of years considering that 1930 that the reward really did not boost, it has actually increased the settlement yearly considering that 2009. Over the last 5 years returns have actually expanded approximately 8.7% each year. Presently HSY supply has a returns return of 1.7%.

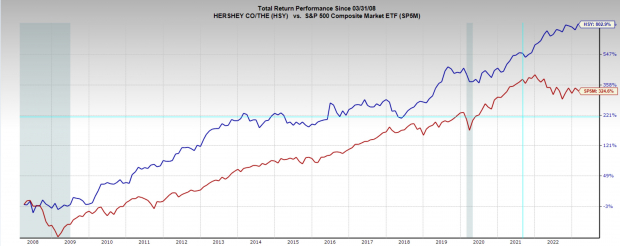

Photo Resource: Zacks Financial Investment Study

Hershey’s supply rate has actually carried out incredibly more than the last 15 years, valuing by approximately 16% each year, surpassing the S&P 500’s standard of 10%.

Photo Resource: Zacks Financial Investment Study

In Addition, over the last 2 years, which have actually been especially unstable, HSY has actually been a consistent entertainer, returning 60% over of the index. Every one of this includes reduced volatility as well as a quarterly reward payment.

Photo Resource: Zacks Financial Investment Study

Hershey is a Zacks Ranking # 1 (Solid Buy) supply, suggesting higher trending incomes modifications. Existing year sales are forecasted to expand 8% YoY to $11.2 billion as well as incomes are anticipated to climb up 10% to $9.39 per share. Profits assumptions have actually been modified greater throughout perpetuity structures, with the existing year being modified 10% over the last 60 days.

HSY has to do with as stable as they come. Over the last one decade its 1 year forward incomes multiple has actually remained within a fairly limited variety contrasted to numerous various other supplies. HSY is presently trading at 25x 1 year forward incomes, which is simply over its 20-year average of 24x.

Photo Resource: Zacks Financial Investment Study

Becton, Dickinson as well as Business

Becton, Dickson as well as Business BDX has actually been elevating its reward yearly for the last 51 years. BDX is a clinical modern technology business involved primarily in the growth, manufacture as well as sale of clinical gadgets, tool systems as well as reagents.

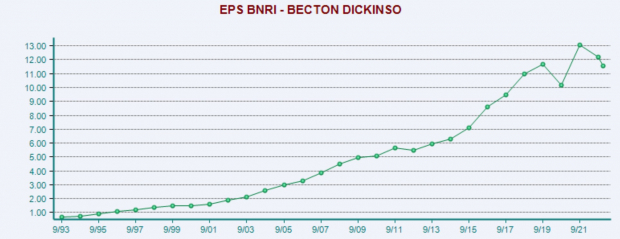

The excellent uniformity with which BDX raised its returns is powered by a similarly amazing development in incomes per share. In between 1993 as well as 2023 EPS has actually expanded from $0.68 per share to $12.23 per share today. That is a 10% CAGR.

Photo Resource: Zacks Financial Investment Study

BDX supply has actually been settling in a variety for virtually 5 years, which is not something I have actually seen really usually. Although that might worry some capitalists it deserves keeping in mind that both sales as well as incomes have actually raised over that time.

Photo Resource: TradingView

Beckton, Dickson as well as Business flaunt a Zacks Ranking # 2 (Buy), suggesting a higher incomes modification fad. The existing quarter incomes have actually been modified reduced over the last 60 days, however existing year as well as following year incomes have actually both been modified greater over the last 60 as well as 1 month.

Photo Resource: Zacks Financial Investment Study

BDX is trading at a 1 year forward incomes multiple of 19x, which is simply listed below its five-year average of 20x. BDX presently has a returns return of 1.6%, which has actually raised by approximately 4% each year over the last 5 years.

Photo Resource: Zacks Financial Investment Study

Aflac

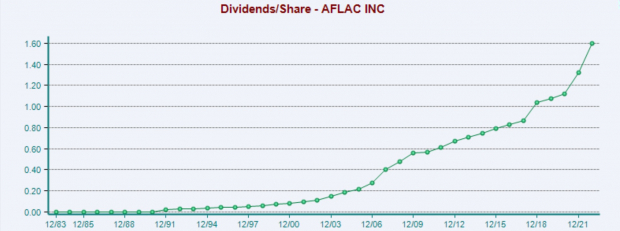

Aflac AFL, an additional life as well as medical insurance business has actually increased its reward yearly for the last 39 years. Not just has AFL increased its reward continually, in the last couple of years the dimension of the rise has actually sped up. Approximately 10% in the last 5 years, 14% the last 3 years, as well as 21% this in 2014. Today the reward return is 2.6%.

Photo Resource: Zacks Financial Investment Study

Like various other reward development supplies, AFL has actually outshined the marketplace significantly over the last 2, really difficult years.

Photo Resource: Zacks Financial Investment Study

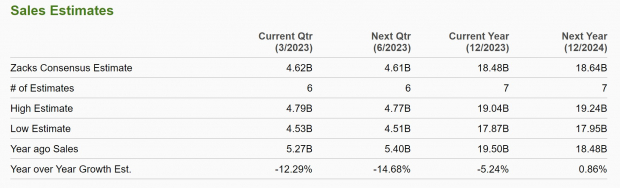

Experts are anticipating sales to diminish over the coming year, however AFL supply still flaunts a Zacks Ranking # 2 (Buy), as incomes modifications are trending greater on perpetuity structures.

Photo Resource: Zacks Financial Investment Study

Photo Resource: Zacks Financial Investment Study

Aflac is one more supply with really stable as well as constant assessment. Leaving out the Covid accident, its 1 year forward incomes multiple has actually remained in simply a four-point variety over the last one decade. At 11x 1 year onward incomes, it remains in line with its 10-year average of 11x.

Photo Resource: Zacks Financial Investment Study

Verdict

Reward development investing might not be one of the most amazing trading technique, however in markets what is amazing is hardly ever rewarding. Monotonous is an excellent way to gradually worsen as well as expand wide range. Routine reward payments offer capitalists with stable returns together with the alternative to utilize the cash money for costs or reinvest it right into even more supplies.

4 Oil Supplies with Large Benefits

International need for oil is with the roof covering … as well as oil manufacturers are battling to maintain. So despite the fact that oil costs are well off their current highs, you can anticipate large benefit from the firms that provide the globe with “black gold.”

Zacks Financial investment Research study has actually simply launched an immediate unique record to assist you rely on this fad.

In Oil Market ablaze, you’ll uncover 4 unanticipated oil as well as gas supplies placed for large gains in the coming weeks as well as months. You do not wish to miss out on these referrals.

Download your free report now to see them.

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

Hershey Company (The) (HSY) : Free Stock Analysis Report

Aflac Incorporated (AFL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views revealed here are the sights as well as point of views of the writer as well as do not always show those of Nasdaq, Inc.