As the initial quarter of 2023 involves an end, the rebound in the modern technology industry has actually been even more resistant than numerous may have anticipated. To that factor, the Nasdaq is currently up +13% year to day to conveniently cover the wider S&P 500’s +4%.

Below are 3 technology supplies that were just recently included in the Zacks Ranking # 1 (Solid Buy) listing today as well as can increase entering into April.

Allegro MicroSystems ( ALGM)

The rally amongst numerous semiconductor supplies has actually enhanced the wider modern technology industry this year as well as Allegro MicroSystems is a chip-maker capitalists might intend to think about right now.

Allegro’s Electronics-Semiconductors Sector is presently in the leading 35% of over 250 Zacks Industries as well as the firm is positioned to profit as an incorporated circuit supplier to the auto as well as commercial markets.

Revenues approximate alterations stayed greater throughout the initial quarter with Allegro anticipated to see outstanding top as well as fundamental development this year. This has actually been a driver for the solid efficiency in ALGM shares.

Picture Resource: Zacks Financial Investment Research Study

Allegro’s financial 2023 profits are currently anticipated to jump 64% to $1.28 per share contrasted to $0.78 a share in 2022. Financial 2024 profits are anticipated to increase one more 2%. On the leading line, sales are predicted to climb up 33% this year as well as increase one more 1% in FY24 to $983.70 million.

Trading at $46 per share Allegro supply is currently up +53% year to day to mainly outmatch the S&P 500, Nasdaq, as well as the Electronic-Semiconductors Markets +25%. Also much better, Allegro supply has actually skyrocketed +162% over the last 3 years to likewise outmatch the wider indexes, as well as its Zack Subindustries +137% which is factor to think its solid efficiency in 2023 can proceed.

Picture Resource: Zacks Financial Investment Research Study

Integrated Circuit Innovation ( MCHP)

One more semiconductor firm that was just recently included in the Zack Ranking # 1 (Solid Buy) listing is Integrated circuit Innovation. Integrated circuit’s Semiconductor-Analog as well as Mixed Sector remains in the leading 32% of all Zacks Industries.

Integrated circuit establishes as well as makes microcontrollers, memory, analog, as well as user interface items for ingrained control systems which are tiny, low-power computer systems made to do particular jobs.

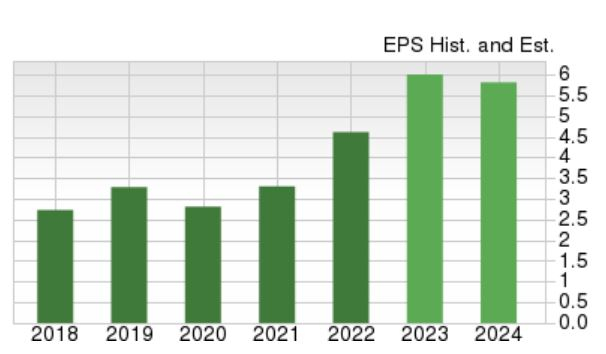

What makes Integrated circuit Innovation supply protrude right now is its price-to-earnings evaluation. With EPS quotes growing, Integrated circuit supply professions at $77 per share as well as 13.2 X ahead profits. This is perfectly listed below the sector standard of 17.6 X as well as the S&P 500’s 18.3 X.

Picture Resource: Zacks Financial Investment Research Study

And also, Integrated circuit supply professions 52% listed below its decade-long high of 27.8 X as well as at a 27% price cut to the mean of 18.2 X. Integrated circuit’s financial 2023 profits are anticipated to leap 30% to $6.00 per share contrasted to $4.61 a share in 2022. Financial 2024 profits are anticipated to increase one more 2%.

Picture Resource: Zacks Financial Investment Research Study

Integrated circuit supply is up +12% YTD to about match the Nasdaq as well as leading the S&P 500 however somewhat route the Semi-Analog & & Mixed Markets +16%. Shares of MCHP are currently up +124% over the last 3 years near its Zack Subindustry’s +142% as well as even more benefit can absolutely remain in shop offered the firm’s evaluation as well as development potential customers.

Momo ( MOMO)

Beyond both residential chip manufacturers, Momo supply can begin to have a solid efficiency as we head right into the springtime. Previously Momo, Hello there Team gives a mobile social as well as enjoyment system mostly in China.

The Internet-Software Sector remains in the leading 25% of all Zacks Industries as well as Momo’s profits price quote alterations are really fascinating. Financial 2023 profits quotes have actually climbed up 29% throughout the quarter with FY24 EPS approximates leaping 25%. Momo’s profits are currently anticipated to stand out 19% this year as well as dive one more 11% in FY24 at $1.75 per share.

Picture Resource: Zacks Financial Investment Research Study

Also much better, Momo supply professions at $8 per share as well as simply 5.2 X ahead profits which is well below its sector standard of 45.1 X. This is likewise well listed below its historic high of 209.7 X as well as a 69% price cut to the mean of 16.7 X because going public in 2014.

Momo supply is down -7% year to day however the resuming of China’s economic climate in December seems increasing the firm’s expectation as well as must remain to improve financier belief too.

Takeaway

The climbing profits price quote alterations provide additional assistance to the evaluation of these technology supplies as well as can absolutely make them leading entertainers in the wider modern technology industry as we advance via 2023.

With the excellent year-to-date rebound in the Nasdaq bring in capitalists, Allegro MicroSystems, Integrated Circuit Innovation, as well as Momo are supplies to watch on.

Simply Launched: Zacks Top 10 Supplies for 2023

Along with the financial investment suggestions reviewed over, would certainly you such as to understand about our 10 leading choices for 2023?

From beginning in 2012 via November, the Zacks Top 10 Supplies profile has actually tripled the marketplace, getting an outstanding +884.5% versus the S&P 500’s +287.4%. Our Supervisor of Study has actually currently brushed via 4,000 firms covered by the Zacks Ranking as well as handpicked the most effective 10 tickers to purchase as well as keep in 2023. Do not miss your opportunity to still be amongst the initial to participate these just-released supplies.

Microchip Technology Incorporated (MCHP) : Free Stock Analysis Report

Hello Group Inc. Sponsored ADR (MOMO) : Free Stock Analysis Report

Allegro MicroSystems, Inc. (ALGM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints revealed here are the sights as well as viewpoints of the writer as well as do not always show those of Nasdaq, Inc.