This year has actually been among the trickiest and also most tough years that I have actually seen in the marketplace. With variables like increasing rate of interest, rising cost of living, geopolitical stress, and also threat of financial stagnation there are a lot of variables that can clean and also unnerve financiers. However, market indexes have actually been extremely solid.

The most effective means to remain based in markets such as this is to make use of a tested procedure. The Zacks Ranking is an incredibly efficient means to discover supplies with a high chance of valuing in rate over the near-term, significantly enhancing financiers’ chances of success.

Marriot International MAR, MGM Resorts International MGM, and also United Airlines UAL are all Zacks Ranking # 1 (Solid Buy) supplies, showing higher trending profits modifications, and also near-term favorable assumptions.

Upgrades throughout these 3 supplies might likewise show some fascinating growths developing. Each of these supplies were struck extremely hard adhering to the Covid pandemic, and also still float around or listed below their pre-Covid highs. Yet with airline companies, resorts and also video gaming firms anticipating far better profits, we might be seeing the beginning of a complete healing and also outbreak in the tourist sector.

This would certainly run counter to the story of a slowing down economic climate and also might recommend a contrarian profession thesis. If so, each of these supplies might be beginning a significant bull run.

Marriot International

While it has actually been a tough time, Marriot International has actually been an incredibly solid carrying out supply over the last ten years. Intensifying at a yearly price of 16% over that time, it has actually outmatched the wide market by a substantial margin.

Picture Resource: Zacks Financial Investment Study

Revenues quotes for Marriot International are very favorable. Experts remain in consentaneous contract in updating assumptions, modifying existing quarter quotes 6% greater and also FY23 quotes 7% greater over the last 60 days. In addition, throughout one of the most current quarterly record, MAR beat profits assumptions by 12%. In action to the beat, MAR supply rallied 5%.

Picture Resource: Zacks Financial Investment Study

Existing quarter sales are anticipated to be solid also. Experts are predicting 11.5% development to $5.9 billion for the quarter, and also 12% development to $23.3 billion for FY23. These are extremely durable development prices for such a fully grown business.

MAR is trading at a 1 year forward profits multiple of 21x, which is listed below the sector standard of 22x, and also listed below its 10-year mean of 24x. As a leading franchise business in the sector, with identifiable brand names throughout the range of consumers, MAR is well placed for close to and also lasting supply recognition. Revenues upgrades, and also traditionally lows assessments create a really favorable configuration.

Picture Resource: Zacks Financial Investment Study

MGM Resorts International

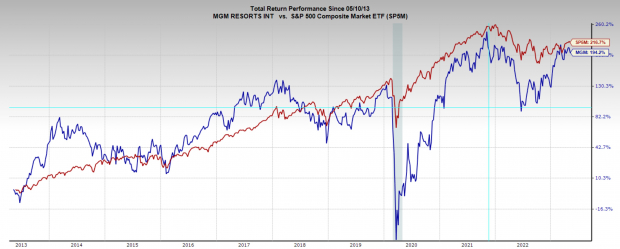

MGM Resorts International is a globally acknowledged resort and also online casino brand name that has actually done more than the last years. MGM supply has actually underperformed the wide market over that duration; nevertheless, it had the ability to make a legendary resurgence from its Covid pandemic lows.

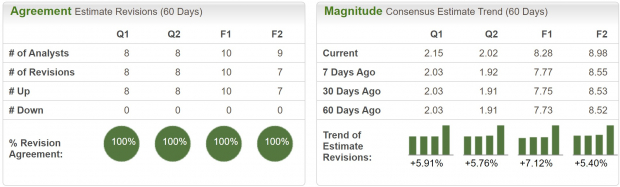

Picture Resource: Zacks Financial Investment Study

MGM has numerous extremely appealing company growths in the pipe that must add to the leading and also profits over the long term. On-line sporting activities wagering and also iGaming are a nonreligious financial huge pattern that MGM must profit greatly from. With considerable experience in conventional traditional video gaming procedures, the shift to electronic must be smooth. Because its launch in 2018 this sector has actually done very well and also is currently running in 24 markets flaunting an expanding market share.

One more significant advancement is the purchase of Realm City Casino Site in New York City. Expanding an impact in a market as considerable as New york city will certainly supply a brand-new lasting resource of profits for the video gaming titan.

Experts have actually changed profits quotes dramatically greater for MGM. After taking care of numerous quarters of unfavorable profits in 2014, revenues have actually currently turned back to favorable region. This favorable profits metric was just valued in over the last 2 months, so quotes are currently a lot greater.

Picture Resource: Zacks Financial Investment Study

After conquering the difficulties presented by the lockdowns in the United States and also a lot more just recently China, MGM has actually confirmed qualified monitoring and also solid remaining power. MGM is presently trading at a 1 year forward profits multiple of 22x, which is over the marketplace standard of 19x, and also well listed below its 10-year mean of 33x. This traditionally reduced evaluation in addition to the numerous favorable stimulants detailed makes MGM a solid prospect for financiers profiles.

Picture Resource: Zacks Financial Investment Study

United Airlines

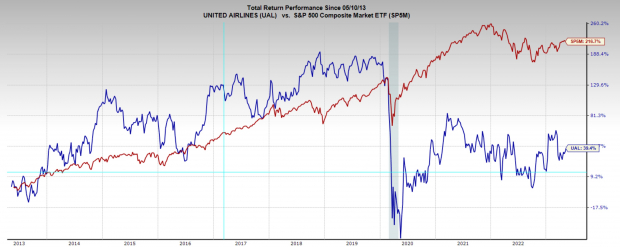

United Airlines supply has actually had a hard time over the previous years. The underperformance is noted by an unpleasant decrease in 2020, which the supply has yet to recuperate from. Nonetheless, enhancing profits assumptions, and also a resumption of worldwide and also residential traveling might be precisely what UAL requires to begin trending greater once again.

Picture Resource: Zacks Financial Investment Study

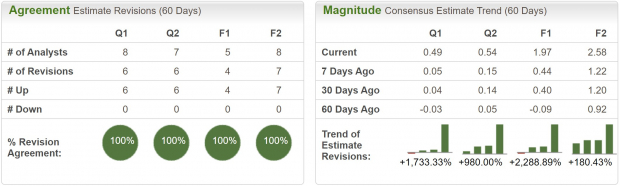

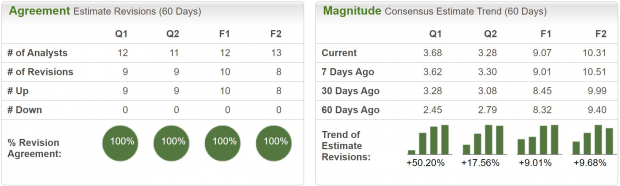

Experts have actually with one voice updated profits assumptions for UAL. Existing quarter profits quotes have actually been changed greater by 50% over the previous 2 months, and also all various other durations are anticipating boosted outcomes also. Existing quarter sales are anticipated to expand 15% YoY to $13.9 billion and also FY23 sales are anticipated to climb up 18% YoY to $53 billion.

Picture Resource: Zacks Financial Investment Study

UAL is trading at a 1 year forward profits multiple of 5x, which is listed below the sector standard of 10x, and also listed below its 10-year mean of 9x. This is a traditionally low-cost evaluation for the airline company and also supplies a possibility to have a market leading supply, that has numerous favorable stimulants imminent.

Picture Resource: Zacks Financial Investment Study

Profits

Market and also sector characteristics have actually moved at breakneck rate over the previous 3 years. Tourist and also traveling were several of the industries that took the most awful of the financial discomfort. Yet these sectors are plainly seeing a turn right. Having actually endured among the most awful feasible circumstances these supplies must be much better located than ever before.

Zacks Exposes ChatGPT “Sleeper” Supply

One obscure business goes to the heart of a specifically dazzling Expert system market. By 2030, the AI sector is anticipated to have a net and also iPhone-scale financial influence of $15.7 Trillion.

As a solution to viewers, Zacks is supplying a reward record that names and also discusses this eruptive development supply and also 4 various other “should gets.” Plus a lot more.

Download Free ChatGPT Stock Report Right Now >>

Marriott International, Inc. (MAR) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

MGM Resorts International (MGM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints shared here are the sights and also viewpoints of the writer and also do not always show those of Nasdaq, Inc.