It is difficult to fail acquiring supply in excellent quality services that have actually constantly expanded sales and also revenues every year. Also far better if you can acquire them when they have boosting revenues quotes and also high Zacks Ranks, as this additional boosts the near-term chances of the supply trading greater.

By checking the Zacks Ranking, I have actually determined 3 top-ranked supplies with precisely these qualities. Copart CPRT, Akami Technologies AKAM, and also Salesforce CRM all have various favorable stimulants acting in their support.

Picture Resource: Zacks Financial Investment Study

Copart

Copart is a worldwide on the internet automobile public auction and also remarketing system established in 1982. It assists in the trading of lorries with its electronic market, offering people, car dealerships, and also insurance provider. With procedures at over 200 places in 11 nations, Copart has greater than 250,000 lorries offered online each day.

The firm concentrates on innovative modern technologies and also information analytics to improve the public auction experience. Copart’s effective procedures and also comprehensive network have actually developed its setting as a leading gamer in the vehicle market with an approximated 40% market share in the public auction market.

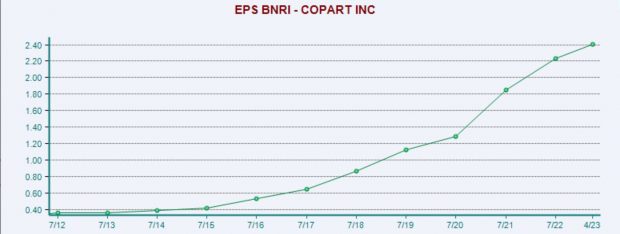

CPRT supply has actually been a phenomenal entertainer over the last ten years intensifying at a yearly price of 27.4% and also returning 1,026% over that time. Additionally, over that duration yearly sales have actually gradually enhanced from $1.1 billion to $3.7 billion, and also EPS have actually expanded from $0.39 to $2.41 per share.

Picture Resource: Zacks Financial Investment Study

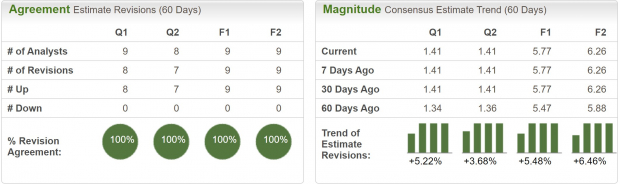

Copart appreciates a Zacks Ranking # 1 (Solid Buy), suggesting higher trending revenues modifications. Experts have actually all updated revenues assumptions throughout durations, with present quarter revenues quotes modified 3.5% greater and also FY23 revenues quotes modified virtually 4% greater. Furthermore, present quarter revenues are predicted to expand 5.3% YoY and also FY23 revenues are anticipated to climb up 9% YoY.

Picture Resource: Zacks Financial Investment Study

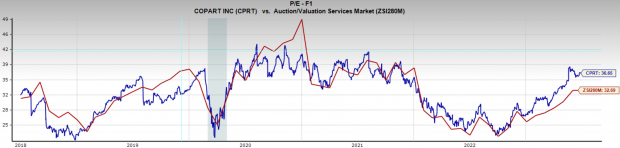

CPRT is trading at a 1 year forward revenues numerous 36.7 x, which is over the market standard of 32.7 x and also over its five-year average of 32x. Nonetheless, as the leading public auction system in the market, it is easy to understand that Copart makes a costs evaluation.

Picture Resource: Zacks Financial Investment Study

Akami Technologies

Akamai Technologies is a worldwide web content distribution network (CDN) and also cloud providers established in 1998. The firm provides options to speed up and also protect the distribution of on the internet web content, applications, and also media. With a durable network facilities and also progressed CDN innovation, Akamai offers customers throughout numerous sectors, enhancing internet site efficiency and also offering cloud protection versus cybersecurity hazards. Akamai stays a leading gamer in the electronic web content area, continually adjusting to fulfill progressing market needs.

AKAM has actually experienced solid upgrades in its revenues quotes, shown by its Zacks Ranking # 1 (Solid Buy). Present quarter revenues quotes have actually been modified greater by 5.2% and also are predicted to expand 4.5% YoY. FY23 revenues have actually enhanced by 5.5% over the last 2 months and also are anticipated to climb up 7.5% YoY.

Picture Resource: Zacks Financial Investment Study

Akami Technologies is trading at a 1 year forward revenues multiple of 19.8 x, which is listed below the market standard of 23.9 x, and also listed below its 10-year average of 26.3 x. With an evaluation listed below its historical standard and also proceeded revenues development, AKAM looks rather attractive.

Picture Resource: Zacks Financial Investment Study

Salesforce

Salesforce is a cloud-based client partnership administration (CRM) system that provides a collection of devices and also solutions to take care of sales, advertising, customer support, and also analytics. Established in 1999, Salesforce has actually come to be a worldwide leader in CRM options, offering services with a central center for keeping and also handling client information.

The system provides personalization alternatives and also combinations to fulfill particular service demands. With its easy to use user interface and also scalability, Salesforce makes it possible for companies to enhance client partnerships and also drive development with effective CRM administration.

After a significant restructuring previously this year which entailed giving up some 12,000 staff members to raise revenues, CRM has actually been among the leading supplies in the marketplace. The supply is up an excellent 59% YTD.

Energy appears to have actually taken ahold of Salesforce supply as the graph resembles it awaits its following leg greater. The technological pattern listed below shows that if CRM can get rid of the $214 degree, it might extremely well launch an additional bull go to brand-new YTD highs. However, if the supply can not hold over the $205 degree, the pattern is void, and also capitalists can await an additional profession arrangement.

Picture Resource: TradingView

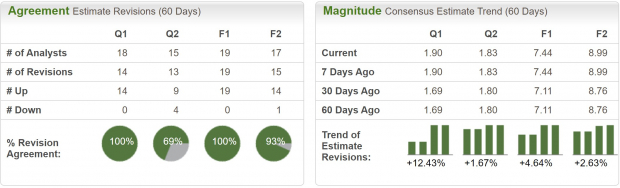

More boosting the chances that CRM rallies once more are its higher trending revenues modifications. Salesforce presently flaunts a Zacks Ranking # 1 (Solid Buy). Present quarter revenues quotes have actually been modified greater by 12.4% and also are anticipated to climb up a massive 60% YoY. FY23 revenues quotes have actually been updated by 4.6% and also are predicted to raise 42% YoY.

Sales for the software application titan are anticipated to expand ~ 10% YoY throughout durations, so plainly the restructuring has actually succeeded in increasing the lower line.

Picture Resource: Zacks Financial Investment Study

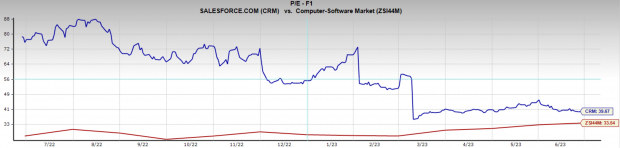

Salesforce has actually taken care of to designer something instead one-of-a-kind. In spite of substantial supply admiration over the in 2015, its revenues multiple has greater than halved many thanks to the huge rise in revenues. CRM is trading at a 1 year onward numerous of 39.7 x, which is over the market standard of 33.5 x, and also listed below its five-year average of 122x.

Picture Resource: Zacks Financial Investment Study

Profits

Capitalists utilizing Zacks exclusive research study do not require to look much to discover excellent quality financial investment suggestions. While timing the marketplace is an unbelievably hard task, capitalists’ chances of success can be considerably enhanced by trading just supplies on the Zacks Ranking # 1 listing, which consistently exceed the marketplace.

Zacks Names “Solitary Best Select to Dual”

From countless supplies, 5 Zacks specialists each have actually selected their favored to increase +100% or even more in months to find. From those 5, Supervisor of Research study Sheraz Mian hand-picks one to have one of the most eruptive advantage of all.

It’s an obscure chemical firm that’s up 65% over in 2015, yet still economical. With unrelenting need, rising 2022 revenues quotes, and also $1.5 billion for redeeming shares, retail capitalists might enter any time.

This firm might match or go beyond various other current Zacks’ Supplies Ready To Dual like Boston Beer Firm which soared +143.0% in little bit greater than 9 months and also NVIDIA which grew +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Salesforce Inc. (CRM) : Free Stock Analysis Report

Akamai Technologies, Inc. (AKAM) : Free Stock Analysis Report

Copart, Inc. (CPRT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints shared here are the sights and also viewpoints of the writer and also do not always mirror those of Nasdaq, Inc.