Supply buybacks, additionally called share bought programs, are just one of a number of methods for business to return money to investors. By soaking up a part of the exceptional shares, a firm properly lowers the share matter unconditionally increasing the share rate.

Firms will certainly do this when the supply is underestimated, or there are restricted reinvestment possibilities presently readily available. Buybacks aren’t without restrictions though as there are lots of methods for business to pass them in a bad method. Nonetheless, a number of the most effective business have a lengthy background of tactically redeeming shares at the advantage of capitalists.

Seeing a graph of decreasing shares exceptional can be one solid sign of accountable monitoring, and also a supply that has actually likely been trending greater. To additionally boost the chance of getting a great supply, capitalists can make use of Zacks exclusive research study, which determines supplies with a raised possibility of relocating greater in the close to term.

In this short article I will certainly cover 3 supplies that have actually substantially lowered their exceptional shares over the last years, have a solid executing supply, and also a high Zacks Ranking. Pulte Team PHM, Steel Characteristics STLD, and also W.W. Grainger GWW fit all those standards.

Picture Resource: Zacks Financial Investment Study

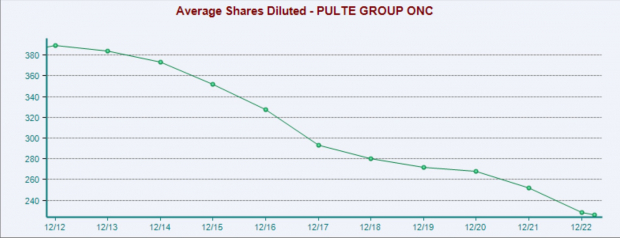

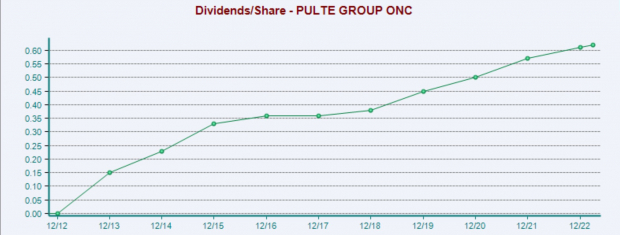

Pulte Team

Pulte Team is a homebuilder and also economic solutions firm based in the United States. The Homebuilding section provides a wide array of house styles consisting of solitary family members separated, condominiums, condos, and also duplexes at various costs. The economic solutions section is simply 2% of overall incomes and also provides home mortgage financial and also title solutions.

Pulte Team has actually been a relentless purchaser of its very own shares over the last years. Over that time the variety of shares exceptional has actually been lowered by 40%. Additionally in the last years, PHM shares have actually intensified at a yearly price of 12.6%, somewhat slipping by the returns of the S&P 500.

Picture Resource: Zacks Financial Investment Study

Incomes over the last 10 years have actually expanded enormously too, almost tripling from $5.8 billion in 2014, to $16.8 billion today. PHM has actually been incredibly charitable to its investors, dramatically enhancing returns over that duration too. With expanding incomes, and also returns along with the share buybacks, PHM’s supply rate admiration is plainly greater than simply economic design.

Picture Resource: Zacks Financial Investment Study

Pulte Team is trading at a 1 year forward profits multiple of 7.5 x, which is listed below the market standard of 10x, and also listed below its 10-year mean of 10.4 x. PHM additionally flaunts a Zacks Ranking # 1 (Solid Buy), suggesting higher trending profits alterations.

Picture Resource: Zacks Financial Investment Study

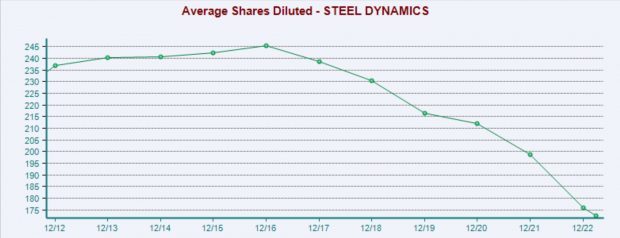

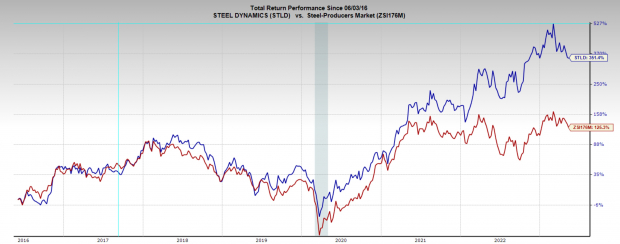

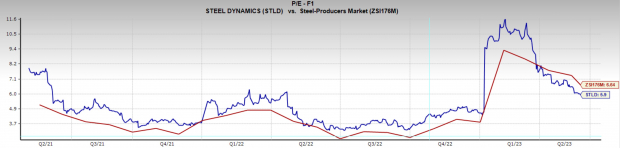

Steel Characteristics

Steel Characteristics is amongst the leading steel manufacturers and also steel recyclers in the United States. It presently has steelmaking and also finishing capability of about 16 million heaps. STLD is among one of the most varied steel business in the nation with a huge variety of specialized items. The firm makes and also markets steel items, procedures and also markets recycled ferrous and also nonferrous steels, and also produces and also markets steel joist and also outdoor decking items globally.

Steel Characteristics is an additional firm that has actually made significant initiatives to constantly redeem shares. In between 2016 and also today, overall shares exceptional have actually been lowered by 30%. Additionally, over that duration incomes have actually tripled from $7.7 billion to $21.6 billion, and also returns per share have actually additionally tripled.

Picture Resource: Zacks Financial Investment Study

Like Pulte Team, Steel Characteristics supply has actually plainly rallied for factors aside from its share buybacks, specifically the significant development in incomes and also financier pleasant reward payments. Considering that 2016 STLD has actually intensified at a yearly price of 24%, increasing the yearly returns of the wide market index.

Picture Resource: Zacks Financial Investment Study

STLD is trading at a 1 year forward profits multiple of 5.9 x, which is listed below the market typical 6.6 x, and also listed below its 10-year mean of 12x. With such a reasonably reduced assessment along with a Zack Ranking # 2 (Buy), STLD is a deserving factor to consider for capitalists considering supplies redeeming shares.

Picture Resource: Zacks Financial Investment Study

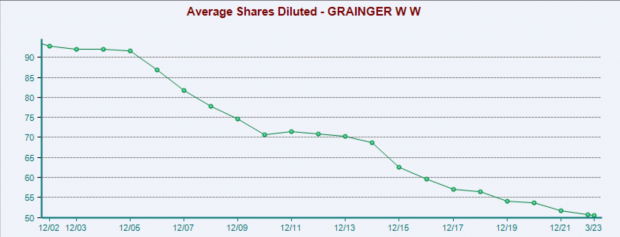

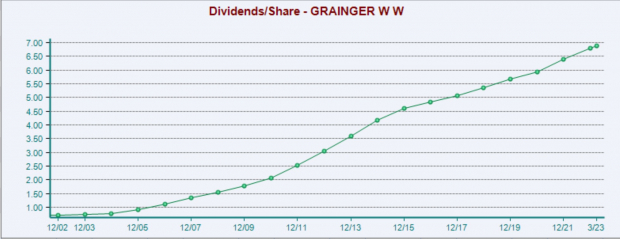

W.W. Grainger

W.W. Grainger is a business-to-business representative of upkeep, repair service and also operating (MRO) product or services. Its procedures are mostly in The United States and Canada, Japan, and also the U.K. Its consumers stand for a vast variety of sectors consisting of federal government, production, transport, business and also service providers. Its items consist of material-handling devices, safety and security and also safety materials, lights and also electric items, power and also hand devices, pumps and also pipes materials, cleansing and also upkeep materials, and also metalworking devices.

W.W. Grainer’s 20-year buyback project has actually lowered its exceptional shares by 45% over that time. Over that duration incomes have actually tripled from $5 billion to $15 billion and also profits per share have 10x would certainly $3.02 to $32.21 per share.

Picture Resource: Zacks Financial Investment Study

GWW plainly likes its capitalists as returns have actually additionally been trending greater over the last twenty years. Rewards per share have actually climbed up from $0.79 in 2004 to $6.88 per share today.

Picture Resource: Zacks Financial Investment Study

GWW is trading at a 1 year forward profits multiple of 19x, which remains in line with the market standard and also simply listed below its 10-year mean of 20. W.W. Grainger additionally has a Zacks Ranking # 1 (Solid Buy), suggesting higher trending profits alterations.

Picture Resource: Zacks Financial Investment Study

Profits

These 3 supplies have actually revealed a background of returning significant quantities of cash to capitalists via both supply buybacks and also returns. Activities such as this are regular of supplies with solid long-lasting returns. In addition, with the existing high Zacks Ranks, they have great chances of excellent returns in the near-term too.

This Obscure Semiconductor Supply Might Be Your Profile’s Bush Versus Rising cost of living

Everybody makes use of semiconductors. Yet just a handful of individuals understand what they are and also what they do. If you utilize a smart device, computer system, microwave, electronic cam or fridge (which’s simply the suggestion of the iceberg), you have a demand for semiconductors. That’s why their significance can not be overemphasized and also their interruption in the supply chain has such an international result. Yet every cloud has a positive side. Shockwaves to the global supply chain from the worldwide pandemic have actually uncovered a significant possibility for capitalists. As well as today, Zacks’ prominent supply planner is exposing the one semiconductor supply that stands to acquire one of the most in a brand-new FREE record. It’s your own at no charge and also without commitment.

>>Yes, I Want to Help Protect My Portfolio During the Recession

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

W.W. Grainger, Inc. (GWW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints shared here are the sights and also viewpoints of the writer and also do not always show those of Nasdaq, Inc.