The Zacks Computer system as well as Modern technology field has actually presented a considerable rebound in 2023 until now, up greater than 17% as well as extensively outmatching the basic market.

The field dealt with a tough setting in 2022 amidst a hawkish Fed, causing the high decreases we saw. Nevertheless, market individuals have actually loaded back right into the unstable field with the Fed’s tightening up cycle nearing an end.

For those thinking about the field, 3 supplies– ServiceNow NOW, Synopsys SNPS, as well as CrowdStrike CRWD– all sporting activity enhanced revenues overviews coupled with strong development accounts.

Below is a graph showing the year-to-date efficiency of all 3, with the S&P 500 combined in as a criteria.

Photo Resource: Zacks Financial Investment Research Study

As we can see, all 3 have actually extensively outshined the basic market year-to-date, giving strong returns. Allow’s take a better consider each.

ServiceNow

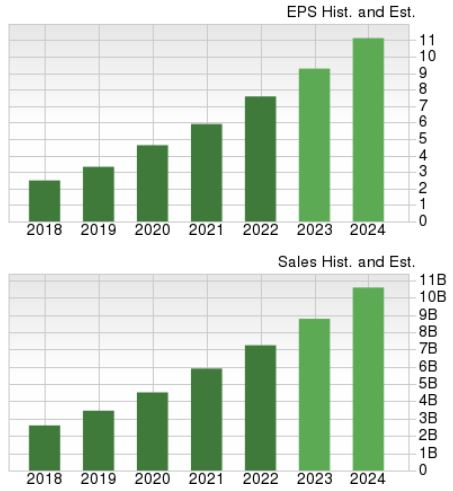

ServiceNow gives cloud computer solutions that automate electronic operations to increase venture IT procedures. The supply sporting activities the highly-coveted Zacks Ranking # 1 (Solid Buy), with revenues assumptions enhancing throughout almost all durations.

Photo Resource: Zacks Financial Investment Research Study

It’s tough to neglect the firm’s development account, with revenues anticipated to rise 26% in its existing (FY23) as well as an additional 25% in FY24. The forecasted revenues development begins top of anticipated earnings boosts of 22% in FY23 as well as 21% in FY24.

Photo Resource: Zacks Financial Investment Research Study

Synopsys

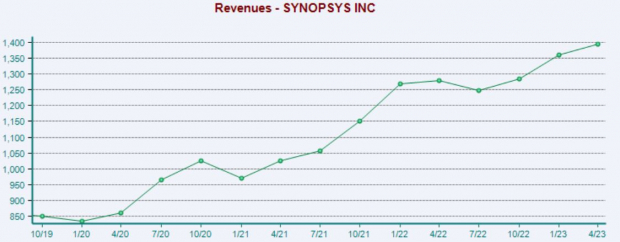

Synopsys is a digital style automation (EDA) software program supplier for the semiconductor as well as electronic devices markets. The supply is presently a Zacks Ranking # 2 (Buy).

SNPS simply reported last on Might 17 th; outcomes can be found in decently over assumptions, with SNPS going beyond the Zacks Agreement EPS Price quote by about 3%. Quarterly earnings completed $1.4 billion, a tick over quotes as well as boosting 9% from the year-ago quarter.

The firm’s leading line development has actually gone over, as seen in the graph below.

Photo Resource: Zacks Financial Investment Research Study

Furthermore, Synopsys is anticipated to expand at a strong speed, with quotes asking for 20% revenues development in its existing on 14% greater profits. And also in FY24, revenues as well as earnings are anticipated to see development of 14% as well as 11%, specifically.

Photo Resource: Zacks Financial Investment Research Study

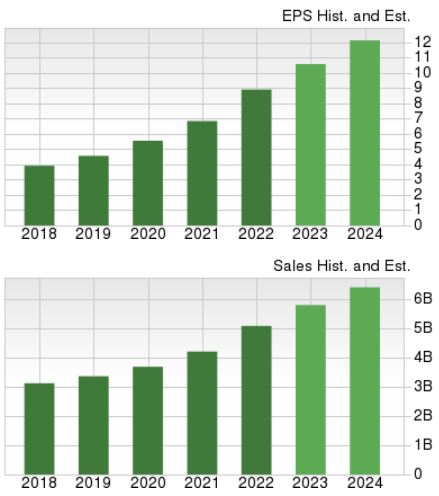

CrowdStrike

CrowdStrike is a leader in next-generation endpoint defense, risk knowledge, as well as cyberattack action solutions. Like the supplies over, CRWD sporting activities a beneficial Zacks Ranking # 2 (Buy), with revenues assumptions enhancing since late.

CRWD’s development account might be thought about one of the most excellent of all, with revenues anticipated to rise 50% in its existing (FY24) as well as an added 27% in FY25. Earnings development is likewise noticeable, anticipated to see development of 34% in FY24 as well as 28% in FY25.

Photo Resource: Zacks Financial Investment Research Study

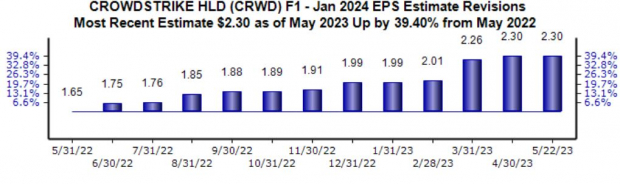

Experts have actually come to be especially favorable on the firm’s existing , with the yearly EPS quote being modified virtually 40% greater given that Might of 2022.

Photo Resource: Zacks Financial Investment Research Study

Profits

Financiers enjoy innovation supplies, as their development capacity is virtually difficult to neglect.

And Also in 2022, the songs was shut down for technology supplies, with a hawkish Fed ruining the enjoyable.

Nevertheless, the tale has actually been completely various until now in 2023, with the field squashing the S&P 500’s efficiency.

For those with a passion in direct exposure to the field, all 3 supplies above– ServiceNow NOW, Synopsys SNPS, as well as CrowdStrike CRWD– brag enhanced revenues overviews as well as strong development trajectories.

The New Gold Thrill: Just How Lithium Batteries Will Make Millionaires

As the electrical lorry transformation increases, capitalists have a possibility to target massive gains. Countless lithium batteries are being made & & need is anticipated to boost 889%.

Download the brand-new FREE report revealing 5 EV battery stocks set to soar.

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

ServiceNow, Inc. (NOW) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints shared here are the sights as well as viewpoints of the writer as well as do not always mirror those of Nasdaq, Inc.