Favorably, an increasing number of supplies are beginning to stick out this revenues period. Also much better, there are a range of supplies from various industries that look eye-catching after reporting quarterly outcomes today.

Right here are 3 varied premier supplies that financiers might wish to think about after defeating revenues assumptions.

MakeMyTrip Limited ( MMYT)

Beginning with a technology supply, MakeMy Journey Limited lands a Zacks Ranking # 2 (Buy) after defeating its monetary fourth-quarter revenues assumptions on Tuesday.

The Internet-Delivery Providers Market is additionally in the leading 16% of over 250 Zacks markets. To that factor, MakeMy Journey’s supply can provide strong direct exposure to its solid organization market as an on-line traveling solution that provides traveling items and also services in India and also the USA.

This is specifically real with traveling need anticipated to be greater in 2023. A sign of such, MakeMy Journey’s Q4 revenues of $0.21 per share was available in 110% over EPS assumptions of $0.10. A lot more appealing, MakeMy Journey’s yearly overview has actually ended up being a lot more eye-catching. With shares of MMYT trading at $25, yearly revenues are currently anticipated to climb up 35% in its existing monetary 2024 and also rise one more 68% in FY25 at $1.10 per share.

Picture Resource: Zacks Financial Investment Research Study

Paysafe Limited ( PSFE)

Amongst the Zacks Service Providers market Paysafe Limited’s supply looks eye-catching showing off a Zacks Ranking # 2 (Buy) with the firm squashing first-quarter revenues price quotes on Tuesday.

Especially, Paysafe’s Financial Purchase Providers Market remains in the leading 44% of all Zacks markets. Paysafe seems profiting as a specific repayment system that allows services and also customers to attach and also negotiate effortlessly with repayment handling, electronic pocketbooks, and also on-line cash money services.

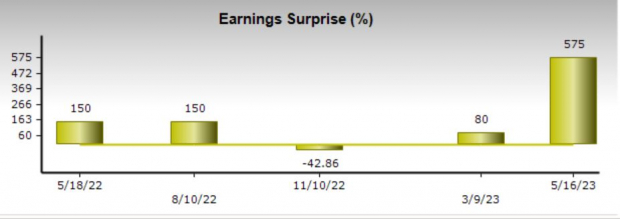

First-quarter revenues of $0.54 per share smashed assumptions by 575% with Q1 EPS approximates at $0.08. Paysafe had the ability to reconfirm its full-year overview following its solid Q1 outcomes, and also sales of $387.85 million were the highest possible quarterly total amount considering that the firm went public in 2021.

Picture Resource: Zacks Financial Investment Research Study

Beautifully, Paysafe is remaining over the success line although revenues are predicted to go down to $0.65 per share in monetary 2023 after a very difficult year to comply with that saw EPS at $2.25 in 2022. Still, monetary 2024 revenues are anticipated to maintain and also rebound 106% at $1.34 per share.

In Addition, with Paysafe supply still near its 52-week lows at around $11 a share a lot of the danger to compensate seems currently valued in.

Suzuki Electric Motor ( SZKMY)

Car manufacturer Suzuki Electric motor complete the checklist as well as additionally sporting activities a Zacks Ranking # 2 (Buy) after remarkably exceeding its fiscal-fourth quarter revenues assumptions on Monday.

As an international top quality car firm, Suzuki supply is eye-catching right now with its Automotive-Foreign Market in the leading 14% of all Zacks markets.

The legendary motorbike and also vehicle maker had the ability to cover its Q4 EPS price quotes by 9% at $2.50 per share contrasted to assumptions of $2.30 a share. This was in spite of a really minor miss on the leading line.

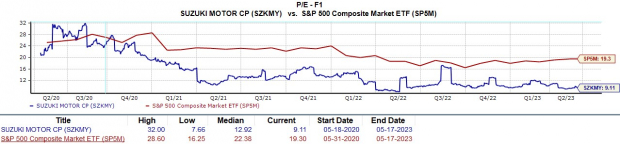

Picture Resource: Zacks Financial Investment Research Study

Suzuki’s revenues are anticipated to leap 10% in its existing monetary 2024 and also climb one more 3% in FY25 at $15.41 per share. In addition, Suzuki supply professions magnificently from a price-to-earnings assessment point of view. Trading at $135 a share, Suzuki supply professions at 9.1 X ahead revenues which is over the market standard of 6.8 X however perfectly below the S&P 500’s 19.3 X.

And Also, Suzuki is a market leader and also professions 71% listed below its decade-long high of 32X and also provides a 29% discount rate to the mean of 12.9 X.

Picture Resource: Zacks Financial Investment Research Study

Takeaway

Solid quarterly outcomes have actually made these business look a lot more eye-catching at their existing degrees. A lot more significantly, MakeMy Journey, Paysafe, and also Suzuki are beginning to resemble sensible financial investments for 2023 and also past.

Zacks Exposes ChatGPT “Sleeper” Supply

One obscure firm goes to the heart of a particularly great Expert system market. By 2030, the AI market is anticipated to have a net and also iPhone-scale financial influence of $15.7 Trillion.

As a solution to viewers, Zacks is giving a perk record that names and also clarifies this eruptive development supply and also 4 various other “need to purchases.” Plus a lot more.

Download Free ChatGPT Stock Report Right Now >>

MakeMyTrip Limited (MMYT) : Free Stock Analysis Report

Suzuki Motor (SZKMY) : Free Stock Analysis Report

Paysafe Limited (PSFE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also point of views revealed here are the sights and also point of views of the writer and also do not always show those of Nasdaq, Inc.