As we strategy the brand new 12 months, buyers can be evaluating the most effective shares to think about, with the know-how sector actually of curiosity.

Semiconductor shares can be focused particularly, due to their attain in configuring synthetic intelligence. That mentioned, listed below are three of the highest semiconductor shares to spend money on going into 2025.

Broadcom – AVGO

YTD Efficiency: +116%

One firm leveraging the demand for AI chips of late is Broadcom AVGO which is a key provider to Apple AAPL. Designing customized AI accelerators for knowledge facilities, Broadcom not too long ago introduced it secured two hyper-scale knowledge middle prospects that are rumored to be Alphabet GOOGL and Meta Platforms META or the likes of Amazon AMZN and Microsoft MSFT.

These strategic partnerships have made Broadcom’s development narrative very interesting with the corporate regarded as the second-largest AI semiconductor provider.

Nvidia – NVDA

YTD Efficiency: +176%

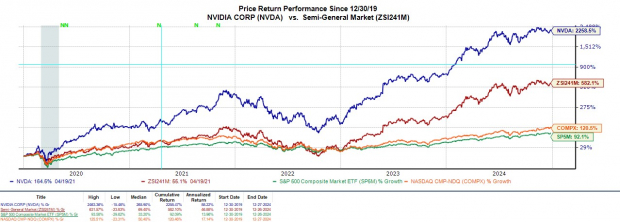

We’ll pivot to the biggest AI chipmaker Nvidia NVDA. Whereas Nvidia’s Blackwell collection AI chips have confronted some challenges with overheating they’re thought of the highest-performing AI chips in the marketplace.

Moreover, Nvidia’s H100 and H200 collection chips have sparked appreciable development with the corporate’s whole gross sales projected at $129.02 billion in its present fiscal 2025. This is a rise of over 1000% from the beginning of the present decade with 2020 gross sales at $10.91 billion.

Picture Supply: Zacks Funding Analysis

Astonishingly, the value efficiency of NVDA has greater than doubled the share development the corporate has seen on its high line making it noteworthy that FY26 gross sales are projected to extend one other 48% to $191.84 billion.

Picture Supply: Zacks Funding Analysis

Taiwan Semiconductor – TSM

YTD Efficiency: +94%

Final however not least is Taiwan Semiconductor TSM which can also be a key provider for Apple because the world’s largest supplier of built-in circuit foundries (ICs). Whereas Taiwan Semiconductor doesn’t manufacture AI chips immediately, it gives the foundries that assist different firms produce AI chips together with Nvidia.

What could attraction to buyers is that TSM has the most affordable P/E valuation on the listing at 29.2X ahead earnings. Even higher, Taiwan Semiconductor is anticipated to put up double-digit high and bottom-line development this 12 months and in FY25.

Picture Supply: Zacks Funding Analysis

Backside Line

With theglobal marketfor synthetic intelligence presumed to be value trillions within the coming years, these high semiconductor shares needs to be profitable investments going into 2025. To that time, Broadcom, Nvidia, and Taiwan Semiconductor ought to proceed to embody this interesting development narrative.

Free Report: 5 Clear Power Shares with Large Upside

Power is the spine of our economic system. It’s a multi-trillion greenback business that has created a number of the world’s largest and most worthwhile firms.

Now state-of-the-art know-how is paving the best way for clear vitality sources to overhaul “old school” fossil fuels. Trillions of {dollars} are already pouring into clear vitality initiatives, from solar energy to hydrogen gasoline cells.

Rising leaders from this house could possibly be a number of the most enjoyable shares in your portfolio.

Download Nuclear to Solar: 5 Stocks Powering the Future to see Zacks’ top picks free today.

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.