When choosing dividend-paying supplies, among the very first points that capitalists check out is, obviously, the yearly return.

It prevails for business to raise their payments when company is rewarding, making them attracting financial investments for income-focused capitalists from a shorter-term viewpoint.

3 high-yield supplies– Sociedad Quimica Y Minera SQM, Perspective Innovation Financing HRZN, as well as Funding Southwest CSWC– might all be factors to consider for those with a hunger for earnings. Allow’s take a better check out each.

Sociedad Quimica Y Minera

Sociedad Quimica Y Minera, an existing Zacks Ranking # 2 (Buy), is just one of the globe’s biggest lithium manufacturers, with among the sector’s the very least impactful water, carbon, as well as power impacts.

The business’s yearly returns currently generates a large 11.5%, squashing the Zacks Basic Products market standard. SQM has actually expanded its returns payment by virtually 60% over the last 5 years, indisputably a significant favorable.

Photo Resource: Zacks Financial Investment Study

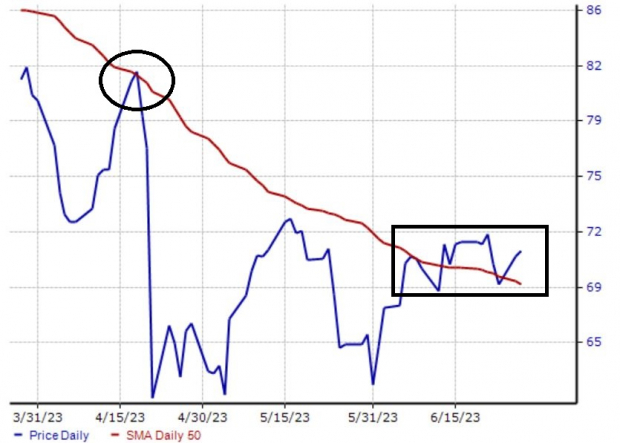

SQM shares have actually just recently seen purchasers tip up near the 50-day relocating standard, a degree they formerly stopped working to obstacle. This is shown in the graph below.

Photo Resource: Zacks Financial Investment Study

Perspective Innovation Financing

Perspective Innovation Financing makes protected car loans to development-stage business in the innovation, life scientific research, health care details as well as solutions, as well as cleantech markets. The supply sporting activities the highly-coveted Zacks Ranking # 1 (Solid Buy), with the modifications fad especially significant for its present .

Photo Resource: Zacks Financial Investment Study

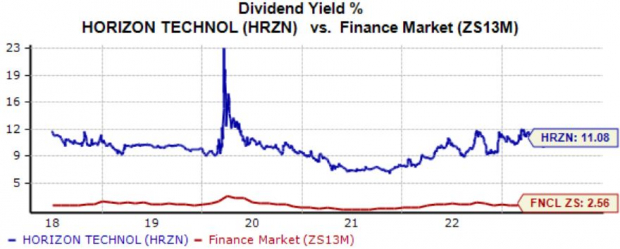

Perspective Innovation shares presently generate 11.1% every year, with the payment expanding decently over the last 5 years. As we can see below, the present return is much from the Zacks Financing market standard.

Photo Resource: Zacks Financial Investment Study

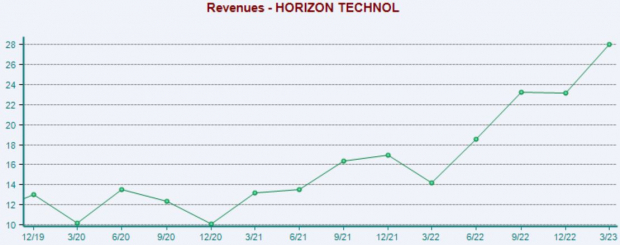

On top of that, the business has actually been a regular incomes entertainer, going beyond incomes as well as income assumptions in each of its last 4 quarters. Simply in its most recent launch, the business supplied an 18% EPS beat as well as a 12.5% income shock.

Photo Resource: Zacks Financial Investment Study

Funding Southwest

Funding Southwest is concentrated on early-stage fundings, development fundings, administration acquistions, as well as recapitalizations in a wide variety of sector sectors. The supply is a Zacks Ranking # 1 (Solid Buy), with incomes assumptions raising throughout the board.

Photo Resource: Zacks Financial Investment Study

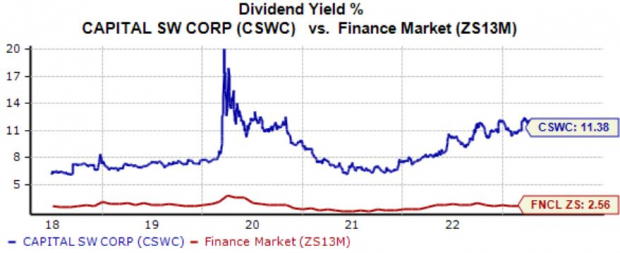

Comparable to the supplies over, CSWC shares presently generate a large 11.4% every year coupled with a 10% five-year annualized returns development price. Still, the business’s 93% payment proportion does elevate worries, living on the high-end of the range.

Photo Resource: Zacks Financial Investment Study

Watch out for the business’s upcoming quarterly launch anticipated on August 7 th; the Zacks Agreement EPS quote of $0.64 recommends a 30% enhancement from the year-ago quarter.

Profits

While high-yielding supplies can permit capitalists to develop a money stack swiftly, the sustainability of the enhanced return, many thanks to prospering company problems, can be at risk when points aren’t going so efficiently.

Rather, for those that look for integrity, targeting business that are taken into consideration Reward Aristocrats gives specifically that.

Zacks Names “Solitary Best Choose to Dual”

From countless supplies, 5 Zacks professionals each have actually picked their favored to escalate +100% or even more in months ahead. From those 5, Supervisor of Research study Sheraz Mian hand-picks one to have one of the most eruptive advantage of all.

It’s an obscure chemical business that’s up 65% over in 2015, yet still economical. With unrelenting need, skyrocketing 2022 incomes quotes, as well as $1.5 billion for buying shares, retail capitalists might enter any time.

This business might measure up to or go beyond various other current Zacks’ Supplies Ready To Dual like Boston Beer Business which skyrocketed +143.0% in bit greater than 9 months as well as NVIDIA which expanded +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Sociedad Quimica y Minera S.A. (SQM) : Free Stock Analysis Report

Horizon Technology Finance Corporation (HRZN) : Free Stock Analysis Report

Capital Southwest Corporation (CSWC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints revealed here are the sights as well as viewpoints of the writer as well as do not always mirror those of Nasdaq, Inc.