Buying high-grade organizations trading at historic discount rates is a sensible technique with the possibility for market-beating returns. In this short article, we will certainly discover 3 such phenomenal supplies that not just display engaging evaluations however likewise have leading Zacks Ranks, improving their near-term potential customers.

Visa V, renowned for its leading setting in the international monetary solutions sector, InMode INMD, a leading gamer in the quickly broadening clinical appearances market, as well as VeriSign VRSN, a relied on supplier of domain windows registry solutions, all show durable organization basics, a record of expanding revenues, as well as affordable benefits within their particular fields.

Picture Resource: Zacks Financial Investment Study

Visa

Visa is the globe’s leader in in bank card purchases. Visa presently refines 61% of all card based purchases in the United States as well as 40% around the world making it the globe’s biggest card cpu by purchase quantity.

The firm basically appreciates a tax obligation on all credit score card-based acquisitions many thanks to its extraordinary network. And also though Visa has actually developed out deep infiltration right into the globe’s settlement options, there is still a lot of area to expand. Globally, money is still one of the most prominent technique of settlement for point-of-sale purchases at 59%, so Visa has area prior to the marketplace is filled.

Visa has a Zacks Ranking # 2 (Buy), suggesting higher trending revenues modifications. Present quarter revenues are forecasted to expand simply 1% YoY, nonetheless FY23 revenues are anticipated to climb up 14.4% YoY.

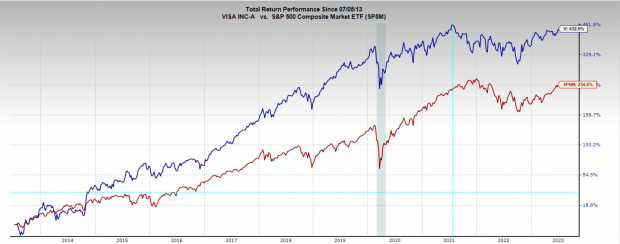

As a result of Visa’s phenomenal organization economics, 99% gross margins as well as 50% internet margins, in addition to sector prominence as well as consistent revenues development, its supply has actually delighted in excellent efficiency. Over the last 10 years it has actually intensified at a yearly price of 18%, much surpassing the wide market.

Nevertheless, in the efficiency graph below, we can see that the consistent climb greater has actually reduced, as well as over the last 3 years the supply has actually made little progression. This develops a fantastic possibility for critical capitalists as its assessment has actually had the possibility to modest, given that the supply rate has actually gone stale while revenues have actually remained to expand.

Picture Resource: Zacks Financial Investment Study

Visa is currently trading at a 1 year forward revenues multiple of 27.7 x, which is listed below its five-year typical of 30.5 x as well as well off its high assessment of 45x. While nearly 28x onward revenues isn’t a yelling discount rate, excellent business like V hardly ever take place sale, so currently is as great a chance as any type of.

Picture Resource: Zacks Financial Investment Study

InMode

InMode is a sector leading clinical modern technology firm expanding at an excellent speed. INMD has actually established a varied profile of minimally intrusive as well as non-invasive gadgets supplying cutting-edge options for body contouring, skin renewal, face therapies, as well as ladies’s health and wellness. By incorporating radiofrequency, laser, as well as various other energy-based innovations, InMode supplies efficient as well as adjustable treatments, gaining acknowledgment amongst doctors worldwide.

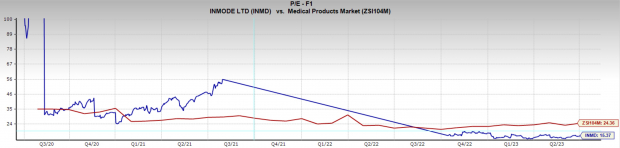

Throughout 2022, INMD supply experienced a ruthless adjustment of almost -80%, nonetheless the supply has actually still intensified at a yearly price of 55% given that its IPO.

InMode has actually expanded sales from $100 million in 2018 to almost $500 million today, which development is anticipated to proceed. FY23 sales are forecasted to expand 18% YoY as well as FY24 are anticipated to expand 16.4% YoY.

Incomes quotes have actually started to experience modifications greater providing InMode a Zacks Ranking # 2 (Buy). FY23 revenues quotes have actually been modified greater by 2% as well as are forecasted to expand 12% YoY to $2.71 per share. FY24 revenues quotes have actually been modified greater by 1.5% as well as are anticipated to expand 13.7% YoY to $3.06 per share.

In addition to numerous various other high-growth supplies, INMD experienced an excruciating 2022 adjustment. Currently a year after the lows, the supply has actually developed out a big base, where it can start a brand-new bull series.

InMode supply has actually run into offering each time the supply has actually traded approximately the $37.50 degree. However the even more a degree obtains evaluated, the most likely it is to fall short. If the rate can trade over the $37.50 degree once more, it might drive the supply dramatically greater. Additionally, if it sheds the $35 degree, it might take a while prior to the following bull run.

Picture Resource: TradingView

The 2022 adjustment has actually likewise brought INMD to an extremely attractive assessment. It is currently trading at a 1 year forward revenues multiple of 15.4 x, which is listed below the sector standard of 24.4 x, as well as well listed below its three-year typical of 31x. As a firm expanding at such a speed, as well as with the technological graph pattern as a stimulant, InMode might be establishing for a huge relocation.

Picture Resource: Zacks Financial Investment Study

VeriSign

VeriSign is a relied on supplier of domain windows registry solutions, playing a crucial function in the performance of the net. As the special driver of the.com and.net domain name computer registries, VeriSign makes certain the safe as well as trusted resolution of countless net domain around the world. With its durable facilities as well as proficiency in handling domain systems, VeriSign preserves the security, safety, as well as accessibility of these crucial on-line possessions.

The firm’s tactical setting as well as long-lasting agreements with ICANN (Web Company for Assigned Labels as well as Figures) offer a strong structure for lasting earnings generation. As net use as well as electronic makeover remain to increase, VeriSign stands to take advantage of the expanding need for domain as well as the enhanced value of on-line existence.

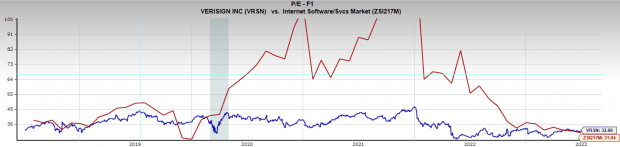

VeriSign is a Zacks Ranking # 1 (Solid Buy) shown by higher trending revenues modifications. FY23 revenues quotes have actually been modified greater by 2.7% as well as are forecasted to expand 11% YoY to $6.92 per share. FY24 quotes have actually been updated by 4.5% as well as are anticipated to climb up 11% YoY to $7.68 per share.

Picture Resource: Zacks Financial Investment Study

VeriSign is trading at a 1 year forward revenues multiple of 32.7 x, which is simply over the sector standard of 31x, as well as listed below its five-year typical of 37.1 x. While 31x onward revenues is not a deep worth financial investment, VRSN’s essential function in the net almost guarantees its organization future. And also with enhancing revenues quotes, as well as an appraisal listed below its historic typical there might not be a chance to acquire it at a more affordable assessment.

Picture Resource: Zacks Financial Investment Study

Profits

It is tough to fail acquiring industry-leading supplies at historic discount rates. While choosing supplies is constantly enjoyable, capitalists ought to maintain threat monitoring top of mind as well as consider their direct exposure as well as max threat per profession.

Zacks Names “Solitary Best Select to Dual”

From hundreds of supplies, 5 Zacks professionals each have actually picked their preferred to escalate +100% or even more in months to find. From those 5, Supervisor of Research study Sheraz Mian hand-picks one to have one of the most eruptive advantage of all.

It’s an obscure chemical firm that’s up 65% over in 2014, yet still economical. With unrelenting need, rising 2022 revenues quotes, as well as $1.5 billion for buying shares, retail capitalists can enter any time.

This firm can equal or exceed various other current Zacks’ Supplies Ready To Dual like Boston Beer Firm which soared +143.0% in bit greater than 9 months as well as NVIDIA which expanded +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Visa Inc. (V) : Free Stock Analysis Report

VeriSign, Inc. (VRSN) : Free Stock Analysis Report

InMode Ltd. (INMD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views shared here are the sights as well as point of views of the writer as well as do not always mirror those of Nasdaq, Inc.