Fresh rising cost of living information was launched on Tuesday, and also it revealed that the price of rising cost of living was greater than anticipated in January. Experts predicted YoY rising cost of living at 6.2% and also Core rising cost of living at 5.5%, yet numbers can be found in warm at 6.4% and also 5.6% specifically.

The CPI part with the 2nd greatest YoY rising cost of living was Utilities, at a tremendous 26.7%. While high rising cost of living is unquestionably poor for customers, in this circumstances it is rather great for the energies supplies.

Energies are additionally presently the # 1 industry in the Zacks Market Ranks. Energies commonly supply a reduced threat, stable return for profiles, and also deal charitable reward accept boot. If 2023 is anything like in 2014, it might be an additional great year for protective supplies like energies.

The York Public Utility

The York Public Utility YORW is a 200-year-old water collection and also circulation energy. YORW has a variety of wastewater collection and also therapy centers, 2 storage tanks having an approximated 2.2 billion gallons of water, a 15-mile pipe from the Susquehanna River and also 9 groundwater wells. It offers a variety of markets throughout 3 regions in south-central Pennsylvania, and also although older, is not large, with a market cap of $635 million.

York Public utility presently sporting activities a Zacks Ranking # 1 (Solid Buy), showing higher trending incomes alterations. The existing quarter sales quotes are anticipated to expand 2% to $14 million, while existing year sales are predicted to expand 7% to $59 million. Following year’s sales are anticipated to climb up 17% to $69 million, which is rather remarkable development for an energy business.

YORW additionally has a solid record of elevating its reward repayment. The existing reward return is 1.8%, and also has actually been elevated by 4% over the past 1, 3, and also 5 years. Taking into consideration a huge component of the safety and security used by energies is the reward, it makes YORW really enticing.

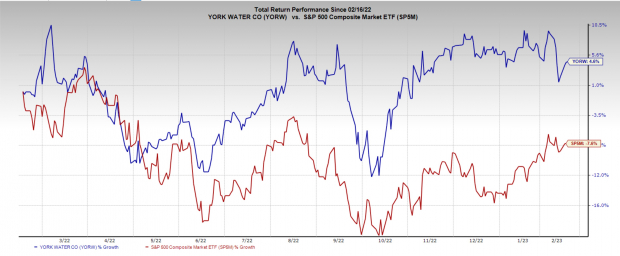

Picture Resource: Zacks Financial Investment Study

YORW has actually had really equivalent go back to the S&P 500 over the previous 10 years, and also over the in 2014 has substantially outshined the index.

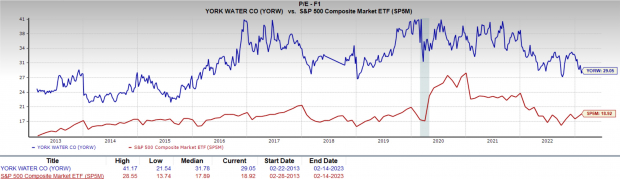

Picture Resource: Zacks Financial Investment Study

At 29x 1 year onward P/E, the supply is not low-cost, yet often you need to compensate for safety and security. Pennsylvania absolutely isn’t mosting likely to quit taking in water at any time quickly. With such safety and security, YORW has actually preserved a raised appraisal for a very long time currently, and also also at 29x is listed below its ten-year average of 32x.

Picture Resource: Zacks Financial Investment Study

MGE Power

MGE Power MGEE, is an utility holding business associated with electrical, gas, and also power procedures. MGEE is based in Wisconsin and also offers electrical energy to 159,000 families in Dane area, and also disperses gas to 169,000 consumers in 7 Wisconsin regions. The business produces, acquisitions and also disperses from coal-fired, gas-fired, and also renewable resource resources in addition to acquisitions power under brief and also lasting dedications.

MGE Power presently holds a Zacks Ranking # 1 (Solid Buy), indicating experts are changing incomes assumptions greater. MGEE records incomes on February 22, and also has high assumptions for the quarter. EPS for the quarter are anticipated to expand 83% to $0.66 per share, while sales are anticipated to expand 5.7% to $171 million over the exact same duration.

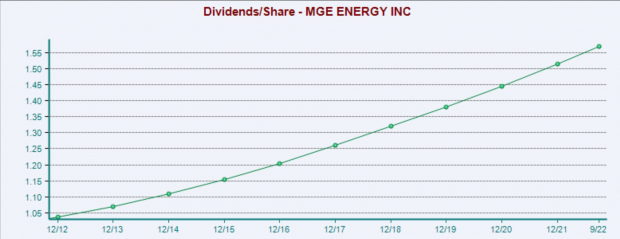

MGEE is an additional regular reward raiser. At the existing return of 2.3%, rewards have actually been elevated 5% usually over the last 1, 3, and also 5 years. Its 5% annualized accumulates and also because 2012, with financier reward circulation up 50%.

Picture Resource: Zacks Financial Investment Study

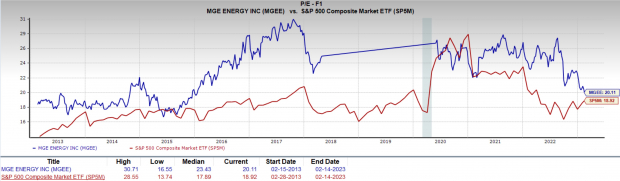

MGE power is trading at a sensible appraisal also. At 20x 1 year onward P/E, the supply is well off the high appraisal of 30x, and also listed below the 10-year average of 23x.

Picture Resource: Zacks Financial Investment Study

Allete

Allete ALE is a very engaging financial investment currently. ALE is a varied electrical, power, and also water energy supplying electrical energy for 15,000 consumers, gas for 13,000 residences, water for 10,000 residences, and also controlled energy electrical solutions for 145,000 retail consumers in northeastern Minnesota.

ALE produces electrical energy from coal-fired, biomass, gas, hydroelectric, wind, and also solar. It additionally concentrates on creating, getting, and also running tidy and also renewable resource tasks, and also has a 1,000 megawatt wind ranch.

Allete is a very fascinating financial investment as a result of its really varied properties, which are highlighted by their expanding alternate power plants, and also sensible appraisal. ALE is presently trading at 14.5 x 1 year onward P/E, nearing its ten-year reduced appraisal of 13x, and also well listed below its average of 18x. For this you obtain a conventional energy organization and also business that is well placed for advancing power landscape.

Picture Resource: Zacks Financial Investment Study

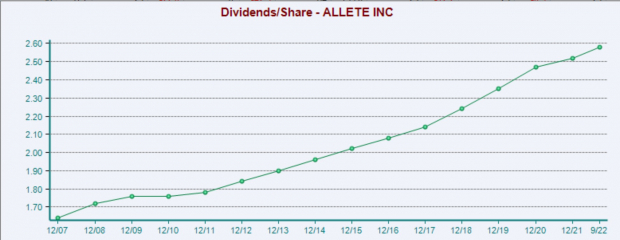

This progressive energy organization is additionally highlighted by a significant 4.6% reward, which has actually expanded by approximately 3.5% yearly for the last 5 years. Over the previous 15 years the reward has actually progressively raised from $1.72 per share to $2.58 per share, a CAGR of 2.8%.

Picture Resource: Zacks Financial Investment Study

Profits

Any kind of well varied financial investment profile should have to have the equilibrium of Energy supplies. While they might not supply the recognition of a development supply, your persistence is awarded with stable returns and also an expanding reward repayment.

Moreover, with high development innovation business, you never ever understand when AI or a few other sophisticated technology is mosting likely to interrupt business design. As is seen in YORW, these energies business have amazing remaining power.

While development supply have actually gotten on a tear to begin the year, that pattern might extremely well not proceed, and also if it does not, you can wager financiers will certainly load back right into protective supplies like energies.

Free Record Discloses Just How You Can Benefit from the Expanding Electric Car Sector

Worldwide, electrical auto sales proceed their exceptional development also after exceeding in 2021. High gas costs have actually sustained his need, yet so has advancing EV convenience, attributes and also innovation. So, the eagerness for EVs will certainly be about long after gas costs stabilize. Not just are makers seeing record-high earnings, yet manufacturers of EV-related innovation are generating the dough also. Do you understand exactly how to money in? Otherwise, we have the best record for you– and also it’s FREE! Today, do not miss your possibility to download and install Zacks’ leading 5 supplies for the electrical lorry change at no charge and also without any commitment.

>>Send me my free report on the top 5 EV stocks

The York Water Company (YORW) : Free Stock Analysis Report

Allete, Inc. (ALE) : Free Stock Analysis Report

MGE Energy Inc. (MGEE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints shared here are the sights and also viewpoints of the writer and also do not always show those of Nasdaq, Inc.