Whether or not you are a seasoned investor or a first-time investor, exchange-traded funds (ETFs) may be a good way to develop your wealth. Nevertheless, with 1000’s of ETFs to select from, making a variety generally is a daunting process.

One option to simplify the method is to slender down your choices. With that in thoughts, listed below are 4 ETFs supplied by Invesco that I consider are price contemplating.

Picture supply: Getty Photographs.

Invesco S&P MidCap High quality ETF

First up is the Invesco S&P MidCap High quality ETF (NYSEMKT: XMHQ). This fund is concentrated on mid-cap stocks, that means shares whose market cap is between $2 billion and $10 billion.

The fund’s holdings are numerous, with manufacturing (18%), finance (16%), industrials (8%), and know-how (8%) comprising the largest sector representations.

| Firm Title | Image | Share of Property |

|---|---|---|

| MANH | Manhattan Associates | 3.8% |

| WSM | Williams-Sonoma | 3.7% |

| RS | Reliance | 3% |

| CSL | Carlisle Corporations | 2.8% |

| EME | EMCOR Group | 2.7% |

The “high quality” within the fund’s title comes from the methodology used to pick out its holdings. The fund examines the S&P Midcap 400 index, then selects its holdings primarily based on a mixture of fundamentals, equivalent to larger return on equity and balance sheet energy, and total market cap. Shares with the most effective fundamentals and the best market caps earn the best weighting within the fund.

As for charges, the fund’s expense ratio is 0.25%, that means buyers pay $25/yr for each $10,000 invested.

Invesco NASDAQ Web ETF

Subsequent up is a sector ETF, the Invesco NASDAQ Web ETF (NASDAQ: PNQI). This fund, which targets firms whose major enterprise is operated on or by way of the web, boasts prime holdings from a few of the world’s best-known firms.

| Firm Title | Image | Share of Property |

|---|---|---|

| Alphabet | GOOG | 9.3% |

| Amazon | AMZN | 8.2% |

| Meta Platforms | META | 8.2% |

| Microsoft | MSFT | 8% |

| Apple | AAPL | 7.6% |

| Walt Disney | DIS | 4.2% |

| Reserving Holdings | BKNG | 4.1% |

| Netflix | NFLX | 3.8% |

| Salesforce | CRM | 3.6% |

| Uber Applied sciences | UBER | 3.6% |

But though this fund is a sector ETF, it boasts vital diversification. Giant holdings like Alphabet and Meta Platforms depend on digital promoting; Walt Disney and Netflix are leisure firms; Reserving Holdings is a journey inventory.

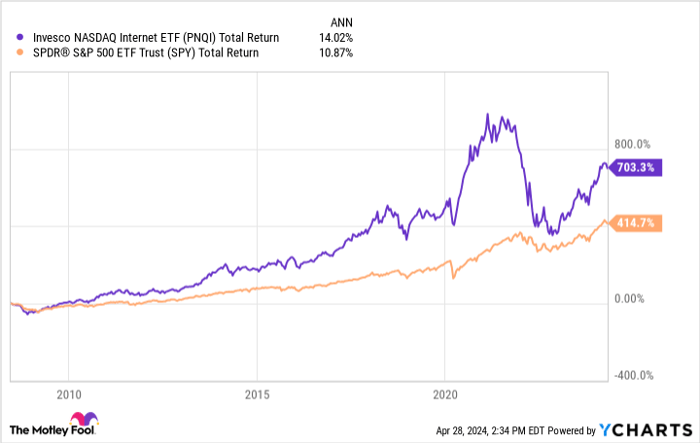

Turning to charges, the fund has an above-average expense ratio of 0.6%. Nevertheless, that above-average price has include strong outcomes. Since its inception in 2008, the fund has generated a compound annual progress price (CAGR) of 14.2%, far forward of the S&P 500’s 10.9% return over the identical interval.

PNQI Total Return Level information by YCharts

Invesco S&P 500® High quality ETF

Subsequent is one other ETF that hangs its hat on high quality. This one is the Invesco S&P 500 High quality ETF (NYSEMKT: SPHQ). Much like the Invesco S&P MidCap High quality ETF, this fund begins with an S&P index — on this case the S&P 500 index — then applies sure basic standards to fine-tune its weightings.

The result’s an index that appears and sounds just like the S&P 500, however on the identical time is just not the S&P 500.

For instance, listed below are the highest 10 shares within the S&P 500:

| Firm Title | Image | Share of Property |

|---|---|---|

| Microsoft | MSFT | 7% |

| Apple | AAPL | 5.8% |

| Nvidia | NVDA | 4.8% |

| Alphabet | GOOG & GOOGL | 4% |

| Amazon | AMZN | 3.8% |

| Meta Platforms | META | 2.3% |

| Berkshire Hathaway | BRK.B | 1.7% |

| Eli Lilly | LLY | 1.4% |

| Broadcom | AVGO | 1.3% |

| JPMorgan Chase | JPM | 1.3% |

And right here is the highest 10 holdings for the Invesco S&P 500® High quality ETF:

| Firm Title | Image | Share of Property |

|---|---|---|

| Nvidia | NVDA | 7.5% |

| Broadcom | AVGO | 5.7% |

| Alphabet | GOOG | 5.3% |

| Mastercard | MA | 5% |

| Microsoft | MSFT | 4.9% |

| Visa | V | 4.3% |

| ExxonMobil | XOM | 4.1% |

| Apple | AAPL | 3.9% |

| Proctor & Gamble | PG | 3.1% |

| Johnson & Johnson | JNJ | 3% |

As you’ll be able to see, there are key variations. This fund weights Nvidia a lot larger, and Microsoft and Apple a lot decrease, for starters. As well as, Mastercard and Visa are every weighted about 4 instances larger within the Invesco fund than within the S&P 500. Furthermore, basic blue chip shares like Proctor and Gamble and ExxonMobil see their weightings lifted, whereas sure “Magnificent Seven” shares like Amazon and Meta Platforms see their weightings reduce considerably.

Turning to charges, buyers pay a meager 0.15% expense ratio — that means solely $15/yr for each $10,000 invested. Lastly, the fund boasts a dividend yield of 1.3% — in keeping with the general S&P 500.

Invesco QQQ Belief

Final however certainly not least is essentially the most distinguished of all Invesco funds, the Invesco QQQ Belief (NASDAQ: QQQ). The fund, also referred to as “the Qs,” is among the largest ETFs on the planet, with common each day buying and selling quantity second solely to the SPDR S&P 500 Belief (often known as “the SPY”).

Extra to the purpose, this ETF is maybe essentially the most profitable ETF — ever. A fast have a look at its 10-year whole return efficiency reveals an astounding 18.4% CAGR. Granted, the fund has endured catastrophic drawdowns, equivalent to an 88% peak to trough decline in the course of the dot-com bubble of 2000-2003, and a 53% drawdown in the course of the nice monetary disaster of 2007-2009.

But by way of all of it, the QQQs have come roaring again. Led by tech giants like Apple, Microsoft, Nvidia, Broadcom, Alphabet, and Meta Platforms, the QQQs presents a fast, straightforward, and low cost option to put money into large tech.

The fund’s 0.2% expense ratio is inexpensive, if not the bottom round, and its meager 0.6% dividend yield means this fund is just not for income-seeking buyers.

Nonetheless, most portfolios would do effectively to have a style of the QQQs — they’re just too good to disregard.

Must you make investments $1,000 in Invesco QQQ Belief proper now?

Before you purchase inventory in Invesco QQQ Belief, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 best stocks for buyers to purchase now… and Invesco QQQ Belief wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $544,015!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of Could 3, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. JPMorgan Chase is an promoting associate of The Ascent, a Motley Idiot firm. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Jake Lerch has positions in Alphabet, Amazon, Invesco QQQ Belief, Procter & Gamble, Visa, and Walt Disney. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Reserving Holdings, JPMorgan Chase, Mastercard, Meta Platforms, Microsoft, Netflix, Salesforce, Uber Applied sciences, Visa, Walt Disney, and Williams-Sonoma. The Motley Idiot recommends Broadcom and Johnson & Johnson and recommends the next choices: lengthy January 2025 $370 calls on Mastercard, lengthy January 2026 $395 calls on Microsoft, brief January 2025 $380 calls on Mastercard, and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.