A few of our greatest pals are technicians. Ed was at Prudential Fairness Group concurrently Ralph Acampora, the famend market historian and technical analyst. Ralph’s evaluation usually confirmed Ed’s elementary evaluation. So in our spare time we wish to comply with the charts for clues concerning the future, and we sometimes spot tendencies that appear to assist our forecasts.

Presently, we’re specializing in the bond, , , and charts, which look bearish, bearish, bullish, and bullish respectively:

(1) Bonds

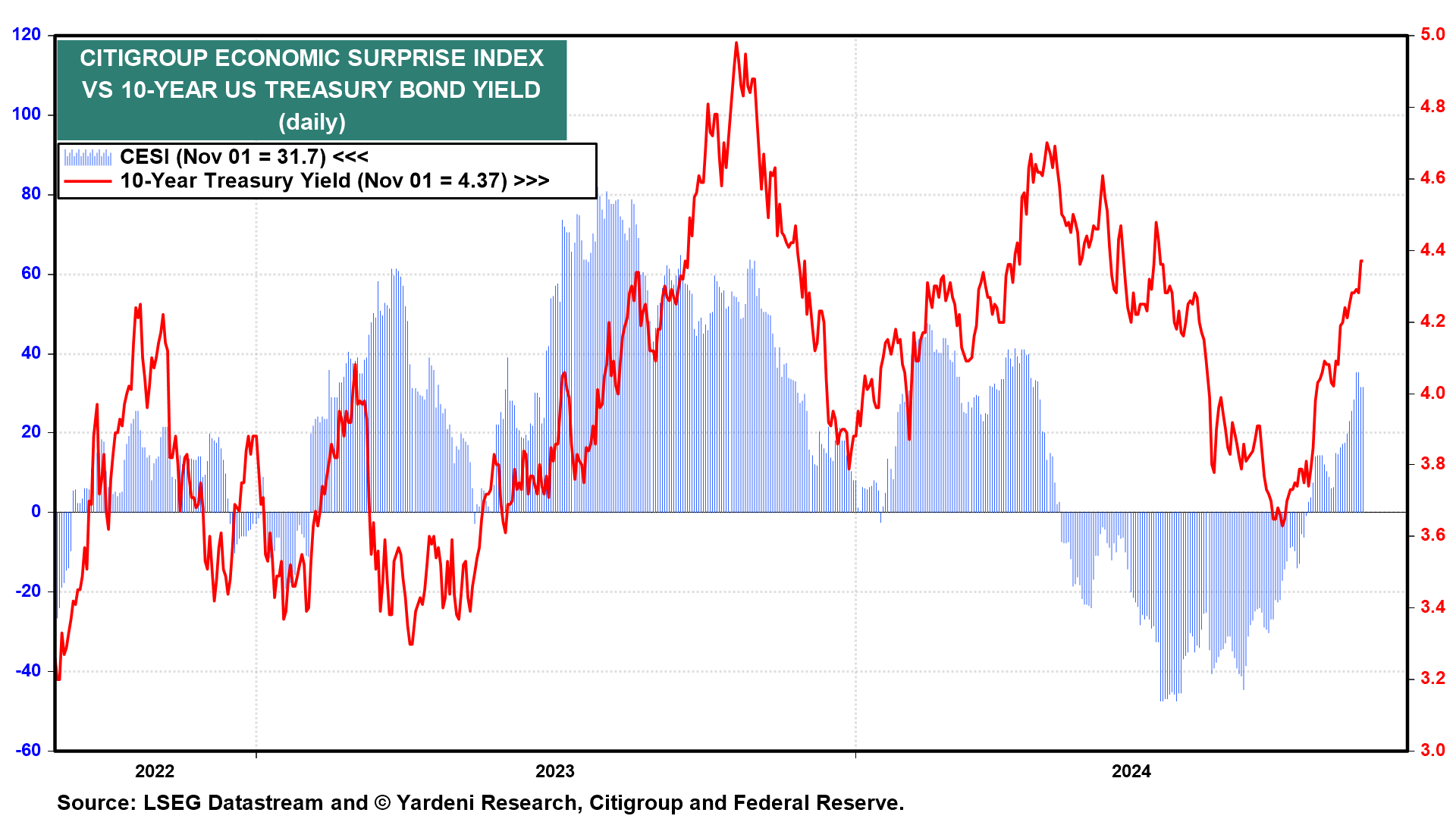

Our August 19 Morning Briefing and webcast had been each titled “Get Prepared To Brief Bonds?” The ten-year bond yield was 3.86% on the time (chart). It fell to three.63% on September 16. Since then it has jumped to 4.397% this night. It broke proper by way of a resistance line at 4.26%.

If it breaks by way of 4.40%, the following cease may by 4.70%, which was the April 25 peak. If that does not maintain, then a check of the 5.00% degree is feasible. That was final yr’s peak on October 19.

The bond yield has been rising on better-than-expected financial numbers, as we anticipated (chart). We really turned extra bearish on bonds after the minimize the federal funds charge by 50bps on September 18, figuring the Fed was stimulating an financial system that did not must be stimulated. That is very true since fiscal coverage stays stimulative and should proceed to be so with the brand new incoming administration. The bond market appears to agree with our evaluation.

(2) Oil

Typically previously, the bond yield has had a constructive correlation with the value of oil principally as a result of the anticipated inflation unfold between the 10-year nominal bond yield and the comparable yield is very correlated with the value of oil, which is sensible. In latest weeks, regardless of the escalating battle within the Center East, the value of oil has been weak reflecting the lackluster world financial system (chart). But the bond yield has risen sharply together with the anticipated inflation unfold. Traders are worrying that the Fed is easing an excessive amount of too quickly, thus elevating the danger of reviving inflation.

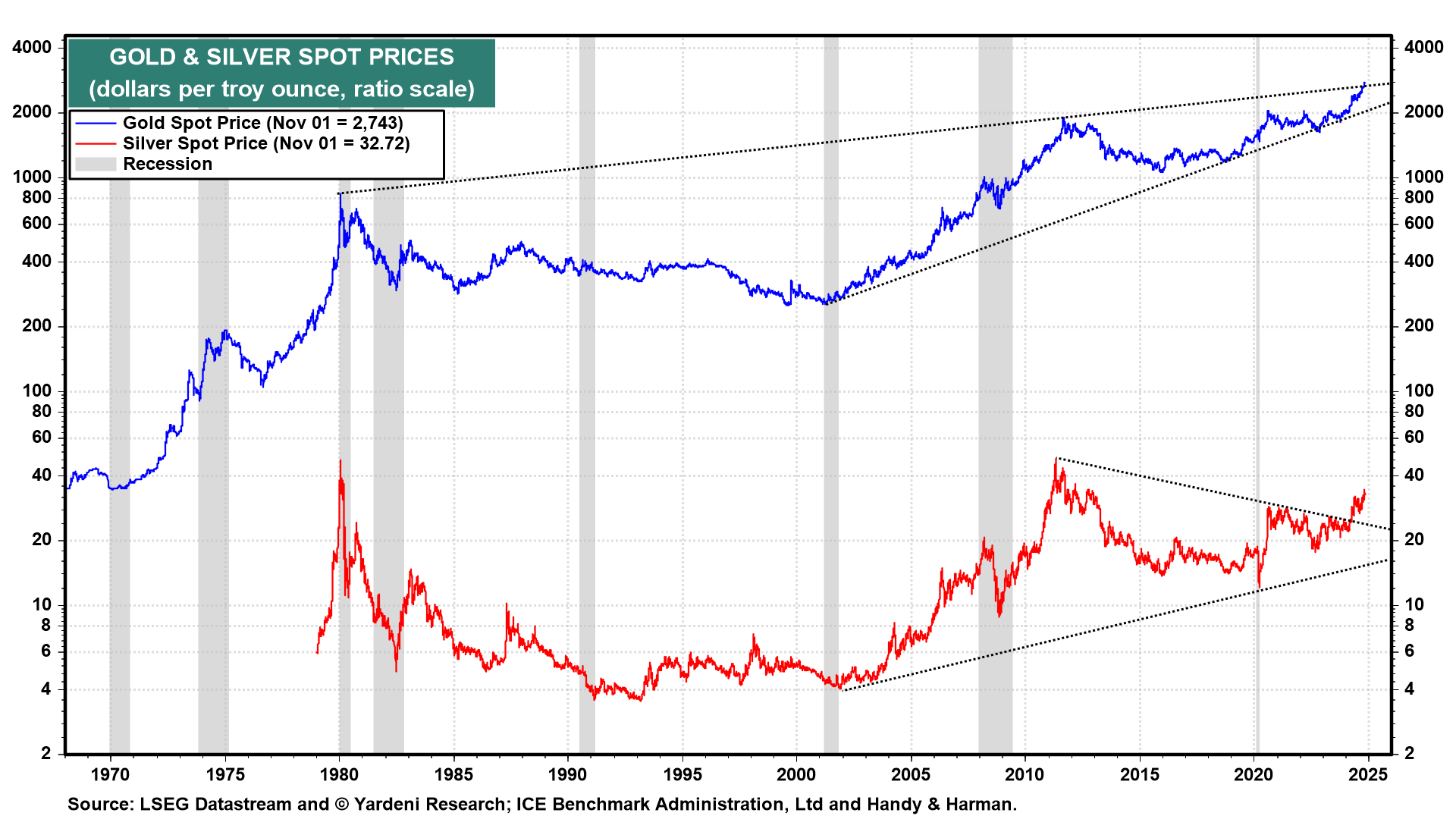

(3) Gold

Gold is a hedge towards inflation, home political instability, and geopolitical crises. Gold was buying and selling round $1900 per ounce when Russia invaded Ukraine in February 2022. The US and its allies slapped sanctions on Russia, together with freezing the nation’s foreign money reserves. Since then, the central banks of America’s geopolitical adversaries have been shopping for extra gold. So now the gold worth is breaking out above an ascending trendline that began in 1980 (chart)

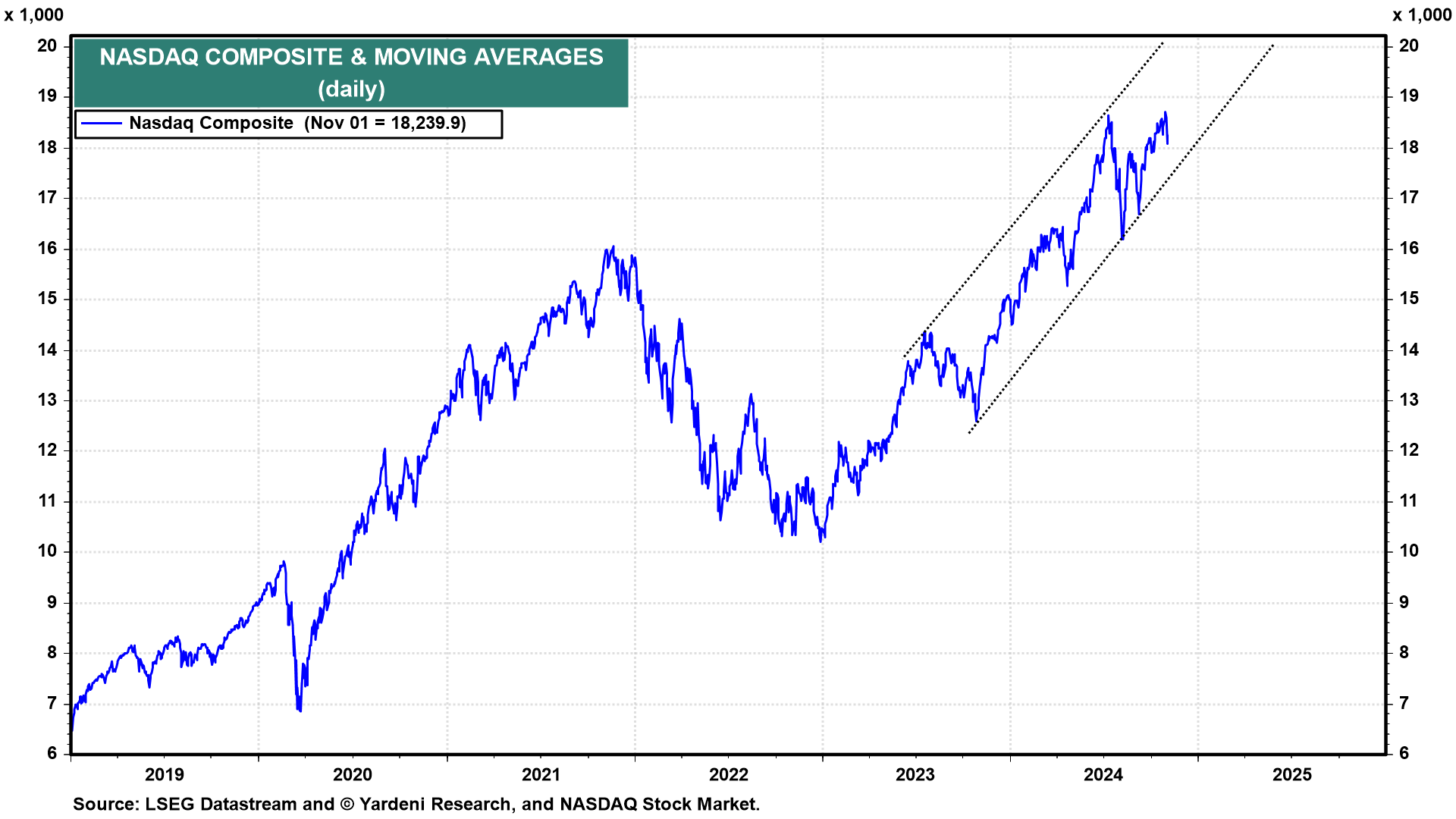

(4) Nasdaq

The has been unstable, however trending greater in a channel that began in late 2023 (chart). If it stays in that channel, it ought to hit 20,000 earlier than Could 2025. That is prone to occur in our Roaring 2020s situation. A backup within the bond yield to five.00% would undoubtedly depress the Nasdaq and delay such a transfer by the Nasdaq.

We requested Michael Brush for an replace on insider exercise: “Useful house owners (10%+ holders) had been large patrons final week in vitality and biotech, and Berkshire Hathaway (NYSE:) continued to load up considered one of its favourite leisure shares. Whereas precise insiders (administrators and executives) remained scarce, they did make a number of actionable buys in retail. Insiders seem bullish on the patron.”