As the vacation season approaches, retailers are bracing up for modest progress amid a troublesome financial backdrop. Elements corresponding to inflation, ongoing geopolitical tensions and a contentious presidential election are anticipated to affect client habits, resulting in cautious spending exercise. The Nationwide Retail Federation (NRF) tasks that holiday sales will enhance between 2.5% and three.5%, the bottom progress price seen in six years.

Regardless of the anticipated slowdown, vacation spending will nonetheless be substantial. The NRF estimates complete gross sales throughout the November-December interval to be between $979.5 billion and $989 billion, reflecting a slight enhance from final 12 months’s complete of $955.6 billion. This progress, nonetheless, trails behind the three.9% enhance recorded in 2023.

Retailers corresponding to Abercrombie & Fitch Co. ANF, Costco Wholesale Company COST, Burlington Shops, Inc. BURL and Boot Barn Holdings, Inc. BOOT are getting ready to adapt to those difficult situations and capitalize on potential alternatives. Respectable job progress and regular wage beneficial properties ought to assist client spending. Furthermore, the current 50-basis level reduce within the rate of interest has lifted confidence.

Vacation Season: Tendencies and Insights

This 12 months’s vacation season is six days shorter than final 12 months, decreasing the variety of purchasing days between Thanksgiving and Christmas to 26. With fewer days to buy, shoppers are anticipated to be extra frugal with their spending, choosing budget-friendly options. In response, retailers are prone to introduce deeper reductions and promotions to draw price-sensitive customers.

On-line purchasing as soon as once more is predicted to be a shiny spot for retailers. The NRF predicts that on-line and non-store gross sales will develop by 8% to 9% to $295.1 billion to $297.9 billion. This means a big enhance from final 12 months’s $273.3 billion, reflecting the continuing shift towards on-line purchasing as shoppers prioritize comfort.

In anticipation of elevated vacation demand, retailers are anticipated to rent between 400,000 and 500,000 seasonal employees. Whereas that is barely beneath final 12 months’s 509,000 hires, it displays the necessity for extra employees to handle early vacation occasions and promotions. Many corporations have already begun their seasonal hiring to win over early-bird customers.

That stated, we’ve got highlighted 4 shares from the Retail – Wholesale sector that look well-positioned primarily based on their sound fundamentals.

Previous-Yr Inventory Value Efficiency of ANF, COST, BURL & BOOT

Picture Supply: Zacks Funding Analysis

4 Distinguished Retail Shares

Abercrombie & Fitch: Model Visibility & International Enlargement

Abercrombie & Fitch stands out as a robust funding selection. The corporate excels in integrating digital and bodily retail channels, providing a seamless purchasing expertise and driving larger buyer satisfaction and loyalty. Strategic advertising and marketing initiatives, notably focused campaigns in key markets, have been efficient in boosting model visibility and buyer acquisition. The introduction of modern product traces meets particular buyer wants and broadens the model’s enchantment. Abercrombie & Fitch’s regional working mannequin, with a deal with the Americas, the EMEA (Europe, the Center East and Africa) and the APAC (Asia-Pacific), offers a stable basis for world growth.

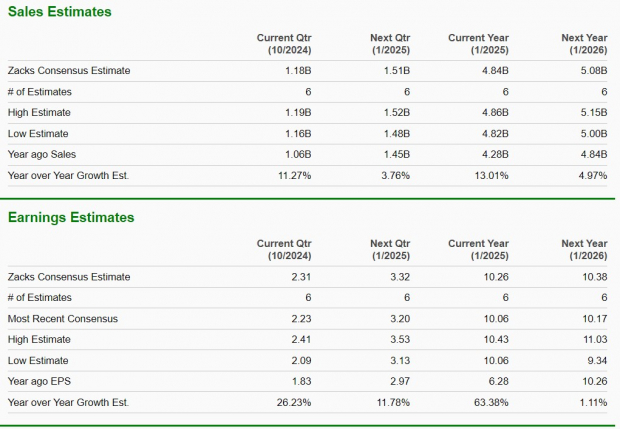

This main, world, omnichannel specialty retailer of attire and equipment for males, ladies and children has a trailing four-quarter earnings shock of 28%, on common. The Zacks Consensus Estimate for Abercrombie & Fitch’s present financial-year gross sales and earnings per share (EPS) suggests progress of 13% and 63.4% from the year-ago interval. The corporate sports activities a Zacks Rank #1 (Robust Purchase). You’ll be able to see the complete list of today’s Zacks #1 Rank stocks here.

Picture Supply: Zacks Funding Analysis

Costco: Leveraging Membership Mannequin for Success

Costco has been navigating the market’s ups and downs fairly properly. Strategic investments, a customer-centric method, merchandise initiatives and an emphasis on memberships have been this low cost retailer’s main strengths. Costco’s distinctive membership enterprise mannequin and pricing energy set it aside from conventional gamers. By way of a calculated method that includes figuring out untapped markets and tailoring choices to fulfill buyer preferences, Costco has managed to deepen its roots.

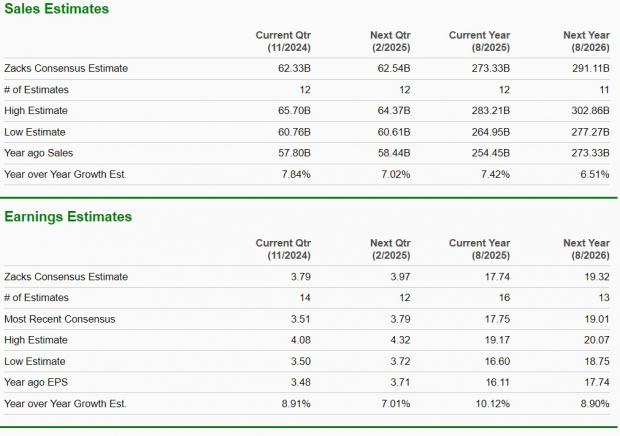

The Zacks Consensus Estimate for Costco’s present financial-year gross sales and EPS implies progress of seven.4% and 10.1%, respectively, from the year-ago interval’s actuals. This Zacks Rank #2 (Purchase) firm has a trailing four-quarter earnings shock of two%, on common.

Discover the most recent EPS estimates and surprises on Zacks Earnings Calendar.

Picture Supply: Zacks Funding Analysis

Burlington: Merchandising Enhancements & Retailer Productiveness

Burlington Shops is a nationally acknowledged off-price retailer. The corporate has demonstrated a robust means to adapt to client developments, which provides it a aggressive edge. By staying in tune with buyer preferences and adjusting its product choices, Burlington Shops is well-positioned to seize market share. The corporate has balanced promotions with common value gross sales, interesting to budget-conscious customers whereas defending margins. Its strategic initiatives, together with enhancing merchandising capabilities and optimizing retailer operations, have supported income progress. With focused retailer openings, relocations and real-time stock administration, Burlington Shops has seized alternatives and improved retailer productiveness.

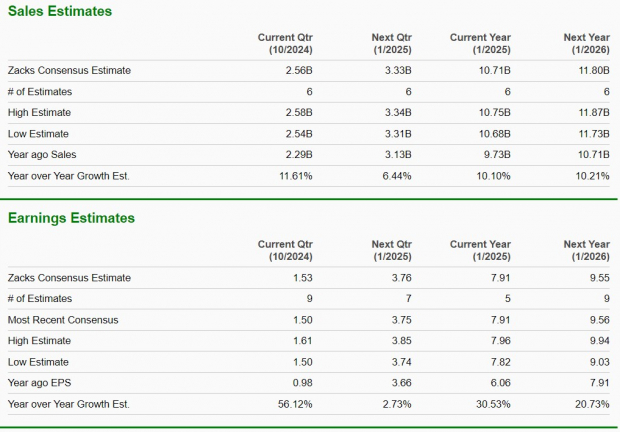

The Zacks Consensus Estimate for Burlington Shops’ present financial-year gross sales and EPS suggests progress of 10.1% and 30.5%, respectively, from the year-ago reported figures. This Zacks Rank #2 firm has a trailing four-quarter earnings shock of 18.4%, on common.

Picture Supply: Zacks Funding Analysis

Boot Barn Holdings: A Various Product Portfolio

Boot Barn Holdings’ various product choices, which embrace western put on, boots and outside attire, align properly with seasonal developments and appeal to a broader buyer base. The corporate’s continued funding in enhancing the omnichannel purchasing expertise permits prospects to transition seamlessly between on-line and bodily shops. Focused advertising and marketing campaigns designed to resonate with shoppers, together with the introduction of unique product traces, distinguish Boot Barn from its opponents. Buyer loyalty packages incentivize repeat purchases, whereas a recovering economic system fosters elevated client confidence and discretionary spending, creating a perfect atmosphere for gross sales progress.

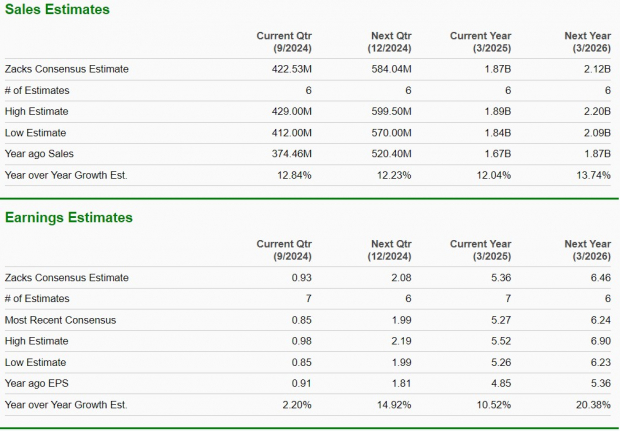

The Zacks Consensus Estimate for Boot Barn Holdings’ present financial-year gross sales and EPS suggests progress of 12% and 10.5%, respectively, from the year-ago reported figures. This Zacks Rank #2 firm has a trailing four-quarter earnings shock of seven.1%, on common.

Picture Supply: Zacks Funding Analysis

Zacks Names #1 Semiconductor Inventory

It is only one/9,000th the scale of NVIDIA which skyrocketed greater than +800% since we beneficial it. NVIDIA remains to be sturdy, however our new prime chip inventory has far more room to increase.

With sturdy earnings progress and an increasing buyer base, it is positioned to feed the rampant demand for Synthetic Intelligence, Machine Studying, and Web of Issues. International semiconductor manufacturing is projected to blow up from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report

Burlington Stores, Inc. (BURL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.