Volatility has returned to Wall Road, disrupting the stable rebound that adopted a large selloff in early August. The latest inventory market volatility is being triggered by fears over the economic system’s well being rekindled by disappointing jobs information.

Additionally, September, through the years, has confirmed to be one of many worst months for shares. Given this case, it could be protected to spend money on utility shares like American Water Works Firm, Inc. AWK, American States Water Firm AWR, Evergy, Inc. EVRG and OGE Power Corp. OGE which might be defensive in nature.

Weak Jobs Information Affect Markets

A weak jobs information launched on Thursday, renewed issues of a weakening economic system. Employers employed at a sluggish tempo, with personal payrolls including simply 99,000 jobs in August, its smallest improve since January 2021 and sharply beneath the consensus estimate of a acquire of 145,000.

Following the discharge of the report, shares tumbled. The Dow declined 0.5%, whereas the S&P 500 shed 0.3%. The S&P 500 has now edged down for the third straight session.

A resilient labor market was the Federal Reserve’s greatest problem in its struggle to regulate inflation. Nevertheless, it has began displaying indicators of cooling over the previous few months.

Nevertheless, job additions to the economic system have slowed greater than anticipated now, igniting fears that the nation’s economic system is weakening.

Different Elements Taking a Toll on Shares

Additionally, the manufacturing sector has been struggling over the previous a number of months as larger borrowing prices haven’t solely pushed up uncooked materials and different prices however are additionally drying up demand.

The Institute for Provide Administration (ISM) stated that its manufacturing PMI rose to only 47.2 in August from 46.8 in July. The manufacturing sector accounts for 10.3% of the economic system. Nevertheless, any PMI studying beneath 50 signifies a contraction within the economic system.

Inflation has declined sharply over the previous few months however continues to be above the Fed’s 2% goal. The Fed has hinted at beginning its easing cycle quickly and is anticipated to go forward with its first fee minimize this month.

Market members are pricing in a 25-basis-point fee minimize. Nevertheless, the Federal Reserve hasn’t but stated something on how huge the speed minimize will likely be and what number of fee cuts it plans this 12 months.

Additionally, Wall Road is more likely to encounter seasonal challenges, as September has historically been essentially the most difficult month for the S&P 500 over the previous 10 years. This development might lengthen market volatility.

5 Utility Shares With Progress Potential

Given this case, it could be smart to spend money on defensive shares like utilities. We have now chosen 4 such shares which might be protected bets throughout occasions of market volatility.

Additionally, these belong to the class of low-beta shares (beta better than 0 however lower than 1). Therefore, the really helpful method is to spend money on low-beta shares with a high-dividend yield and a positive Zacks Rank.

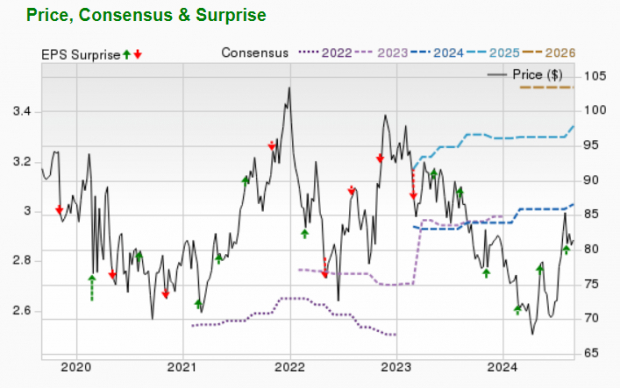

American Water Works Firm

American Water Works Firm, Inc.supplies important water companies to over 14 million prospects in 24 states and has an worker power of 6,500. AWK additionally acquires small water service suppliers to develop its buyer base.

American Water Works Firm has an anticipated earnings progress fee of seven.4% for the present 12 months. The Zacks Consensus Estimate for current-year earnings has improved 0.4% over the past 60 days. American Water Works has a beta of 0.69 and a present dividend yield of two.12%. At the moment, AWK carries a Zacks Rank #2 (Purchase). You possibly can see the complete list of today’s Zacks #1 Rank stocks here.

Picture Supply: Zacks Funding Analysis

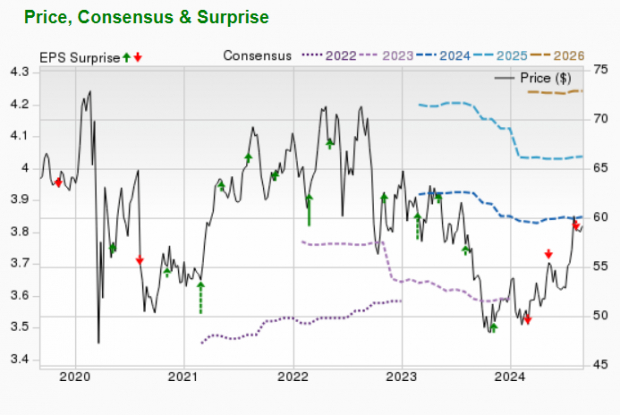

American States Water Firm

American States Water Firm, together with its subsidiaries, supplies contemporary water, wastewater companies and electrical energy to its prospects in the USA. AWR principally works via its two main subsidiaries — Golden State Water Firm and American States Utility Providers.

American States Water Firm has an anticipated earnings progress fee of 6.3% for the present 12 months. The Zacks Consensus Estimate for current-year earnings has improved 0.7% over the past 60 days. AWR presently carries a Zacks Rank #2. American States Water Firm has a beta of 0.49 and a present dividend yield of two.29%.

Picture Supply: Zacks Funding Analysis

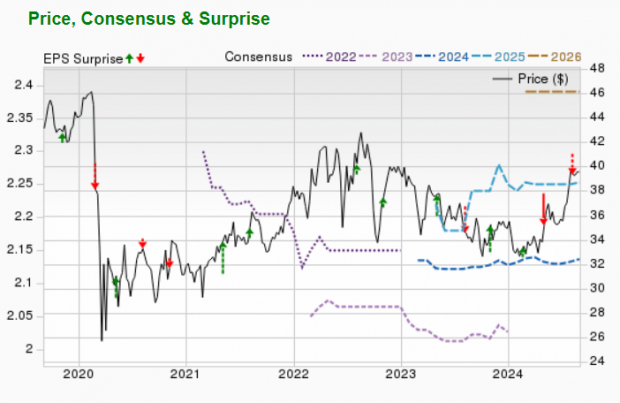

Evergy, Inc.

Evergy, Inc., via its working subsidiaries Kansas Metropolis Energy & Gentle Firm, Evergy Metro, Inc., and Evergy Missouri West, Inc., supplies clear, protected and dependable power to greater than 1.7 million prospects in Kansas and Missouri. EVRG has 15,600 megawatts of owned producing capability and renewable energy buy agreements.

Evergy has an anticipated earnings progress fee of 8.8% for the present 12 months. The Zacks Consensus Estimate for current-year earnings has improved 0.3% over the past 60 days. EVRG at present carries a Zacks Rank #2. Evergy has a beta of 0.62 and a present dividend yield of 4.27%.

Picture Supply: Zacks Funding Analysis

OGE Power Corp.

OGE Power Corp. supplies electrical energy in Oklahoma and western Arkansas. OGE is the father or mother firm of Oklahoma Gasoline and Electrical Firm, which is the most important electrical utility in Oklahoma and its franchised service territory is the Fort Smith, AR space.

OGE Power Corp has an anticipated earnings progress fee of three.4% for the present 12 months. The Zacks Consensus Estimate for current-year earnings has improved 0.5% over the past 60 days. OGE presently has a Zacks Rank #3 (Maintain). OGE Power Corp has a beta of 0.74 and a present dividend yield of 4.27%.

Picture Supply: Zacks Funding Analysis

Solely $1 to See All Zacks’ Buys and Sells

We’re not kidding.

A number of years in the past, we shocked our members by providing them 30-day entry to all our picks for the overall sum of solely $1. No obligation to spend one other cent.

Hundreds have taken benefit of this chance. Hundreds didn’t – they thought there have to be a catch. Sure, we do have a cause. We would like you to get acquainted with our portfolio companies like Shock Dealer, Shares Below $10, Know-how Innovators,and extra, that closed 228 positions with double- and triple-digit beneficial properties in 2023 alone.

OGE Energy Corporation (OGE) : Free Stock Analysis Report

American Water Works Company, Inc. (AWK) : Free Stock Analysis Report

American States Water Company (AWR) : Free Stock Analysis Report

Evergy Inc. (EVRG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.