Trump Wins Election: What Does it Imply for Shares?

The U.S. presidential election is within the books, and former President Donald J. Trump will once more assume the White Home in opposition to all odds. As with all elections, roughly half of the nation is elated, whereas the opposite half is completely dissatisfied. Sadly, firmly held political views mixes with investing like oil mixes with water. No matter the place we land on the political spectrum, it’s our job as traders to separate our feelings from our investing framework and examine the market in a chilly, calculated method.

U.S. Shares Principally Rise No matter Who’s in Workplace

The reality is that, outdoors of Black Swan occasions just like the Nice Melancholy and the World Monetary Disaster, U.S. equities are likely to rise over time, no matter which political occasion takes the White Home. Under is an impressive infographic from Ryan Detrick of Carson Funding Analysis that illustrates the facility of the American inventory market.

Picture Supply: Carson Funding Analysis, Factset

Although traders who index will likely be joyful to know that information, lively inventory pickers should drill deeper into particular industries and perceive how a brand new president will probably impression them. Under are 5 industries to observe in President Donald Trump’s second time period:

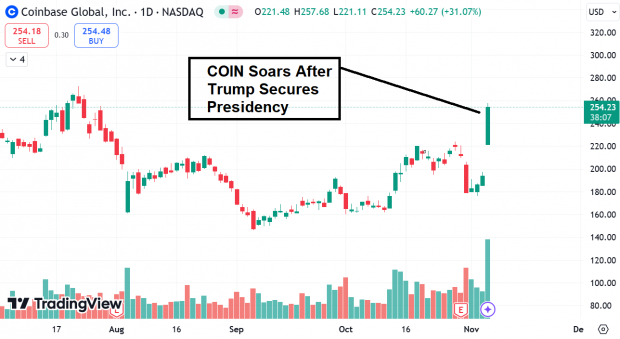

Crypto: Gensler is Gone

When it turned evident that Trump would reclaim the White Home Tuesday, Bitcoin jumped above $75,000 for the primary time. A key purpose for the transfer is the probability of a change on the head of the Securities and Alternate Fee. Talking at a Bitcoin convention a couple of months in the past, Trump promised to switch Gary Gensler because the chair of the SEC. Gensler is broadly seen as anti-crypto by traders. Crypto trade Coinbase (COIN) soared greater than 30% on the information.

Picture Supply: TradingView

Photo voltaic: No Extra Subsidies?

Photo voltaic was one of many few weak industries in Tuesday’s Session. Trump has promised to chop again or get rid of most clear power subsidies, which is bearish for shares like First Photo voltaic (FSLR).

Tariffs and Small Caps

Considered one of Trump’s highest convictions on the financial entrance is to leverage tariffs on international international locations to power corporations to convey again jobs to America. Trump has acknowledged quite a few instances that he’s a “tariff man” and he plans to implement a reciprocal tariff on any nation imposing one on the U.S. These “protectionist” insurance policies are bullish for small-cap shares as a result of international locations like China may have issue transport items to America if shoppers are compelled to pay extra for items. The Russell 2000 Index ETF (IWM) soared greater than 5% in response to the election outcomes.

Prescribed drugs: RFK Plans to “MAHA”

Unbiased candidate Robert F Kennedy joined forces with Trump to defeat Kamala Harris. In return for his endorsement, it seems Trump will appoint RFK to a big function within the well being division so he can “Make America Wholesome Once more.” Kennedy is controversial for linking varied vaccines with autism and different antagonistic well being situations. With that in thoughts, it’s protected to imagine that Pfizer (PFE) and different vaccine makers will probably face heavier scrutiny within the coming Trump administration.

Power: “Liquid Gold”

President Trump has touted that the U.S. has extra “liquid gold” than some other nation, and needs to “drill child, drill.” In different phrases, Trump will look to decontrol the oil and gasoline business and encourage drilling. Tuesday, the Power Choose Sector SPDR ETF (XLE) gushed greater by 4% on heavy quantity.

Backside Line

Equities often rise no matter who assumes the White Home. Nonetheless, savvy, lively traders perceive the significance of analyzing particular industries beneath a brand new administration.

Zacks Names #1 Semiconductor Inventory

It is only one/9,000th the dimensions of NVIDIA which skyrocketed greater than +800% since we really useful it. NVIDIA remains to be robust, however our new prime chip inventory has rather more room to increase.

With robust earnings progress and an increasing buyer base, it is positioned to feed the rampant demand for Synthetic Intelligence, Machine Studying, and Web of Issues. World semiconductor manufacturing is projected to blow up from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Pfizer Inc. (PFE) : Free Stock Analysis Report

First Solar, Inc. (FSLR) : Free Stock Analysis Report

Energy Select Sector SPDR ETF (XLE): ETF Research Reports

iShares Russell 2000 ETF (IWM): ETF Research Reports

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.