Sellers seem like in management on Wall Road following a sturdy 2024. With many indicators at tipping factors, now’s a major time for buyers to refocus and monitor numerous market indicators. Beneath are 5 issues fairness buyers ought to watch as 2025 kicks off on Wall Road:

Sentiment: Market Flashes Concern Sign

Bullish buyers simply loved a banner yr in US equities with the S&P 500 Index scoring positive factors of practically 25% for 2024. Following the US presidential election, shares soared and the S&P 500 Index printed an all-time excessive final month. Nevertheless, buyers could also be stunned to watch that sentiment, as measured by the “CNN Concern and Greed Index,” plunged to the “Excessive Concern” stage on December 19th after a comparatively shallow, Federal Reserve-induced pullback in shares.

Picture Supply: Zacks Funding Analysis

I’ve noticed that “Excessive Concern” readings within the CNN Concern and Greed Index could be a uncommon but highly effective bottoming indicator. Although sentiment is a secondary indicator, extreme concern could be a implausible contrarian sign when used along side different market metrics.

The Intermediate Market Development is Intact

Not like sentiment, worth motion is a “main indicator.” The ten-week shifting common is the optimum development intermediate development filter for savvy buyers to observe. Tech shares and the Nasdaq 100 Index ETF (QQQ) have been the leaders over the previous few months, so they’re the perfect market phase to observe. QQQ has trended above the 10-week MA since September and is at the moment testing the extent once more. If QQQ bulls can maintain the 10-week MA, it will likely be proof that the intermediate development is undamaged.

Picture Supply: Zacks Funding Analysis

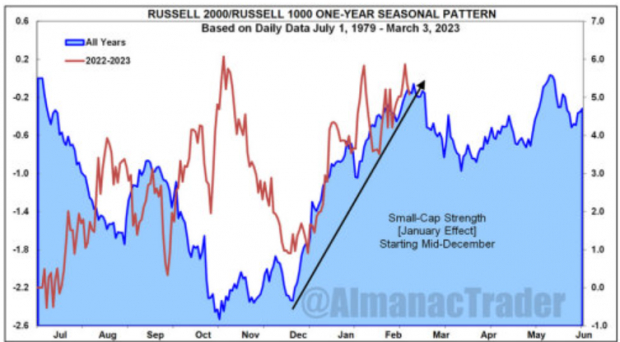

Small-cap Seasonality & “The January Impact”

As measured by the Russell 2000 Index ETF (IWM), small-cap shares drastically underperformed large-caps in 2024. Nonetheless, cussed bulls might lastly reap some rewards in January. Traditionally, small-caps carry out the perfect in January. As well as, the beaten-down IWM is discovering assist close to its rising 200-day shifting common – a long-term assist zone.

Picture Supply: (Jeffrey Hirsch, @almanactrader)

“Danger-On” Clues

Danger-on shares comparable toRigetti Computing (RGTI), Intuitive Machines (LUNR), Unity Software program (U) proceed to search out consumers – a bullish signal. Nevertheless, buyers ought to monitor the rising USD ETF (UUP), as a rising greenback could be a headwind for equities.

Poor Finish to Yr is Not a Demise Sentence

The ordinarily robust “Santa Rally” handed buyers coal for Christmas, main to a few consecutive crimson classes to shut the yr. Although it could appear counterintuitive to buyers, a weak finish to the yr doesn’t essentially translate to a poor begin to the yr (a minimum of in response to the information). When the S&P 500 Index has declined three consecutive classes to finish the yr (over the previous 100 years), it has completed increased one week and one month later 100% of the time (5 cases).

Picture Supply: (@subuTrade, @RyanDetrick)

Backside Line

After a sturdy 2024, sellers are again in management on Wall Road. Buyers ought to observe the 5 indicators talked about on this article to find out the subsequent huge market transfer.

Simply Launched: Zacks High 10 Shares for 2024

Hurry – you may nonetheless get in early on our 10 high tickers for 2025. Handpicked by Zacks Director of Analysis Sheraz Mian, this portfolio has been stunningly and persistently profitable. From inception in 2012 via November, 2024, the Zacks High 10 Shares gained +2,112.6%, greater than QUADRUPLING the S&P 500’s +475.6%. Sheraz has combed via 4,400 corporations coated by the Zacks Rank and handpicked the perfect 10 to purchase and maintain in 2025. You possibly can nonetheless be among the many first to see these just-released shares with huge potential.

Invesco QQQ (QQQ): ETF Research Reports

Invesco DB US Dollar Index Bullish ETF (UUP): ETF Research Reports

iShares Russell 2000 ETF (IWM): ETF Research Reports

Unity Software Inc. (U) : Free Stock Analysis Report

Rigetti Computing, Inc. (RGTI) : Free Stock Analysis Report

Intuitive Machines, Inc. (LUNR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.