The Psychology of Wall Avenue

Most novice traders intention to “purchase low and promote excessive.” All through my twenty years on Wall Avenue, I’ve realized that such a technique is flawed and won’t work for many traders (besides for getting the S&P 500 Index for long-term & retirement accounts. In my expertise, one of the best ways to seize excessive reward-to threat zones out there is to try as a substitute to buy “reactionary” pullbacks inside an current bull market. Nevertheless, not like Amazon’s (AMZN) “Prime Day,” traders usually look past a cut price. Nonetheless, shopping for pullbacks in a bull market is perfect for 3 major causes, together with:

· Buyers can Commerce Towards a Stage: When a market retreats to a shifting common just like the 50-day shifting common, traders can handle their threat towards a “degree.”

· Keep away from Chasing: Shopping for devices which might be “sticking straight up” could be harmful as a result of sellers usually step in after spikes out there.

· Psychology: In robust bull markets, it solely takes a minor decline to shift investor sentiment from sizzling to ice chilly. The way in which to earn cash on Wall Avenue is to fade the gang.

Beneath are 5 causes that the S&P 500 Index ETF (SPY) and the most important U.S. indices are prone to bounce quickly, together with

EPS Anticipation / Quick Overlaying

Earnings season is across the nook. Tomorrow, streaming juggernaut Netflix (NFLX) will kick off earnings season for giant tech. Usually, shares run up in anticipation of earnings in bull markets, whereas quick sellers cowl their bearish positions to keep away from the binary occasion.

Leaders are at Worth Assist

So go the leaders, so goes the market. Main shares like Tremendous Micro Pc (SMCI), Nvidia (NVDA), and Coinbase (COIN) are retreating to their 10-week shifting averages for the primary time in ages. The primary tag of the 10-week is an space the place consumers are likely to step in.

Picture Supply: TradingView

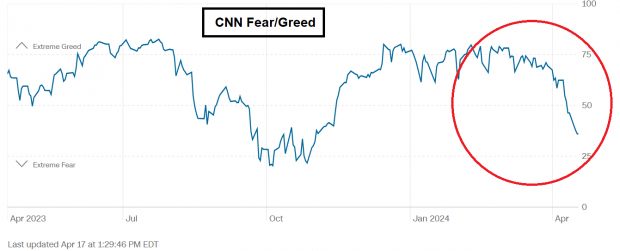

Buyers have One Foot out the Door

Market sentiment has crashed decrease regardless of the comparatively gentle retreat in equities (the S&P 500 is about 5% off its all-time excessive). Keep in mind, bull markets prefer to climb a “wall of fear.”

For instance, the CNN Worry & Greed Indicator plunged from “Excessive Greed” in March to “Worry.”

Picture Supply: CNN

Hole Fill & Retest of Break Out Zone

Wednesday, QQQ stuffed an open every day hole. Hole fills usually are turning factors and act as help.

Picture Supply: TradingView

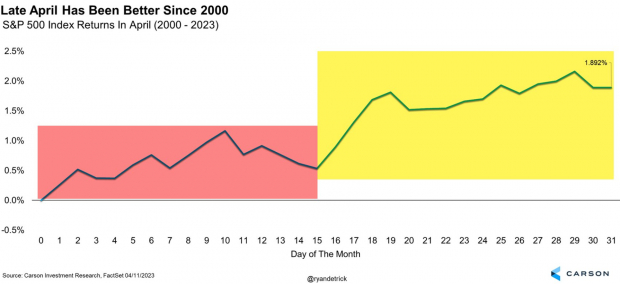

Seasonality

In line with seasonality research, since 2000, historic tendencies favor the bulls within the again half of April.

Picture Supply: Ryan Detrick, Carson Analysis

Backside Line

Although the present market weak spot has scared many traders, 5 alerts recommend that it could be an optimum time for opportunistic traders to benefit from.

Free Report – The Bitcoin Revenue Phenomenon

Zacks Funding Analysis has launched a Particular Report that can assist you pursue huge earnings from the world’s first and largest decentralized type of cash.

No ensures for the long run, however prior to now three presidential election years, Bitcoin’s returns have been as follows: 2012 +272.4%, 2016 +161.1%, and 2020 +302.8%.

Zacks predicts one other important surge. Click on beneath for Bitcoin: A Tumultuous But Resilient Historical past.

Download Now – Today It’s FREE >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.