5-year, 10-year, and multi-decade charts of market actions all present that inventory market sell-offs occur. Nobody is aware of after they’ll start, how extreme the downturn might be, or how lengthy they will final. Nevertheless, we do know that sell-offs of 20% or extra from current highs, generally known as bear markets, occur about every 3.5 years however do not final practically so long as bull markets. Meaning sell-offs create great shopping for alternatives for long-term traders.

Promote-offs can be scary. Some traders flip to purchasing what are thought-about safer shares if they’re apprehensive a few sell-off. That is very true for risk-averse traders in search of shares to complement revenue in retirement or anybody extra targeted on capital preservation than capital appreciation. These safer shares have a tendency to carry up higher in a sell-off.

Begin Your Mornings Smarter! Get up with Breakfast information in your inbox each market day. Sign Up For Free »

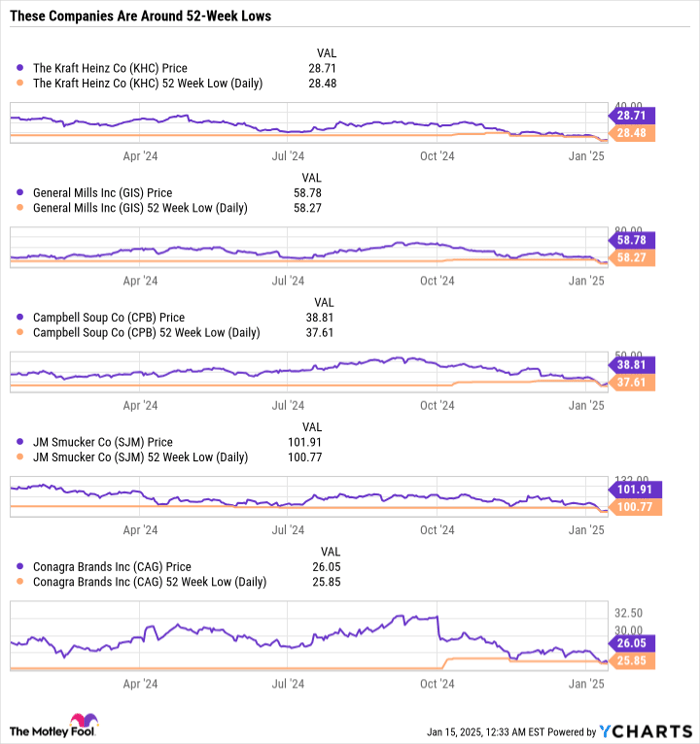

Kraft Heinz (NASDAQ: KHC), Campbell’s (NASDAQ: CPB), Common Mills (NYSE: GIS), J.M. Smucker (NYSE: SJM), and Conagra Manufacturers (NYSE: CAG) are 5 packaged-food firms which might be thought-about secure shares. Proper now, every gives excessive yields partly as a result of they’ve missed out on the broader market rally over the past two years. Actually, all 5 firms commerce inside only a few proportion factors or much less of their 52-week lows, and most are inside hanging distance of their three- to five-year lows.

However sustained market rallies like we noticed in 2023-24 inevitably result in sell-offs in some unspecified time in the future. This is why these dividend stocks are a shopping for alternative for revenue traders if there’s a sell-off in 2025.

Picture supply: Getty Photos.

Inflation’s impact on the trade

Financial cycles are likely to have the largest impact on sectors like shopper discretionary, industrials, and financials. They often even have an effect on the know-how sector. However the shopper staples sector is considerably proof against financial cycles. Demand for packaged meals tends to be pretty recession-resistant. Shoppers are much less more likely to change their buying conduct on favored manufacturers like Kraft mac and cheese, Campbell’s soups, Common Mills’ cereals, J.M. Smucker’s Jif peanut butter, or Conagra Manufacturers’ Banquet frozen meals than they’re on discretionary purchases like furnishings and leisure. That makes the packaged meals trade pretty dependable it doesn’t matter what the financial system is doing.

This sector remains to be vulnerable to inflationary pressures although and the previous couple of years have been difficult for the trade. Many of those firms have overly relied on price increases to offset stagnating and declining volumes. So, whereas the S&P 500 total trades close to all-time highs, packaged items firms have noticeably offered off whereas inflation stays barely elevated.

Information by YCharts.

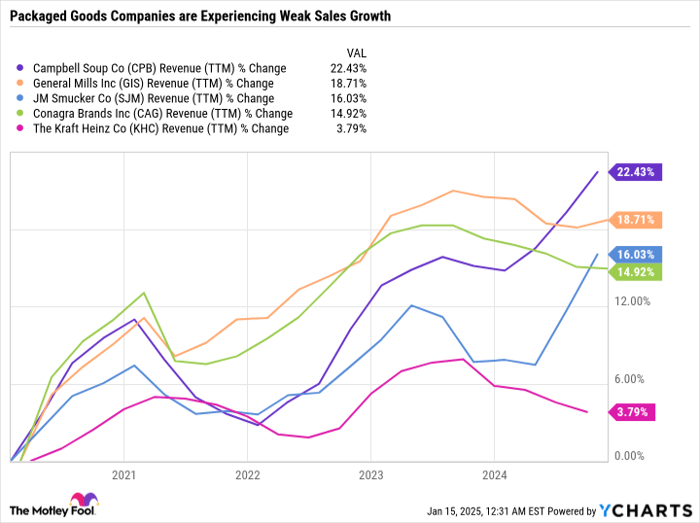

Gross sales progress for the group over the previous 5 years has been risky, considerably influenced by inflation.

Information by YCharts; TTM = trailing 12 months.

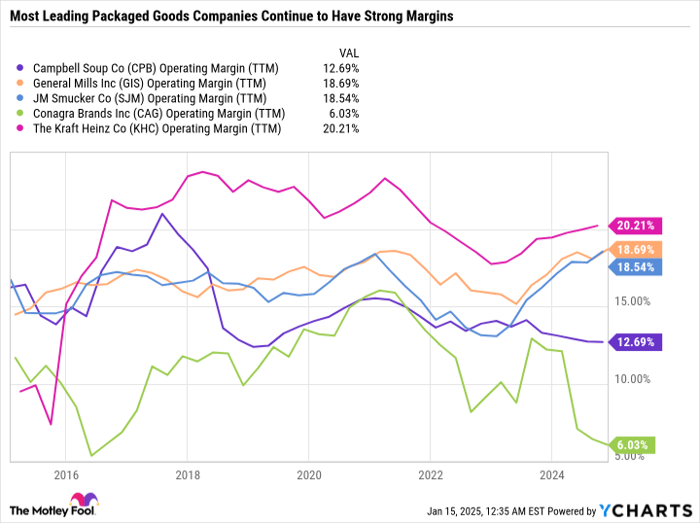

Regardless of the poorly performing inventory costs and weak gross sales progress, margins for many of those firms have typically held up, particularly for Kraft, Common Mills, and J.M. Smucker.

Information by YCharts.

Good margins point out that an organization is not overly counting on value cuts to spur quantity progress. When packaged items firms, it is essential to know the steadiness between gross sales progress and margins. If Campbell’s actually wished to develop gross sales, it may simply undercut different soup firms. However that technique would do extra hurt than good as a result of it might be hurting its margins.

Dust-cheap valuations with excessive yields

The sell-off throughout packaged items firms, paired with steadily rising gross sales and earnings (albeit slowly), has pushed the trade’s valuations all the way down to bargain-bin levels.

Information by YCharts; PE = value to earnings.

What’s extra, it is pushed the dividend yields of all 5 firms above 3%, and considerably greater than their common ranges over the past 5 years.

This mix of worth and revenue could appear too good to be true for passive-income traders, they usually would not essentially be fallacious. There are legitimate dangers to think about earlier than diving headfirst into any of those shares.

The largest threat is the corporate’s capability to afford the dividend expense not to mention increase its dividend from 12 months to 12 months. The trade would not have the perfect monitor file for constant dividend raises. Kraft has saved its payout the identical for years. Campbell’s has made modest raises over time however would not constantly enhance its payout yearly. Common Mills and Conagra have raised their dividends yearly since 2007. And J.M. Smucker has elevated its dividend yearly because it started paying one in 2000.

In case you’re in search of shopper staples firms with impeccable track records of dividend growth, then these packaged items firms aren’t the perfect match. As an alternative, you may discover Procter & Gamble, Walmart, Coca-Cola, PepsiCo, Kenvue, Colgate-Palmolive, Hormel Meals, and Kimberly-Clark (amongst others). These shares are all Dividend Kings which have paid and raised their payouts yearly for a minimum of 50 consecutive years.

Though traders should not count on sizable raises from all 5 of those firms within the close to time period, they’ll take solace in understanding that every one 5 firms ought to have the ability to afford their present payouts. This is a take a look at fiscal 2025 projected earnings for every firm, together with their ahead dividends per share.

|

Firm |

Ahead Annual Dividend per Share |

Fiscal 2025 Projected EPS |

Ahead Dividend Yield |

|---|---|---|---|

|

Kraft Heinz |

$1.60 |

$3.06 |

5.6% |

|

Campbell’s |

$1.48 |

$3.14 |

3.3% |

|

Common Mills |

$2.40 |

$4.41 |

3.6% |

|

Conagra Manufacturers |

$1.40 |

$2.45 |

5.1% |

|

J.M. Smucker |

$4.32 |

$9.89 |

3.8% |

Information supply: Yahoo Finance. Notice: The projected EPS relies on consensus analyst estimates.

Energy your passive revenue with packaged items shares

Probably the most precious and best-performing shopper staples shares in 2024 — Walmart and Costo Wholesale — have low yields and expensive valuations. Whereas slower-growing giants like Coke, Pepsi, and P&G have strong yields and affordable valuations. Then there are the ultra-inexpensive packaged items firms which might be primarily the lowest-growth pocket of the buyer staples sector.

Worth and revenue traders are getting a superb alternative to purchase shares of those high-yield packaged items firms whereas they’re out of favor. Investing in equal components among the many 5 shares mentioned on this article produces a median yield of 4.3% whereas nonetheless permitting traders to take part within the inventory market. For context, the yield on a 10-year Treasury be aware is 4.8%. In fact, investing in equities is riskier than a Treasury be aware.

Kraft Heinz, Campbell’s, Common Mills, J.M. Smucker, and Conagra Manufacturers aren’t the type of firms more likely to maintain tempo with the S&P 500 over the long run as a result of their restricted progress prospects. However they’re glorious decisions in the event you’re extra involved in passive revenue from comparatively safer worth shares than the upside potential from quickly rising companies.

Do you have to make investments $1,000 in Kraft Heinz proper now?

Before you purchase inventory in Kraft Heinz, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 best stocks for traders to purchase now… and Kraft Heinz wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $843,960!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of January 13, 2025

Daniel Foelber has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Colgate-Palmolive, Costco Wholesale, J.M. Smucker, Kenvue, and Walmart. The Motley Idiot recommends Campbell’s and Kraft Heinz and recommends the next choices: lengthy January 2026 $13 calls on Kenvue. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.