” When Hinton was talked to on the American tv program 60 Minutes, the job interviewer asked whether he was mad at those that had actually placed him behind bars. He reacted that he had actually forgiven all individuals that had actually sent him to prison. The job interviewer incredulously asked, ‘However they took thirty years of your life– just how can you not be mad?’ Hinton reacted, ‘If I’m mad and also ruthless, they will certainly have taken the remainder of my life.’ Unforgiveness burglarizes us of our capability to take pleasure in and also value our life, since we are caught in a previous loaded with rage and also resentment. Mercy enables us to relocate past the past and also value today, consisting of the declines of rainfall dropping on our face.”

Dalai Lama, Desmond Tutu, and also Douglas Carlton Abrams Guide of Pleasure

The Sight from 30,000 feet

Recently was loaded with favorable advancements: A financial debt ceiling dilemma was avoided, which brought with it enigma concerning the influences of the tidal bore of financial debt issuance to adhere to, the Fed enhanced messaging around the time out in June, on the back of restricted indications of compromising rising cost of living and also or tightening up of the labor market, and also the disliked slim rally started to expand out right into the more comprehensive indices Likewise of rate of interest is socializing and also approval a spin to the soft-landing story. The most up to date story is focused around a moving economic crisis thesis, where silos of the economic climate such as production, technology and also real estate go into short, field certain economic crises, driven by wild pandemic/post-pandemic inequalities in liquidity and also need suddenly fixing, while large cash money equilibriums buffer a whipsaw reduced while liquidity is being choked off.

Although this is a possible description wherefore is taking place on a coincident basis, the concept leaves a big enigma when cash money equilibriums sustaining investing discolor and also the sequestering of liquidity gains grip. In the meanwhile, births, affixed to weak basics in production and also view continue to be secured a fight versus bulls, that remain to play AI driven energy and also hold on to pay equilibriums and also wage development driving investing up until it runs completely dry.

- Messaging from Fed and also labor market record incorporate to develop agreement sight of a time out

- The fight in between reducing production field vs solid customer and also with AI craze

- Signals of a product downturn forming in Europe and also Asia enter into emphasis

- One Of The Most Often Asked Concern from customer’s today: With the relentless toughness in the labor markets and also rising cost of living, when will the Fed cut prices?

Messaging from Fed and also labor market record incorporate to develop agreement sight of a time out

- The week started with a 72% chance that the Fed would certainly trek 25 bps to 550 bps on June 14th and also finished the week with a 69% chance that the Fed would certainly stop briefly on June 14th.

- Jefferson, that is anticipated to be the following Vice Chair of the Fed, gave support thought to be honored by Powell, that the Fed means to hold prices consistent in June, which produced a change in assumptions.

- Recently’s labor market information suggested tearing around the sides.

- SHAKES.

- Unanticipated increased to 1m openings vs assumptions of a decrease to 9.4 m.

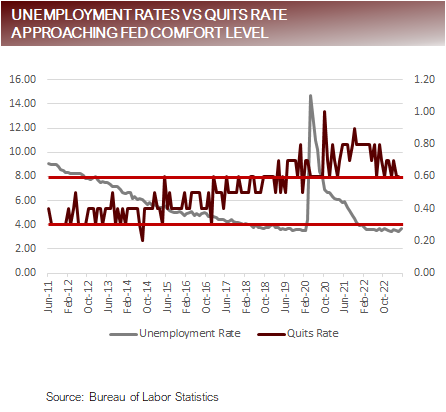

- Positive Side: Gives up price was up to 4, bringing it back inline with pre-pandemic fads.

- Joblessness Insurance Claims.

- Can Be Found In at 232k, remaining to trend reduced given that mid-March, indicating a leading indication of absence of toughness in labor markets.

- Pay-roll Record.

- Nonfarm Payrolls included 339k tasks, the 14th successive beat of assumptions, dumbfounding also one of the most favorable experts.

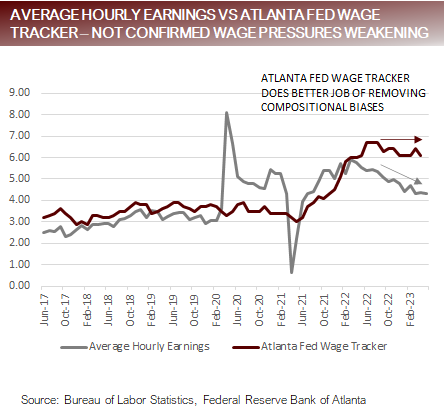

- Positive Side: The Joblessness Price, which climbed up 2 to 3.7, Ordinary Per hour profits, were somewhat softer than anticipated, and also ordinary regular hr went down to 34.3, which is listed below the pre-pandemic pattern of 34.4.

- Profits.

- Some procedures of the labor markets are starting to reveal fractures, yet coincident indications are still over the Fed’s convenience degree. Fed plan is plainly limiting, and also the financial dilemma of March is anticipated to have big influence on the schedule of credit score. There is an expanding agreement that the Fed has actually gone much sufficient and also currently can manage to relax and also analyze the influences of plan and also the tightening up of credit score problems to see if they have actually struck the brakes hard sufficient or if they require to use even more stress.

- SHAKES.

Labor market has yet to verify compromising constant with attaining Fed targets

The fight in between reducing production field vs solid customer and also with AI craze

- Weak point in the economic climate has actually been focused around:.

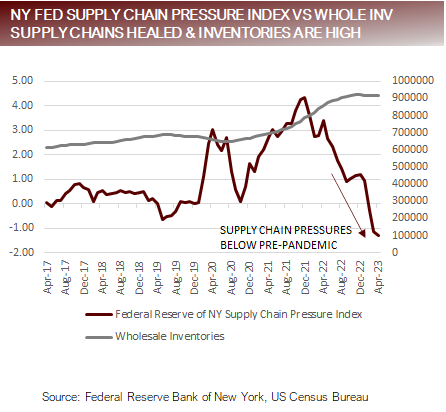

- Dealing with production inequalities triggered by blocked supply chains and also customers purge with cash money

- A sharp downturn in real estate related to greater prices and also an absence of supply

- Over employing in technology that was snuffed out in 2022

- Stamina in the economic climate has actually been focused around:.

- Durable need in the solutions field

- Wage development over of products rising cost of living and also excess financial savings enabling customers to maintain investing

- AI style that has actually buoyed securities market and also is driving a feeling of positive outlook concerning a stagnation without an equity market adjustment

- Due to the unbalanced impacts to production and also what seems little price level of sensitivity in the solution side of the economic climate the Fed might be ending up being hesitant to remain to trek for concern of what it may do to production and also financial, while ending up being mindful of absence of transmission to the solution side of the economic climate.

- With current indications that real estate is locating a flooring and also the disinflationary impulse from production is decreasing, the inquiry for the Fed will certainly be what occurs if they do not obtain the disinflationary aid they require from real estate and also production, considered that solutions us revealing resistance from greater prices.

The aid the Fed was obtaining from disinflationary stress in producing because of go away

Signals of a product downturn forming in Europe and also Asia enter into emphasis

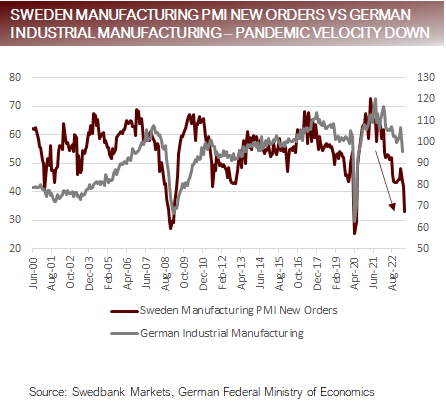

- Indications throughout Europe suggest a product downturn is developing.

- Sweden, which often tends to be an excellent pen for commercial manufacturing in Europe reported a degree of 6 for its PMI, the third most affordable dimension in the background of their production PMI information.

- Germany Industrial Production Orders last analysis was -10.7%, the third most affordable dimension in the background of the

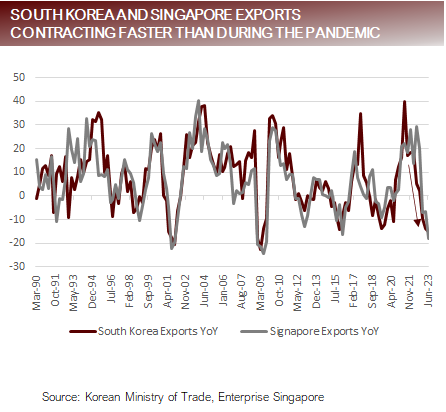

- Wishes of a Chinese resuming have actually fizzled and also taken with various other nations in Asia.

- Chinese Production PMI determined 5, returning right into tightening in Might.

- The Hang Seng is down 5% from its high in late January.

- Korea Exports were down -15.2% year over year and also Singapore Exports were down -18.1% year over year in May, signing up a bigger hideaway after that throughout the pandemic and also the fourth biggest decline given that 1966 for every nation.

- With 2 out of 3 of the globe’s biggest economic climates blinking red and also the Chinese securities market teasing with bearishness area, worldwide development will certainly battle to acquire grip without plan assistance

- Existing degrees of weak point have actually generally introduced plan assistance yet might stop working to in this cycle as a result of inflationary problems by reserve banks.

- Saudi Arabia is trying to enter front of what they think will certainly be a product worldwide downturn sought after by revealing an additional million barrel a day reduce to attempt and also stabilize supply with dropping need. The manufacturing cut will certainly reduce Saudi Ariba to much less than 9m barrels a day, Aside from the pandemic this will certainly be Saudi Arabia’s most affordable manufacturing given that 2011.

European Production PMI New Orders and also Oriental exports dropping as quick or quicker than pandemic

FREQUENTLY ASKED QUESTION: With the relentless toughness in the labor markets and also rising cost of living, when will the Fed cut prices?

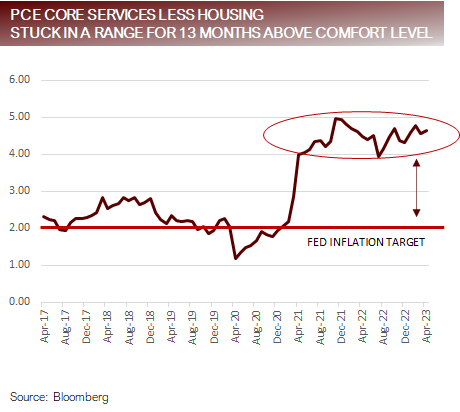

- The most significant wildcard today is what the Fed’s response feature resembles. Over the last years, the Fed relocated preemptively ahead threats to work and also development. They can manage to act preemptively since rising cost of living was not a worry. That is not the situation in 2023. Although, rising cost of living has actually come off its high of a year earlier, Core PCE has actually stagnated considerably in over a year and also is not near the Fed’s convenience degree so also if work actions inline, the Fed might be sluggish to alleviate plan.

- The Fed has 2 requireds, plus.

- Rate Security (PCE Target 0%)

- Complete Work (Joblessness Target 0%)

- Monetary Security (Very First Top Priority)

- Preferably, the Fed would certainly target plan based upon projections to stabilize cost security with development, yet large inequalities driven by the flooding of liquidity and also kinky supply chains has actually produced disparities in information that has actually made historic connections and also projections much less dependable.

- The Fed is picking to take a delay and also see technique, weighting choices for coincident information in the decision-making procedure, instead of rely upon This leaves them vulnerable to make mistakes since they are not totally taking into consideration the ramifications of their activities, instead they are checking out existing influences, which are determined with a lag.

- If the wildcard is when they Fed will certainly reduce prices, the most significant danger is that the marketplaces are overlooking the Fed’s response feature and also connecting historic degrees of weak point with plan changes that might not exist when rising cost of living is disappointing coincident indications of control.

Fed concentrated on coincident information that is not at degrees that suggest convenience degree for reducing

Placing all of it with each other

- Worldwide production information is weakening swiftly, nearing degrees where over the last years it would certainly be typical to see plan treatment since rising cost of living was being kept in check.

- The very first signals of plan changes are showing up from reserve banks worldwide. Every reserve bank will certainly have their very own response feature based upon their viewed degree of danger for rising cost of living, mix of plan concerns, experience of main lenders regulating plan and also political stress.

- In current background, financial tightenings accompany a stagnation in accumulated need, a downdraft in securities market costs and also the start of a weak labor

- Nevertheless, the existing cycle is being propped up excess cash money equilibriums, labor scarcities and also the AI supply craze, which are sustaining accumulated need and also clouding the image for possession costs.

- The existing agreement from planners and also the Fed is that an economic downturn has actually been pressed out the 2nd fifty percent of Nevertheless, S&P 500 profits quote are anticipated to increase in the 2nd fifty percent of 2023. This produces a contradictory sight with equity costs currently marking down the expert sight is appropriate.

For even more information, info, and also evaluation, check out theFixed Income Channel

The sights and also point of views shared here are the sights and also point of views of the writer and also do not always show those of Nasdaq, Inc.