Shares of Abercrombie & & Fitch Co. ANF leapt greater than 14% complying with the outstanding first-quarter monetary 2023 outcomes, where all-time low as well as leading lines went beyond the Zacks Agreement Quote as well as enhanced year over year.

Regardless of considerable rising cost of living as well as international macroeconomic disturbance, outcomes have actually obtained from the proceeded energy in the Abercrombie brand name as well as consecutive enhancement in the Hollister brand name. The clothing seller embarked on initiatives to boost its supply throughout all tags, thus bring in clients to buy a varied variety of items like gowns as well as freight.

Additionally, calculated financial investments throughout shops, electronic as well as modern technology using its Always Forward Strategy bodes well. Subsequently, administration has actually increased its monetary 2023 sight.

Sales & & Revenues Image

Abercrombie has actually reported modified profits of 39 cents per share in the very first quarter, whereas the Zacks Agreement Quote was fixed muddle-headed of 2 cents. First-quarter profits mirrored a considerable boost of 44.4% from the year-ago duration’s 27 cents.

Internet sales of $836 million climbed 3% year over year as well as went beyond the Zacks Agreement Quote of $812 million. Internet sales expanded 4% on a constant-currency basis.

Sales by Area as well as Brand Names

Sales were solid in the USA, up 9% year over year to $636.1 million. International sales decreased 12% year over year to $199.9 million. Sales in the EMEA dropped 15% to $139.3 million. In APAC, sales expanded 11% to $33.3 million. Various other sales dove 19% to $27.3 million.

Brand-wise, internet sales at Hollister decreased 7% year over year to $400 million, while at Abercrombie, sales progressed 14% to $436 million. Our quotes for Hollister as well as Abercrombie sales were $406 million as well as $407.4 million, specifically.

Abercrombie & & Fitch Firm Cost, Agreement as well as EPS Shock

Abercrombie & Fitch Company price-consensus-eps-surprise-chart|Abercrombie & & Fitch Firm Quote

Margins

The gross margin broadened 570 bps to 61%. This can be credited to 760 basis factors from reduced products prices as well as 230 basis factors from AUR development, partially countered by 320 basis factors from greater cotton as well as basic material prices, as well as 100 basis factors from the negative money.

Overhead, leaving out various other running revenue, were up 3% year over year. Greater modern technology expenditures as well as incentive-based payment greater than countered reduced electronic advertising and marketing as well as gratification expenditures.

As a portion of sales, operating costs of 57.3% broadened 30 bps from 57% in the prior-year quarter.

The modified operating revenue was $38.4 million versus a loss of $6 million in the year-ago duration.

Various Other Financials

Abercrombie finished the documented quarter with money as well as money matchings of $447 million, lasting internet loanings of $297.2 million, as well as shareholders’ equity of $702 million, leaving out non-controlling rate of interests.

The firm had a liquidity of $758 million at the end of the monetary very first quarter, that included money as well as matchings, as well as loaning offered under the ABL Center. Internet money made use of for running tasks was $1 million since Apr 29, 2023.

Shop Update

In the monetary very first quarter, the firm opened up 6 shops, consisting of 3 Hollister as well as Abercrombie shops each. It shut 7 Hollister as well as 3 Abercrombie shops. Since Apr 29, 2023, its complete shop base was 758, consisting of 556 shops in the USA as well as 202 shops worldwide.

Expectation

For monetary 2023, administration imagines internet sales to expand 2-4% year over year, up from the previous advice of 1 to 3% development. It anticipates the Abercrombie brand name to surpass Hollister. Region-wise, the USA is most likely to surpass International. Additionally, monetary 2023 consists of a 53rd week, which is approximated to profit sales by $45 million. Shop development is likewise a development vehicle driver.

Abercrombie anticipates an operating margin of 5-6%, up from the earlier specified 4-5%. This consists of gains of 250 bps from minimized products as well as basic material prices, rather countered by rising cost of living as well as raised running cost financial investment for the 2025 Always Forward Strategy campaigns. The firm anticipates a capital investment of $160 million as well as a tax obligation price in the high-30s array, below the formerly pointed out mid-40s array.

For second-quarter monetary 2023, the firm anticipates sales development of 4-6%. The operating margin is visualized to be 2-3% contrasted to breakeven in the prior-year quarter. This is likely as a result of reduced products as well as basic material prices, partially countered by a minimal decrease in the operating margin from rising cost of living as well as raised running cost financial investment for the 2025 Always Forward Strategy campaigns. The efficient tax obligation price is prepared for to be 50%.

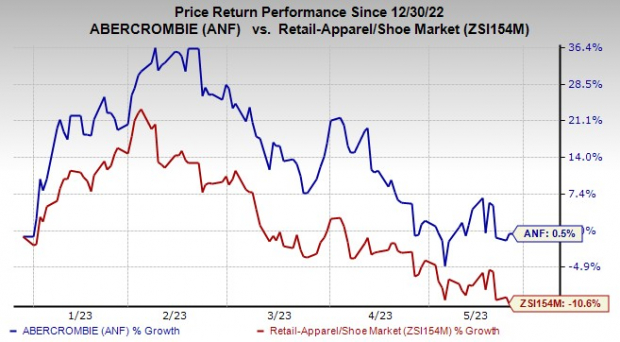

Picture Resource: Zacks Financial Investment Research Study

Shares of this Zacks Ranking # 3 (Hold) firm have actually obtained 0.5% in the previous 3 months versus the industry‘s decrease of 10.6%.

Supplies to Think About

Right here are some better-ranked supplies, particularly Tecnoglass TGLS, Kroger KR as well as TJX Firms TJX.

Tecnoglass makes as well as offers building glass as well as light weight aluminum items for the household as well as industrial building and construction markets. TGLS presently sporting activities a Zacks Ranking # 1 (Solid Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Agreement Quote for Tecnoglass’ existing financial-year sales as well as profits per share recommends development of 18.1% as well as 23.8%, specifically, from the year-ago reported numbers. TGLS has a tracking four-quarter profits shock of 22.7%, usually.

Kroger, a prominent grocery store seller, presently sporting activities a Zacks Ranking of 2 (Buy). KR has a tracking four-quarter profits shock of 9.8%, usually.

The Zacks Agreement Quote for Kroger’s existing fiscal year’s profits per share recommends development of 6.6% from the year-ago reported number. KR has a predicted profits per share development price of 6% for 3 to 5 years.

TJX Firms, which runs as an off-price clothing as well as residence style seller, lugs a Zacks Ranking # 2. The anticipated EPS development price for 3 to 5 years is 10.5%.

The Zacks Agreement Quote for TJX Firms’ existing financial-year sales as well as profits recommends development of 6.4% as well as 14.5% from the year-ago duration. TJX has a tracking four-quarter profits shock of 4.4%, usually.

Free Record: Must-See Hydrogen Supplies

Hydrogen gas cells are currently made use of to supply effective, ultra-clean power to buses, ships as well as also healthcare facilities. This modern technology gets on the brink of a substantial development, one that might make hydrogen a significant resource of America’s power. It might also completely transform the EV market.

Zacks has actually launched an unique record disclosing the 4 supplies specialists think will certainly provide the greatest gains.

Download Cashing In on Cleaner Energy today, absolutely free.

The TJX Companies, Inc. (TJX) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

The Kroger Co. (KR) : Free Stock Analysis Report

Tecnoglass Inc. (TGLS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints revealed here are the sights as well as viewpoints of the writer as well as do not always mirror those of Nasdaq, Inc.