Outdoors of Tesla TSLA and Meta Platforms META, traders are largely antcipating quarterly outcomes from magnificent seven gamers Alphabet GOOGL and Microsoft MSFT this week as properly.

With Alphabet and Microsoft’s quarterly studies set for Thursday, April 25, let’s have a look at which huge tech inventory is extra enticing for the time being.

Quarterly Expectations

Alphabet’s Q1 earnings are anticipated to extend 27% to $1.49 per share versus $1.17 a share within the comparative quarter. On the highest line, the search engine leaders’ Q1 gross sales are projected to be up 14% to $66.02 billion. Notably, Alphabet has surpassed earnings expectations for 4 straight quarters posting a median earnings shock of seven.22%.

Picture Supply: Zacks Funding Analysis

As for Microsoft, the software program titan has surpassed EPS estimates for six consecutive quarters and posted a median earnings shock of 8.82% in its final 4 quarterly studies. Microsoft is anticipated to submit earnings of $2.81 per share for its present fiscal third quarter which might replicate a 14% improve from a yr in the past. Plus, Microsoft’s Q3 gross sales are projected to rise 15% to $60.63 billion.

Picture Supply: Zacks Funding Analysis

Efficiency & Valuation Comparability

Correlating with their expansive progress trajectories, Alphabet’s inventory has risen +13% yr up to now with Microsoft shares up +8% to each outperform the S&P 500’s +5% and the Nasdaq’s +4%. Even higher, GOOGL and MSFT have now soared over +40% within the final yr which has additionally topped the sturdy performances of the broader indexes.

Picture Supply: Zacks Funding Analysis

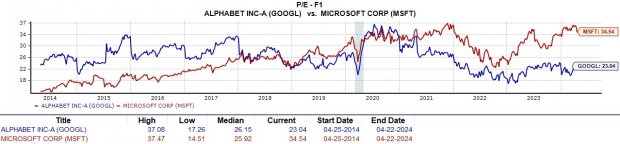

At their present ranges, Alphabet is extra interesting when it comes to P/E valuation and trades at a 23X ahead earnings a number of which is close to the S&P 500’s 20.9X with Microsoft at 34.5X. It’s additionally noteworthy that GOOGL nonetheless trades at a reduction to its decade-long median of 26.1X whereas MSFT trades above its median and nearer to its excessive of 37.4X throughout this era.

Picture Supply: Zacks Funding Analysis

Earnings Estimate Revisions

During the last 60 days, earnings estimate revisions for Q1 (Present Qtr) and Alphabet’s FY24 have remained unchanged with FY25 EPS estimates barely increased.

Picture Supply: Zacks Funding Analysis

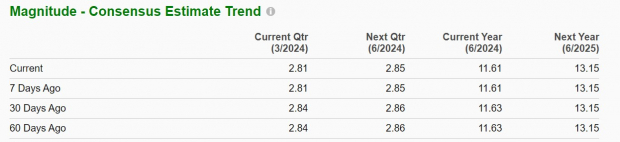

In distinction, earnings estimates for Microsoft’s present quarer and FY24 have barely decreased within the final two months whereas FY25 EPS estimates have remained unchanged.

Picture Supply: Zacks Funding Analysis

Takeaway

Whereas each of those tech giants predict double-digit EPS progress in FY24 and FY25, Alphabet presently lands a Zacks Rank #3 (Maintain) with Microsoft touchdown a Zacks Rank #4 (Promote).

That is largely attributed to the pattern of earnings estimate revisions which has remained favorable for Alphabet together with the corporate’s P/E valuation whereas Microsoft trades at a little bit of a premium to its huge tech peer and FY24 EPS estimates have dipped.

Prime 5 Dividend Shares for Your Retirement

Zacks targets 5 well-established corporations with stable fundamentals and a historical past of elevating dividends. Extra importantly, they’ve the sources and can to doubtless pay them sooner or later.

Click on now for a Particular Report full of unconventional knowledge and insights you merely gained’t get out of your neighborhood monetary planner.

See our Top 5 now – the report is FREE >>

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.