A pair of behemoths within the retail area, each Amazon (NASDAQ: AMZN) and Walmart (NYSE: WMT) have been sturdy winners in 2024. Nonetheless, it is Walmart’s inventory that has been the larger winner this yr, up practically 80% yr thus far as of this writing in comparison with a couple of 47% return for Amazon’s inventory.

With the calendar quickly set to flip over to 2025, let’s examine which inventory appears to be like greatest positioned to outperform subsequent yr.

Begin Your Mornings Smarter! Get up with Breakfast information in your inbox each market day. Sign Up For Free »

Enterprise transformations

There is no doubt that Amazon has had a significant affect on Walmart through the years. Its on-line retail platform and logistics community created an existential problem for Walmart that led the latter firm to rework itself into the most important grocery retailer within the nation. Actually, Walmart now accounts for greater than 1 / 4 of all grocery gross sales within the U.S.

Walmart’s scale and shopping for energy have enabled it to supply its clients the very best costs. Given the excessive inflationary surroundings of the previous few years, this has not solely resonated with Walmart’s core buyer base, however it helped it draw in additional prosperous clients as nicely.

On the identical time, Walmart continues to have a large bodily footprint, to the purpose the place 90% of the U.S. inhabitants is inside 10 miles of one in every of its shops. Combining ubiquity with rising behind-the-scenes automation, the corporate has been in a position to provide free same-day supply by way of its Walmart+ membership, additional including comfort and attracting clients. In some places, it even gives in-home deliveries.

All of this additionally helps energy progress for its common merchandise classes. Final quarter, whereas another general-merchandise retailers resembling Goal had been struggling, Walmart famous energy in classes resembling in-home tech, toys, and seasonal decor.

The corporate has additionally leaned into digital promoting with its Walmart Join advert enterprise, which gives each on-line and offline advertising and marketing options for manufacturers. Final quarter, it stated promoting and memberships helped account for half of the working revenue features it noticed.

Total, Walmart grew income by 5.5% final quarter, working revenue by 8%, and adjusted earnings per share (EPS) by 14%.

Picture supply: Getty Photos.

That stated, Walmart’s success has not hampered Amazon’s retail progress. The web retail big noticed a 9% enhance in income in its North American retail phase final quarter, and a 33% soar in North American working revenue. Like Walmart, Amazon is seeing sturdy digital advert progress, which was up 19%, helped by its sponsored-ad enterprise.

It is also within the grocery enterprise, with Amazon Contemporary and Entire Meals, although they don’t seem to be as essential to Amazon as grocery gross sales are to Walmart. In the meantime, Amazon seems primed to benefit from trade struggles and go after the pharmacy enterprise, because it’s began providing same-day pharmacy providers in a number of main cities.

Amazon has remodeled its enterprise through the years as nicely and is now rather more than simply a web-based retailer. It owns a preferred streaming service in Prime Video, however the firm’s greatest revenue driver is its AWS cloud computing enterprise. This phase grew its income by 19% final quarter, whereas its working revenue soared 49% to $10.4 billion. This compares to working revenue of $5.7 billion for the North American retail phase and $1.3 billion for the worldwide retail phase.

Not surprisingly, Amazon is popping towards artificial intelligence (AI) to assist drive income progress and enhance profitability. In cloud computing, it is serving to clients create their very own AI purposes by way of its SageMaker platform, whereas providing foundational large language models (LLMs) from each itself and AI start-ups with its Bedrock platform. It is also trying to save logistic prices by utilizing AI to seek out the very best routes. And it is utilizing AI to make it simpler for third-party sellers to listing objects on its web site, and to assist with higher product data and suggestions.

Valuation and verdict

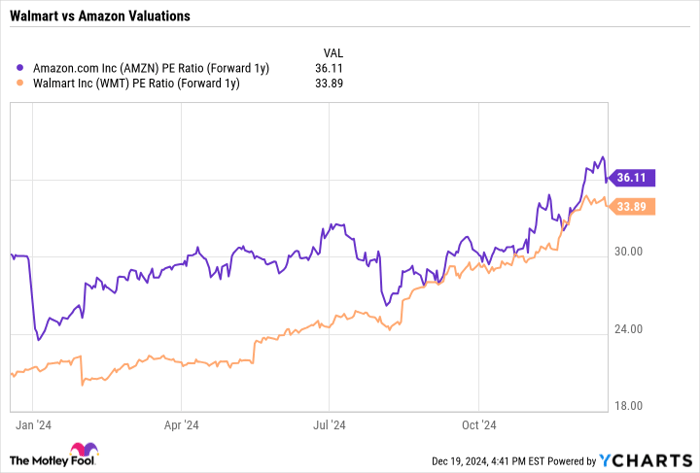

The standard hole in valuation between Amazon and Walmart has closed considerably this yr. Amazon now trades at a forward price-to-earnings (P/E) ratio of 36, whereas Walmart at present sits at a a number of of 34:

AMZN PE Ratio (Forward 1y) information by YCharts.

Amazon just lately has been rising income extra shortly than Walmart (11% final quarter versus 5.5%), though it is spending closely on capital expenditures because it chases its AI alternative.

Each firms have proven the power to adapt and innovate through the years, which ought to lead each their shares to be long-term winners. Nonetheless, for 2025 — given the modest valuation hole between the 2, its greater income progress, and the AI alternative in entrance of it — I want Amazon.

Don’t miss this second probability at a probably profitable alternative

Ever really feel such as you missed the boat in shopping for essentially the most profitable shares? You then’ll need to hear this.

On uncommon events, our knowledgeable crew of analysts points a “Double Down” stock suggestion for firms that they assume are about to pop. In case you’re nervous you’ve already missed your probability to speculate, now could be the very best time to purchase earlier than it’s too late. And the numbers converse for themselves:

- Nvidia: when you invested $1,000 after we doubled down in 2009, you’d have $349,279!*

- Apple: when you invested $1,000 after we doubled down in 2008, you’d have $48,196!*

- Netflix: when you invested $1,000 after we doubled down in 2004, you’d have $490,243!*

Proper now, we’re issuing “Double Down” alerts for 3 unimaginable firms, and there will not be one other probability like this anytime quickly.

*Inventory Advisor returns as of December 16, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Geoffrey Seiler has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon, Goal, and Walmart. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.