The Q3 earnings season is slowly grinding to a halt, with only a small chunk of S&P 500 firms but to disclose their quarterly outcomes.

Keep up-to-date with all quarterly releases: See Zacks Earnings Calendar.

However looming massive is AI-favorite Nvidia NVDA, whose outcomes are anticipated after the market’s shut on Wednesday. A peer, Superior Micro Units AMD, has already delivered its quarterly outcomes, giving us a small read-through of what to anticipate regarding AI demand and tendencies inside video gaming.

Let’s take a better look.

AMD Posts Strong Information Heart Progress

Superior Micro Units posted sturdy development in its launch, with EPS rising 31% on the again of 17% increased gross sales. Margin growth unlocked increased profitability, with its reported gross margin of 54% increasing from the 47% mark within the year-ago interval.

Notably, Information Heart income of $3.5 billion mirrored a quarterly document and climbed an astonishing 122% from the identical interval final 12 months. General, the Information Heart outcomes verify sturdy underlying demand for AI, a pattern we’ve been very accustomed to over latest intervals.

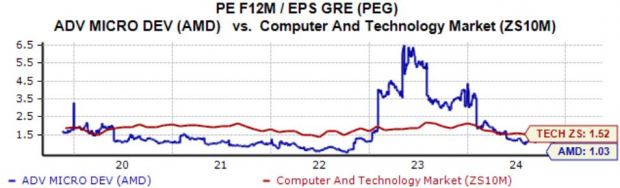

AMD’s knowledge middle outcomes have recurrently exceeded our consensus expectations in latest quarters, as we are able to see under.

Picture Supply: Zacks Funding Analysis

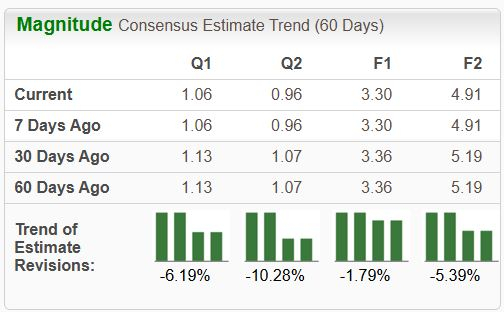

The valuation image doesn’t warrant quick concern, with the present 29.4X ahead 12-month earnings a number of evaluating favorably to a 42.3X five-year median and 106.9X five-year highs. Additional, the present PEG works out to 1.0X, once more properly beneath historic values and evaluating properly to the Zacks Laptop and Expertise sector common.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

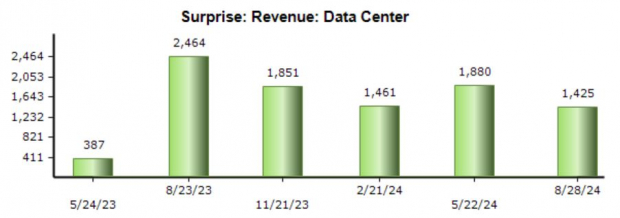

The inventory didn’t see an important post-earnings response regardless of the favorable Information Heart outcomes, with analysts additionally downwardly revising their earnings expectations following the discharge. Weaker-than-expected gross sales forecasts have been a driver behind the unfavourable share sentiment over latest months, additionally explaining the downward estimate revisions.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Nvidia Steering Stays Key

Nvidia’s Information Heart outcomes have been nothing in need of exceptional, persistently blowing away our consensus expectations in latest quarters. As proven under, the beats have been fairly sizable, with the latest totaling a large $1.4 billion amid one other interval of scorching-hot demand.

Picture Supply: Zacks Funding Analysis

Traders can seemingly anticipate one other sturdy exhibiting inside its Information Heart, with our $28.9 billion consensus estimate suggesting practically 100% development year-over-year. The read-through AMD gave us regarding AI demand additionally bodes properly for NVDA right here.

CEO Jensen Huang supplied a bullish long-term remark following the Q2 launch, confirming sturdy demand for Hopper and general anticipation for Blackwell. ‘NVIDIA achieved document revenues as international knowledge facilities are in full throttle to modernize your entire computing stack with accelerated computing and generative AI.’

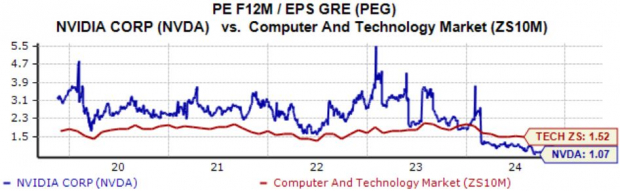

Valuation multiples aren’t costly on a relative foundation, with the present 38.7X ahead 12-month earnings a number of properly beneath the 50.7X five-year median and five-year highs of 106.3X.

As well as, the present PEG ratio works out to 1.1X, once more properly under historic ranges. As proven under, the a number of compares favorably to the Zacks Laptop & Expertise sector common of 1.5X.

Picture Supply: Zacks Funding Analysis

Placing All the pieces Collectively

Traders are eagerly awaiting Nvidia’s NVDA Q3 launch, which can wrap up the reporting interval for the broader Magazine 7 group general. We’ve already heard from a peer, Superior Micro Units AMD, whose Information Heart outcomes confirmed sturdy underlying demand.

Whereas the response to the AMD outcomes wasn’t bullish, it was a results of weaker-than-expected gross sales steerage. It’s cheap to imagine that steerage from NVDA will seemingly dictate the post-earnings transfer as properly, as many already know that sizable Y/Y development is on the horizon.

Nonetheless, persistently sturdy execution from NVDA and an already established stance throughout the AI house retains the inventory the clear AI favourite.

7 Greatest Shares for the Subsequent 30 Days

Simply launched: Consultants distill 7 elite shares from the present listing of 220 Zacks Rank #1 Robust Buys. They deem these tickers “Most Doubtless for Early Value Pops.”

Since 1988, the complete listing has crushed the market greater than 2X over with a median achieve of +23.7% per 12 months. So you should definitely give these hand picked 7 your quick consideration.

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.