Amyris, Inc. AMRS taped a loss (as reported) of 53 cents per share for first-quarter 2023, compared to a loss of 37 cents in the year-ago quarter.

Disallowing single products, modified loss per share was 34 cents per share for the quarter. It remained in line with the Zacks Agreement Quote.

The firm signed up incomes of $56.1 million for the quarter, down around 3% year over year. It defeated the Zacks Agreement Quote of $53 million. The firm saw reduced sales in its Customer and also Modern technology Accessibility systems in the quarter.

Amyris, Inc. Cost, Agreement and also EPS Shock

Amyris, Inc. price-consensus-eps-surprise-chart|Amyris, Inc. Quote

Sector Emphasizes

Incomes from the Customer section dropped 1% year over year to $34.2 million in the documented quarter. The drawback was because of reduced incomes from the Biossance brand name arising from lowered advertising and marketing and also media invest.

The Modern technology Accessibility section generated incomes of around $21.9 million, down around 5% year over year. Components item incomes dropped 18% year over year on continual supply and also functioning resources restraints. R&D cooperation incomes climbed in the quarter driven by numerous brand-new agreement study programs.

Financials

The firm finished the quarter with money and also money matchings of about $11.2 million, down around 83% sequentially. Lasting financial debt was $675.9 million at the end of the very first quarter, level sequentially.

Overview

The firm maintained its expectation for 2023 consisting of earnings advice as divulged in March 2023. It stays concentrated on expense effectiveness, resources framework and also liquidity needed to money business. AMRS remains in the procedure of a tactical testimonial of all elements of its expense framework to sustain its Fit-to-Win efforts with the objective to drive expense and also effectiveness enhancements.

Cost Efficiency

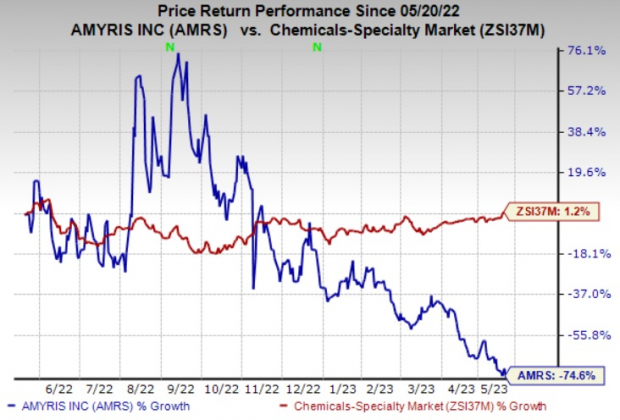

Amyris’ shares are down 74.6% in a year compared to a 1.2% increase taped by the industry.

Photo Resource: Zacks Financial Investment Research Study

Zacks Ranking & & Other Trick Picks

Amyris presently brings a Zacks Ranking # 3 (Hold).

Better-ranked supplies worth taking into consideration in the raw materials area consist of Nucor Firm NUE, PPG Industries, Inc. PPG and also Linde plc LIN.

Nucor presently brings a Zacks Ranking # 1 (Solid Buy). The Zacks Agreement Price quote for NUE’s current-year incomes has actually been changed 16.5% up in the previous 60 days. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Nucor defeated Zacks Agreement Price quote in each of the last 4 quarters. It supplied a tracking four-quarter incomes shock of 10.8% generally. NUE’s shares have actually obtained about 17% in the previous year.

PPG Industries presently brings a Zacks Ranking # 2 (Buy). The Zacks Agreement Price quote for PPG’s current-year incomes has actually been changed 11.2% up in the previous 60 days.

PPG Industries’ incomes defeated the Zacks Agreement Price quote in 3 of the last 4 quarters. It has a tracking four-quarter incomes shock of about 6.8%, generally. PPG has actually obtained about 19% in a year.

Linde presently brings a Zacks Ranking # 2. The Zacks Agreement Price quote for LIN’s current-year incomes has actually been changed 3.8% up in the previous 60 days.

Linde defeated Zacks Agreement Price quote in each of the last 4 quarters. It supplied a tracking four-quarter incomes shock of 5.9% generally. LIN’s shares have actually obtained about 17% in the previous year.

Free Record: Top EV Battery Supplies to Acquire Currently

Just-released record exposes 5 supplies to make money as countless EV batteries are made. Elon Musk tweeted that lithium costs have actually mosted likely to “outrageous degrees,” and also they’re most likely to maintain climbing up. Therefore, a handful of lithium battery supplies are readied to escalate. Accessibility this record to find which battery supplies to get and also which to prevent.

Nucor Corporation (NUE) : Free Stock Analysis Report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

Amyris, Inc. (AMRS) : Free Stock Analysis Report

Linde PLC (LIN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints revealed here are the sights and also viewpoints of the writer and also do not always mirror those of Nasdaq, Inc.