The Might tasks record revealed once more just how durable as well as secure the united state labor market as well as economic climate remain to be, resisting doubters that have actually been cautioning us of alarming financial advancements in advance. The decreasing pattern in the Might wage development numbers reveals that a ‘soft-landing’ circumstance is not simply hopeful reasoning yet instead a sensible assumption for the united state economic climate.

The labor market is rarely the only component of the economic climate that remains to oppose the doubters, compeling them to maintain postponing the beginning of what they view as the day of numeration. Routine visitors of our company profits discourse recognize that we have actually been flagging the ongoing durability of company success for some time.

The 2023 Q1 profits records revealed us that in contrast to anxieties of an approaching profits high cliff, firms were mainly able to shield their profits. We are not recommending that the profits image from the Q1 reporting cycle was terrific, yet instead that it confirmed to be a great deal a lot more secure as well as durable than lots of had actually agreed to offer it credit score.

We see this current profits efficiency as the ideal configuration as we expect the 2023 Q2 profits period, whose very early records have actually begun being available in currently. On that particular matter, we are describing the current Costco price as well as AutoZone AZO launches for their monetary durations finishing Might that we as well as various other information suppliers count as component of the June-quarter profits tally.

We do not wish to discover as playing down the macroeconomic unpredictabilities that are motivating lots of out there to be booking recessionary results in the following couple of quarters. We are not stating those assumptions are incorrect, yet instead that we value the economic climate as well as company industry’s durability as well as see reduced probabilities of such alarming financial results coming up.

Every One Of this has straight ramifications for the wellness of company success.

To obtain a feeling of what is presently anticipated, have a look at the graph listed below that reveals present profits as well as earnings development assumptions for the S&P 500 index for 2023 Q2 as well as the complying with 3 quarters as well as real outcomes for the coming before 4 quarters.

Photo Resource: Zacks Financial Investment Study

As you can see above, 2023 Q2 profits are anticipated to be down -8.6% on -0.6% reduced incomes.

To offer you a feeling of just how much these assumptions have actually advanced over the last 3 months, the -8.6% profits decrease in Q2 today is below the -7.2% decrease that was anticipated on March 10 th, 2023. Quotes for the last 2 quarters of the year have actually likewise boiled down really decently over the exact same amount of time, with 2023 Q3 below +0.3% profits development on March 10 th to a decrease of -0.4% today as well as Q4 below +7.9% after that to +5.6% today.

Please keep in mind that while 2023 Q2 quotes have actually boiled down, the size of unfavorable modifications contrasts positively to what we saw in the similar durations of the coming before number of quarters. To put it simply, quotes have not dropped as high as they did the last couple of quarters, not just for Q2 yet additionally for the remainder of the year.

Actually, our routine visitors have most likely kept in mind that we have actually been mentioning a noteworthy stablizing in the modifications front recently, which about accompanied the beginning of Q2 in April 2023. This was a change in the general modifications pattern, which was constantly unfavorable for virtually a year.

Returning to the 2023 Q2 assumptions, installed in the previously mentioned profits as well as earnings development forecasts is the assumption of ongoing margin stress, which has actually been a repeating style in current quarters.

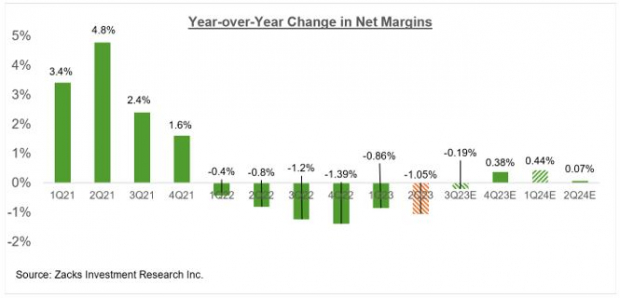

The graph listed below programs the year-over-year modification in web margins for the S&P 500 index.

Photo Resource: Zacks Financial Investment Study

As you can see above, 2023 Q2 will certainly be the 6 th successive quarter of decreasing margins for the S&P 500 index.

Margins in Q2 are anticipated to be listed below the year-earlier degree for 11 of the 16 Zacks markets, with one of the most substantial margin stress anticipated to be in the Basic Products (-382 basis factors decrease), Building and construction (-375 bps), Power (-369 bps), Medical (-248 bps), Empires (-201 bps), Vehicle (-102 bps), Aerospace (-93 bps), as well as Technology (-89 bps).

On the silver lining, the Money industry is the just one anticipated to experience substantial margin gains (up +112 bps), with the Customer Discretionary industry as a far-off 2nd (+40 bps). Fields anticipated to be basically level margins about 2022 Q2 are Retail (+7 bps), Energies (+18 bps), as well as Industrial Products (+1 bps).

The graph listed below programs the profits as well as earnings development image on a yearly basis.

Photo Resource: Zacks Financial Investment Study

As kept in mind previously in the context of going over the modifications pattern regarding 2023 Q2 quotes, we have actually been observing a noteworthy stablizing in the modifications pattern considering that the beginning of April 2023.

This stablizing in 2023 profits quotes stood for a noteworthy turnaround in the constantly unfavorable pattern that had actually remained in area for virtually a year considering that quotes came to a head in April 2022. Present assumptions for 2023, as stood for by the above graph, are down virtually -13% considering that the April 2022 top.

Given that the beginning of 2023 Q2 in April, accumulated profits quotes for 2023 are basically level, with 8 of the 16 Zacks markets appreciating favorable quote modifications because amount of time. Fields appreciating favorable quote modifications considering that the beginning of Q2 consist of Building and construction, Industrial Products, Autos, Technology, as well as Retail.

For a comprehensive check out the general profits image, consisting of assumptions for the coming durations, please have a look at our once a week Profits Fads report >>>>> > > >Assessing the Construction Sector’s Favorable Earnings Outlook

Zacks Discloses ChatGPT “Sleeper” Supply

One obscure business goes to the heart of a specifically fantastic Expert system industry. By 2030, the AI sector is forecasted to have a web as well as iPhone-scale financial effect of $15.7 Trillion.

As a solution to visitors, Zacks is giving a bonus offer record that names as well as describes this eruptive development supply as well as 4 various other “should gets.” Plus a lot more.

Download Free ChatGPT Stock Report Right Now >>

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

AutoZone, Inc. (AZO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views revealed here are the sights as well as point of views of the writer as well as do not always show those of Nasdaq, Inc.