The marketplace liked what it saw in the quarterly launches from JPMorgan JPM, Citigroup C, as well as also Wells Fargo WFC. There was lots to such as in these outcomes, with greater rate of interest aiding these huge gamers increase their margins while need for car loans continued to be solid, aiding funding profiles expand.

The financial institution stresses that took spotlight following the Silicon Valley Financial institution farce really did not concern these huge gamers. JPMorgan, Citi, as well as Wells Fargo, which reported Friday early morning, as well as Financial institution of America, which is set up to report Tuesday early morning (April 18 th), consistently undergo the Fed’s cardiovascular test as well as are viewed as extremely secure.

The decreased self-confidence in the financial room is particularly fixated the tiny as well as mid-sized local financial institutions that will certainly begin reporting outcomes today. The trip to security amongst depositors has actually compelled these financial institutions to use a lot greater down payment prices to stem the trend. This will certainly appear in net-interest margin stress family member not just to what came with from the similarity JPMorgan, Citi, as well as Wells Fargo Friday early morning however additionally about what these exact same financial institutions had actually reported in the previous duration.

Going back to the team’s Q1 outcomes, the truth that the financial investment financial service was weak throughout the duration was not a surprise for the marketplace. We understood that consultatory charges would certainly, at best, have to do with two-thirds of what they remained in the year-earlier duration, as tighter financial plan as well as various other macroeconomic headwinds have actually been considering on deal-making.

JPMorgan’s internet passion revenue leapt +49%, as typical car loans boosted +5% as well as net-interest margin increased to 2.63% from 1.67% in the year-earlier duration. Margins increased for Citigroup as well as Wells Fargo also, as financing prices (the prices supplied to depositors) really did not increase by that much. The marketplace suched as JPMorgan’s elevated assistance for internet passion revenue this year, though administration has actually mentioned that 2023 will certainly note the high watermark on this matter over the following couple of years.

Providing continued to be solid in Q1 however began to soften in the direction of completion of the quarter following the Silicon Valley Financial institution failing, a fad that has actually brought right into the present duration as well as will likely stay an unfavorable aspect over the coming quarters also.

Several on the market see the resulting firm in economic problems as shown in the abovementioned decreased loaning overview coming to be a considerable development headwind for the united state economic climate, which was currently under serious pressure because of the Fed’s remarkable financial plan firm.

Partially driving the marketplace’s positive response to these huge financial institution outcomes is a sigh of alleviation in a manner, which adheres to a virtually unplanned sell-off for the team given that very early March when the Silicon Valley Financial institution concern took spotlight. The JPMorgan, Citigroup, as well as Wells Fargo outcomes were unquestionably great, however view on the team had actually damaged a lot that market individuals discovered the outcomes guaranteeing. Financial institution supplies had actually been leading the marketplace this year with very early March however have actually battled given that March 6 th, as the graph listed below programs.

Picture Resource: Zacks Financial Investment Research Study

The concern with the financial institution supplies isn’t a lot their present revenues power however instead exactly how their success will certainly tone up in the coming financial stagnation. Financial institution capitalists watch out for the team’s performance history of making a great deal of cash throughout the great times, which the team after that repays throughout the hard times.

The concern is exactly how ‘negative’ will certainly the coming ‘hard times’ be for the economic climate as well as what will certainly that do to financial institution revenues.

Relating To the Money field scorecard for Q1, we currently have arise from 18.5% of the field’s market capitalization in the S&P 500 index. Overall revenues for these firms are up +25.3% from the exact same duration in 2015 on +17.3% greater incomes, with 83.3% whipping EPS quotes as well as 100% whipping earnings quotes.

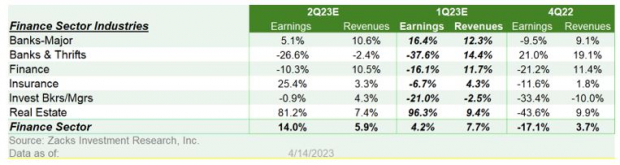

Taking A Look At the Money field in its entirety, overall Q1 revenues for the field are anticipated to be up +4.2% on +7.7% greater incomes.

For the Zacks Major Banks sector, that includes every one of the abovementioned financial institutions as well as make up about 40% of overall Money field revenues, overall Q1 revenues get on track to be up +16.4% from the exact same duration in 2015 on +12.3% greater incomes.

The table listed below programs the field’s Q1 revenues as well as earnings assumptions at the ‘tool’ sector degree in the context of what the room reported in the previous duration as well as what is anticipated in the list below quarter.

Picture Resource: Zacks Financial Investment Research Study

As kept in mind previously, doubters of the financial sector suggest that the team winds up distributing all the revenues that it had actually collected throughout the great times when the macro atmosphere transforms southern. The Covid recession was an abnormality in that regard, however there is some fact to the claims.

We will certainly see exactly how the financial photo unravels in the coming quarters, however the credit scores top quality metrics in the reported Q1 outcomes do not direct towards any kind of unavoidable degeneration.

The revenues development photo for the Money field is anticipated to boost in 2023 as we transform the web page on hard contrasts, although the financial development speed is anticipated to modest under the advancing weight of the Fed’s firm. Money field revenues are anticipated to be up +11.3% in 2023 on -1.9% reduced incomes, which would certainly adhere to the -15.9% revenues decrease on +7.7% greater incomes in 2022.

2023 Q1 Incomes Period Scorecard

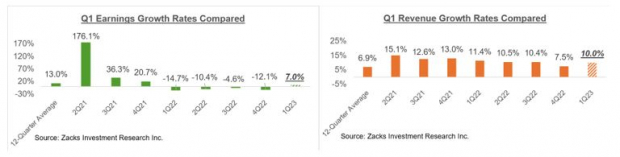

Consisting of Friday early morning’s financial institution outcomes, we currently have Q1 revenues from 30 S&P 500 participants. Overall revenues for these 30 index participants are up +7% from the exact same duration in 2015 on +10% greater incomes, with 83.3% whipping EPS quotes as well as 73.3% whipping earnings quotes.

Financial institutions as well as various other economic drivers control today’s coverage docket, however we additionally have a multitude of leading drivers from Johnson & & Johnson as well as Proctor & & Wager to Netflix, Tesla, as well as several others.

The very first collection of graphes contrasts the revenues as well as earnings development prices for the 30 index participants that have actually reported with what we had actually seen from the team in various other current quarters.

Picture Resource: Zacks Financial Investment Research Study

The contrast graphes listed below placed the Q1 EPS as well as earnings beats portions in a historic context.

Picture Resource: Zacks Financial Investment Research Study

The Incomes Broad View

To obtain a feeling of what is presently anticipated, have a look at the graph listed below that reveals present revenues as well as earnings development assumptions for the S&P 500 index for 2023 Q1 as well as the adhering to 3 quarters.

Picture Resource: Zacks Financial Investment Research Study

As you can see below, 2023 Q1 revenues are anticipated to be down -9.4% on +1.9% greater incomes. This would certainly adhere to the -5.4% revenues decrease in the previous duration (2022 Q4) on +5.9% greater incomes.

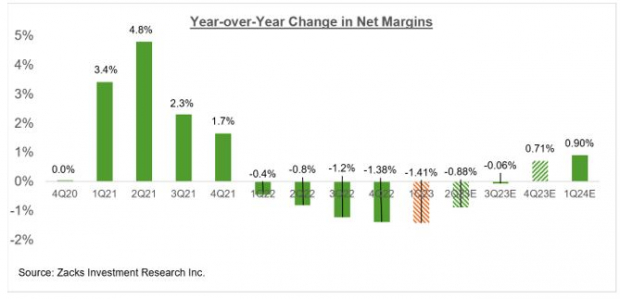

Installed in these 2023 Q1 revenues as well as earnings development estimates is the assumption of ongoing margin stress, which has actually been a persisting style in current quarters. The graph listed below programs the year-over-year adjustment in earnings margins for the S&P 500 index.

Picture Resource: Zacks Financial Investment Research Study

Price quotes for Q1 boiled down as the quarter obtained underway, in-line with the fad that had actually remained in location given that the beginning of 2022. That stated, the size of unfavorable alterations to Q1 quotes was smaller sized about what we had actually seen in the coming before 2 durations.

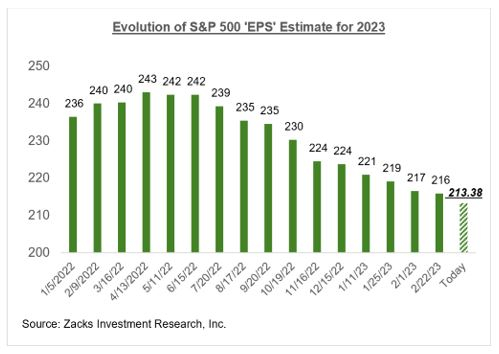

Price quotes for full-year 2023 have actually additionally been boiling down also, as we have actually been mentioning continually in these web pages. The graph listed below demonstrate how the accumulated 2023 S&P 500 revenues price quote has actually advanced.

Picture Resource: Zacks Financial Investment Research Study

As we have actually been mentioning the whole time, 2023 revenues quotes came to a head in April 2022 as well as have actually been boiling down since. Given that the mid-April height, accumulated revenues have actually decreased by -13.1% for the index in its entirety as well as -14.8% for the index on an ex-Energy basis, with the decreases much larger in a variety of significant fields.

You have actually most likely reviewed the about -20% cuts to S&P 500 revenues quotes, generally, in advance of economic downturns.

Several on the market translate this to suggest that quotes still have plenty to drop in the days in advance. However as the abovementioned size of unfavorable alterations over of -14% on an ex-Energy basis program, we have actually currently taken a trip a reasonable range because instructions. Significantly, some essential fields in the course of the Fed’s tightening up cycle, like Building and construction, Retail, Discretionary, as well as also Innovation, have actually currently obtained their 2023 quotes slashed off by a 5th given that mid-April.

We are not claiming that quotes do not require to drop any kind of better. If absolutely nothing else, quotes for the Money field will certainly require ahead down following the recurring financial sector problems. However instead that the mass of the cuts are most likely behind us, specifically if the coming financial recession is a whole lot much less troublesome than several appear to think or be afraid.

Please keep in mind that the $1.893 trillion accumulated revenues price quote for the index in 2023 estimates to an index ‘EPS’ of $213.38, below $221.05 in 2022. The graph listed below demonstrate how this 2023 index ‘EPS’ price quote has actually advanced in time.

Picture Resource: Zacks Financial Investment Research Study

The graph listed below programs the revenues as well as earnings development photo on a yearly basis.

Picture Resource: Zacks Financial Investment Research Study

For a thorough take a look at the general revenues photo, consisting of assumptions for the coming durations, please look into our regular Incomes Fads report >>>>> > > > 2023 Q1 Earnings Season Likely to Reflect Continued Margin Pressures

Wells Fargo & Company (WFC) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Citigroup Inc. (C) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints shared here are the sights as well as viewpoints of the writer as well as do not always mirror those of Nasdaq, Inc.