Tariffs have been the speak of the city over latest weeks, recurrently overshadowing different vital developments and inflicting volatility spikes.

Although proposed tariffs on Mexico and Canada have been delayed for 30 days, the ten% tariffs on Chinese language items are nonetheless scheduled to take impact this week on February 4th.

The preliminary tariffs are a preliminary measure, with President Trump and Chinese language President Xi Jinping more likely to quickly have discussions that form the longer term path of such strikes.

Nonetheless, till we all know extra, investor-favorite Apple AAPL has discovered itself within the crosshairs given the heavy iPhone manufacturing publicity. Let’s take a more in-depth have a look at the event and the tech titan’s latest set of quarterly outcomes.

Is Apple in Hassle?

Apple’s iPhone outcomes got here in a tad tender in its newest launch, an fascinating growth given the implementation of Apple Intelligence. iPhone gross sales of $69.2 billion fell roughly 1% year-over-year, additionally marginally falling wanting our consensus estimate.

Picture Supply: Zacks Funding Analysis

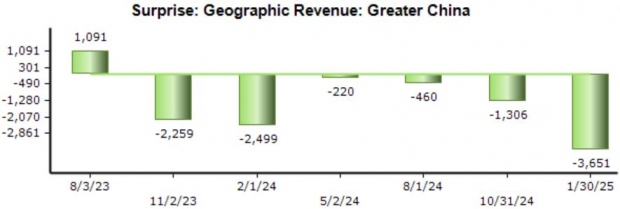

China gross sales have continued to decelerate amid stiffer competitors, with gross sales of $18.5 billion within the area down notably from the $20.8 billion mark within the year-ago interval. Whereas China continues to negatively impression outcomes, the chance and development cooldown has been well-known right here for a number of durations, probably not something ‘new’ for the market to digest.

Picture Supply: Zacks Funding Analysis

Whereas the tariffs information is undoubtedly a tad spooky, the corporate has a number of methods to mitigate the impression, corresponding to rising U.S. costs. Whereas a value improve would assist soak up the impression, decrease demand would definitely stay a priority.

Nonetheless, Apple has been diversifying its provide chain properly lately, increasing manufacturing to nations like India and Vietnam to cut back dependence on China.

Backside Line

Whereas tariffs stay a priority for Apple AAPL given its heavy manufacturing publicity, the corporate stays versatile sufficient to mitigate the impression. The corporate might proceed shifting its manufacturing to different areas, with a value improve on U.S. merchandise additionally an possibility.

For now, the information seems to be a tad spotty, and traders ought to wait to see how the state of affairs actually unfolds given the latest suspensions on tariffs from Mexico and Canada.

Solely $1 to See All Zacks’ Buys and Sells

We’re not kidding.

A number of years in the past, we shocked our members by providing them 30-day entry to all our picks for the whole sum of solely $1. No obligation to spend one other cent.

Hundreds have taken benefit of this chance. Hundreds didn’t – they thought there have to be a catch. Sure, we do have a purpose. We wish you to get acquainted with our portfolio providers like Shock Dealer, Shares Beneath $10, Expertise Innovators,and extra, that closed 228 positions with double- and triple-digit features in 2023 alone.

Apple Inc. (AAPL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.