It’s one other busy slate of earnings this week, with all kinds of firms on the reporting docket. We’ve gotten by way of the large banks’ outcomes and some quarterly releases from ‘Magazine 7’ members, whose outcomes didn’t trigger any significant spooks.

And regarding this week’s docket, investor favourite Apple AAPL is slated to unveil quarterly outcomes. Shares have been significantly weak year-to-date, dropping roughly 10% in comparison with the S&P 500’s 8% acquire.

Picture Supply: Zacks Funding Analysis

Is the inventory a purchase heading into earnings? Let’s study expectations and some key metrics to look at within the launch.

Apple

Apple’s woes in 2024 have primarily been fueled by fears regarding slowing progress and weakening demand from China, with its quiet-natured method to synthetic intelligence (AI) additionally inflicting some head-scratching.

Shares confronted stress post-earnings following its newest launch, with positivity surrounding its Providers portfolio unable to excite the market. It’s price noting that revenues in China totaled $20.8 billion all through the quarter, down 13% from the year-ago interval.

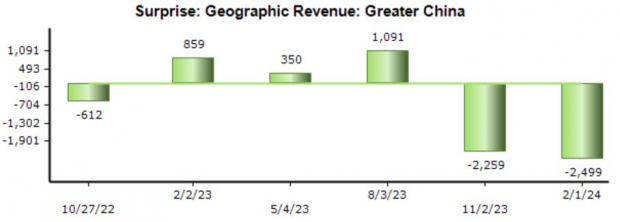

For the quarter to be launched, the Zacks Consensus Estimate for gross sales in China stands at $16.6 billion, suggesting a 6.7% lower from the year-ago interval. As proven beneath, AAPL’s China income has fallen wanting consensus expectations in back-to-back releases, with the newest miss totaling $2.5 billion.

Picture Supply: Zacks Funding Analysis

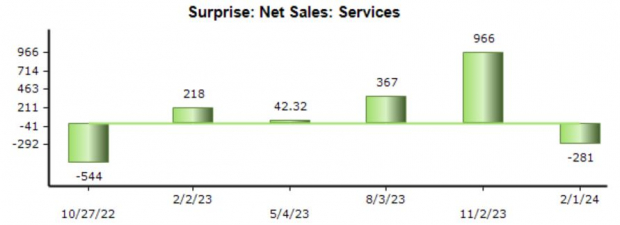

Regarding the Providers portfolio, the Zacks Consensus Estimate stands at $23.3 billion, 11.5% larger than the $20.9 billion reported within the year-ago interval. The tech titan has usually exceeded our Providers expectations however modestly fell quick in its newest launch.

Picture Supply: Zacks Funding Analysis

After all, iPhone outcomes may also be in focus. Our consensus estimate for iPhone gross sales stands at $46.2 billion, reflecting a virtually 10% pullback from the year-ago mark of $51.3 billion. The corporate snapped a streak of destructive iPhone surprises in its newest launch, with the beat totaling roughly $1 billion.

Picture Supply: Zacks Funding Analysis

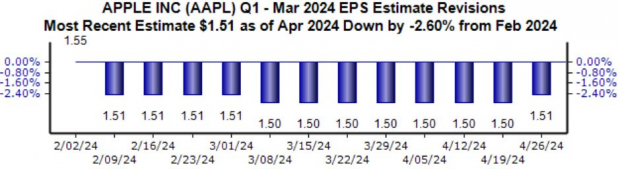

Analysts have modestly lowered their earnings expectations for the reason that starting of February, with the $1.51 per share estimate down 2.6% and primarily flat in comparison with the year-ago determine. Income revisions have moved similarly, because the $90 billion anticipated is down the identical quantity over the identical interval.

Picture Supply: Zacks Funding Analysis

Backside Line

We’ve got many investor favorites on the reporting docket for this week, a listing that features tech heavyweight Apple AAPL.

Traders will likely be tuned into the corporate’s China outcomes, which have just lately confronted stress amid rising competitors. The Providers portfolio will undoubtedly be one other main spotlight, an space of the corporate that’s been a stable progress driver just lately.

Heading into the discharge, Apple is at present a Zacks Rank #3 (Maintain).

Solely $1 to See All Zacks’ Buys and Sells

We’re not kidding.

A number of years in the past, we shocked our members by providing them 30-day entry to all our picks for the overall sum of solely $1. No obligation to spend one other cent.

1000’s have taken benefit of this chance. 1000’s didn’t – they thought there have to be a catch. Sure, we do have a motive. We wish you to get acquainted with our portfolio providers like Shock Dealer, Shares Beneath $10, Expertise Innovators,and extra, that closed 228 positions with double- and triple-digit positive aspects in 2023 alone.

Apple Inc. (AAPL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.