In a uncommon transfer, analysts at Jefferies downgraded one of many largest corporations on this planet, Apple (NASDAQ: AAPL), to underperform. Wall Road analysts are recognized for being bullish, so underperform and promote scores are inclined to make up solely a small proportion of general analyst scores.

For its half, Jefferies sees weak iPhone shipments within the fourth quarter, with Apple’s artificial intelligence (AI) options not resonating with shoppers. It cited a survey that almost all U.S. shoppers don’t discover AI options very helpful. As such, it thinks this is a sign that there won’t be an AI energy improve cycle for the iPhone.

The place to take a position $1,000 proper now? Our analyst group simply revealed what they consider are the 10 finest shares to purchase proper now. See the 10 stocks »

Jefferies expects Apple to overlook present analyst income estimates, calling for five% progress when it stories its This autumn outcomes on the finish of January. It additionally thinks there’s a good chance Apple’s Q1 steering may disappoint as properly. Its value goal for the inventory is $200.75.

Given the uncommon underperform ranking, many buyers could also be questioning if it is time to promote the inventory.

A robust enterprise mannequin

Regardless of the downgrade associated to iPhone gross sales projections, one factor has not modified: Apple has a robust enterprise mannequin. The corporate’s income progress was fairly lackluster all through its fiscal 2024 led to September. It solely grew its income 2% on the yr and 6% for its fiscal This autumn. Income progress for its units, in the meantime, has been even worse. Product income truly fell by 1% for its fiscal yr, whereas rising by 4% final fiscal quarter.

The place Apple has seen stronger progress is in its high-margin companies income. This contains income from its App Retailer, search-sharing income, Apple TV, Apple Pay, and different subscriptions and companies. Final fiscal yr, its companies income climbed 13% and was up 12% in This autumn.

Its companies gross margin is near 74%, whereas its product gross margin is about 37%. With the companies margin practically double, income coming from companies extra simply drops to bottom-line earnings. As such, the corporate was in a position to develop its adjusted earnings per share by 11% final yr to $6.75, regardless of solely a 2% enhance in income.

Picture supply: Getty Photographs.

Proper now, it seems that the massive iPhone improve cycle associated to Apple Intelligence is just not materializing. The corporate has had some points with its providing, akin to its AI producing inaccurate information alerts. In the meantime, each iPhone and Android smartphone customers in surveys have indicated that that AI options are including little to no worth. Then there may be the entire query of whether or not customers will ultimately pay for AI subscription companies. Proper now for Apple, AI appears to be extra of a price with none offsetting income profit.

The corporate additionally hasn’t been in a position to embrace Apple Intelligence with its smartphones in China. It had already been struggling within the nation towards native opponents, and in line with Counterpoint Analysis, iPhone gross sales plunged in China by 18% in This autumn. Gross sales of smartphones from rival Huawei, in the meantime, climbed 15.5% within the quarter.

Apple initially noticed sturdy iPhone gross sales in China after it debuted its newest model. Nonetheless, its AI is just not accepted in China and it should discover a native AI companion to include its know-how to run Apple Intelligence in China. Apple principally competes within the premium smartphone market in China, so the dearth of the most recent AI know-how has left it behind opponents.

Outdoors of smartphone gross sales, Apple additionally faces one other large threat associated the Alphabet antitrust case. Alphabet has been paying Apple an estimated $20 billion a yr as a part of its revenue-sharing mannequin for Google to be the default search engine for its browser Safari. This income can also be nearly pure margin, dropping proper to working earnings. With Alphabet shedding its antitrust case and this settlement in jeopardy, the impression it will definitely may have on this income stream remains to be very a lot within the air because the case may result in some fairly large adjustments. Nonetheless, any impression is probably going years away because the ruling will get appealed and each corporations have motive to attempt to shield what’s at the moment in place.

Increasing valuation

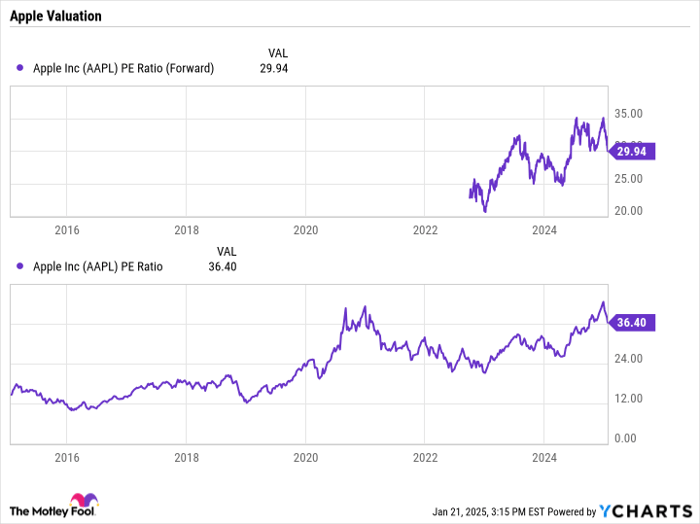

Apple inventory has seen a number of a number of growth prior to now a number of years. Its trailing price-to-earnings (P/E) ratio has basically tripled from 12 occasions to 36 occasions, whereas its ahead P/E primarily based on present fiscal yr estimates is round 30 occasions.

AAPL PE Ratio (Forward) information by YCharts

A few of this a number of growth might be attributed to the shift towards high-margin companies income, as these companies have a tendency to hold greater multiples than {hardware} companies. Apple has additionally confirmed to be a gradual enterprise that tends to have a considerably predictable, albeit lengthening, alternative cycle.

That stated, with the hope of an iPhone improve cycle diminishing and the inventory seeing a number of a number of growth prior to now six years, I believe it could be good to take some earnings on the inventory.

Don’t miss this second probability at a doubtlessly profitable alternative

Ever really feel such as you missed the boat in shopping for essentially the most profitable shares? Then you definately’ll need to hear this.

On uncommon events, our knowledgeable group of analysts points a “Double Down” stock suggestion for corporations that they suppose are about to pop. When you’re apprehensive you’ve already missed your probability to take a position, now could be the most effective time to purchase earlier than it’s too late. And the numbers converse for themselves:

- Nvidia: when you invested $1,000 after we doubled down in 2009, you’d have $369,816!*

- Apple: when you invested $1,000 after we doubled down in 2008, you’d have $42,191!*

- Netflix: when you invested $1,000 after we doubled down in 2004, you’d have $527,206!*

Proper now, we’re issuing “Double Down” alerts for 3 unbelievable corporations, and there is probably not one other probability like this anytime quickly.

*Inventory Advisor returns as of January 21, 2025

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Geoffrey Seiler has positions in Alphabet. The Motley Idiot has positions in and recommends Alphabet and Apple. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.