JPMorgan JPM shares have misplaced roughly -7% of their worth because the finish of August after they reached their 52-week excessive. Wells Fargo WFC, which joins JPMorgan in kicking off the Q3 earnings season for the Finance sector on Friday, October 11th, is down solely half that a lot in that interval.

The efficiency of those two financial institution shares since August 30th contrasts the S&P 500 index, which gained +0.8% over that point window.

The latest underperformance of JPMorgan and Wells Fargo shares however, these two shares have been standout performers over the previous 12 months, as proven within the chart beneath monitoring the one-year relative efficiency of JPMorgan, Wells Fargo, the S&P 500 index, and the mezzanine stage Zacks Main Banks Business.

Picture Supply: Zacks Funding Analysis

Driving these shares’ latest underperformance is the mix of renewed financial progress worries and the influence of decrease rates of interest on near-term web curiosity incomes.

The financial progress overhang is a much more vital subject for banks like JPMorgan and Wells Fargo because it not solely drives the demand for credit score but additionally the well being of the prevailing mortgage portfolio.

Mortgage demand has been anemic in latest quarters, with trade information suggesting mortgage progress of about +1% in Q3. The beginning of the Fed’s easing cycle is unlikely to have an instantaneous influence on this rating, however we are able to moderately anticipate an bettering mortgage demand outlook in 2025, notably if the financial system can keep away from the scary recessionary end result.

Regarding credit score high quality, the issues within the business actual property (CRE) market are well-known and already adequately provisioned for on the main banks. Past CRE, mixture bankruptcies within the U.S. are up considerably from the Covid-driven low of early 2022, however the progress fee has been leveling off in latest months. With present chapter ranges roughly 30% beneath pre-Covid averages, the latest slowing of the chapter progress tempo is doubtless indicative of improved family steadiness sheets. However as with the outlook for mortgage demand, a benign credit score high quality outlook wants the Fed’s easing cycle to assist the financial system keep away from unfavorable progress outcomes.

With respect to funding banking, revenues ought to be up within the low to mid-teens share vary, with year-over-year positive factors within the debt and fairness capital markets actions offset by continued weak point on the M&A facet. The outlook for M&A ought to perk up as soon as the election uncertainty is within the rearview mirror and readability in regards to the political and regulatory atmosphere emerges.

JPMorgan is anticipated to report $4.04 per share in earnings (down -6.7% year-over-year) on $41.01 billion in revenues (up +2.9% YoY). The inventory was modestly up on the final earnings launch on July 12th however was down in response to every of the previous two quarterly releases in April and January 2024. Estimates have modestly come down recently, with the present $4.04 EPS estimate down from $4.05 per week again and $4.06 a month again.

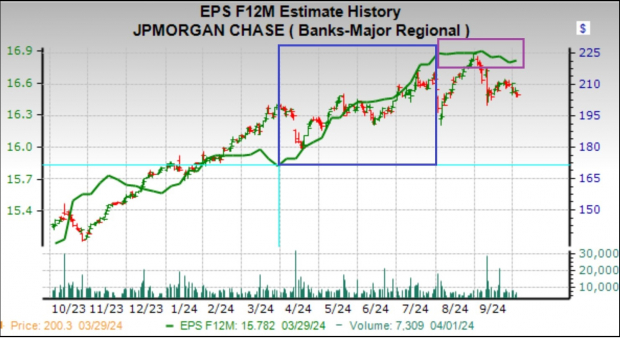

The chart beneath reveals the JPM inventory value efficiency relative to how the ahead 12-month consensus EPS estimate has developed.

Picture Supply: Zacks Funding Analysis

The darkish inexperienced line on this chart represents the ahead EPS estimate, which now we have highlighted in two colours, with the blue spotlight representing the interval from April 1st by way of 30th and the purple spotlight depicting the interval since then. As you possibly can see above, estimates had been steadily going up within the first interval and have been flat to modestly down because the begin of September 2024.

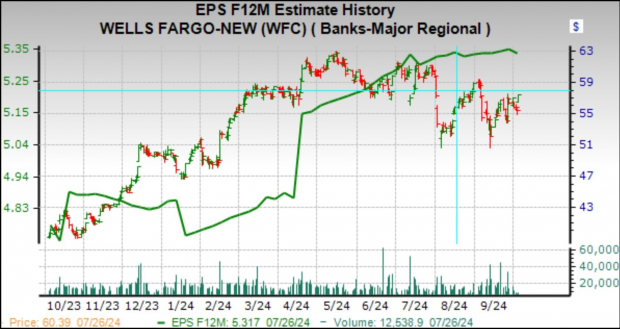

Wells Fargo is anticipated to report EPS of $1.27 (down -8.6% year-over-year) on $20.38 billion in revenues (down -2.3% YOY). Estimates for Q3 have largely been unchanged because the interval obtained underway, with the comparatively long-term revisions development on the constructive facet, as proven within the chart beneath of inventory value relative to the ahead 12-month consensus EPS estimates.

Picture Supply: Zacks Funding Analysis

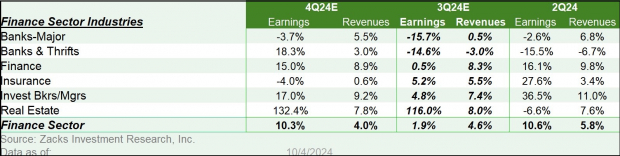

The Zacks Main Banks trade, of which JPMorgan and Wells Fargo are an element, is anticipated to earn -15.7% much less earnings in 2024 Q3 on +0.5% larger revenues. Please notice that this trade introduced in roughly 50% of the Zacks Finance sector’s complete earnings over the trailing four-quarter interval.

Picture Supply: Zacks Funding Analysis

As you possibly can see above, Q3 earnings for the Zacks Finance sector are anticipated to be up +1.9% from the identical interval final 12 months on +4.6% larger revenues.

Regardless of the large financial institution shares’ outperformance over the previous 12 months, they’re nonetheless low cost on most typical valuation metrics. The chart beneath reveals a 10-year historical past of the Zacks Main Banks trade for a ahead 12-month P/E foundation.

Admittedly, the trade isn’t as low cost as in October 2022 when it traded at 7.1X. However the present 9.1X a number of compares to a 10-year excessive of 12.3X, a low of seven.1X, and a median of 9.9X.

Trying relative to the market as an entire, the Zacks Main Banks trade is at the moment buying and selling at 42% of the S&P 500 ahead 12-month P/E a number of. Over the past ten years, the trade has traded as excessive as 69% of the index, as little as 39%, and a median of 53%, because the chart beneath reveals.

Picture Supply: Zacks Funding Analysis

At a time when the S&P 500 index is at or close to its report stage, the Finance sector’s discounted valuation must be one of the crucial enticing funding spots available in the market.

That is notably so for these buyers who consider that the financial system is headed in the direction of a smooth touchdown that can have all of the useful knock-on results on this economically delicate house concerning credit score losses and mortgage demand.

The Earnings Large Image

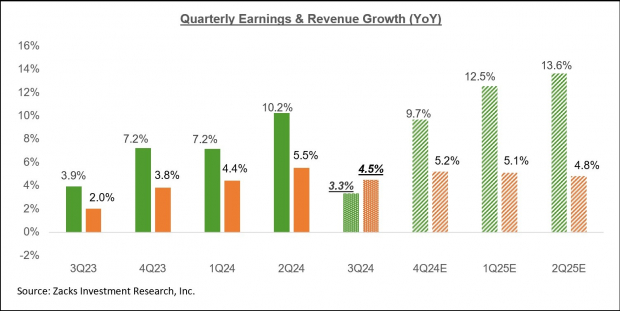

Whole Q3 earnings for the S&P 500 index are anticipated to be up +3.3% from the identical interval final 12 months on +4.5% larger revenues. This could observe the +10.2% earnings progress for the index within the previous interval on +5.5% larger revenues.

Common readers of our earnings commentary are accustomed to our sanguine view on company profitability; the earnings image isn’t nice, however it isn’t dangerous both.

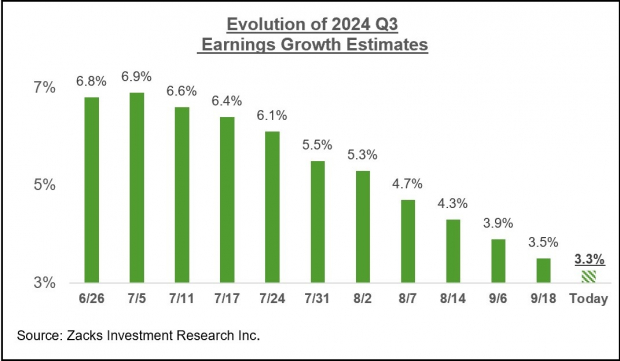

The one latest unfavorable growth on this entrance is the reversal of the sooner favorable revisions development that now we have frequently flagged in our commentary. This unfavorable revisions development is especially notable regarding expectations for 2024 Q3, with earnings estimates for the interval getting revised down rather more than we had seen in different latest intervals. You’ll be able to see this within the chart beneath, which tracks the evolution of Q3 earnings progress expectations over the past couple of months.

Picture Supply: Zacks Funding Analysis

Not solely is the magnitude of cuts to Q3 estimates greater than what we noticed within the comparable intervals for the final three quarters, however additionally it is widespread and never concentrated in a single or a number of sectors.

Of the 16 Zacks sectors, estimates have been revised down for 14 sectors, with the Transportation, Power, Enterprise Companies, and Aerospace sectors struggling the most important declines. The Tech and Finance sectors are the one sectors whose estimates have modestly risen because the interval obtained underway.

The chart beneath reveals the Q3 earnings and income progress expectations within the context of what we noticed in precise outcomes over the previous 4 quarters and what’s anticipated over the next three quarters.

Picture Supply: Zacks Funding Analysis

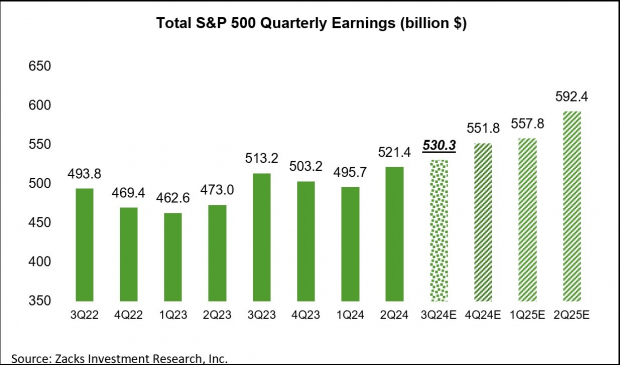

However the aforementioned unfavorable revisions development, the expectation is for an accelerating progress development over the approaching intervals. Additionally, the combination earnings complete for the interval is anticipated to be a brand new all-time quarterly report, because the chart beneath reveals.

Picture Supply: Zacks Funding Analysis

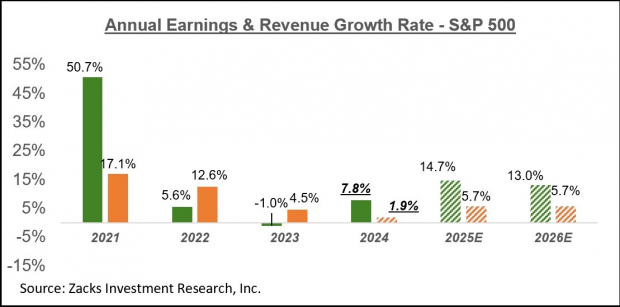

The chart beneath reveals the general earnings image on a calendar-year foundation, with +7.8% earnings progress this 12 months adopted by double-digit positive factors in 2025 and 2026.

Picture Supply: Zacks Funding Analysis

Please notice that this 12 months’s +7.8% earnings progress improves to +9.7% on an ex-Power foundation.

The Q3 Earnings Season Scorecard

The JPMorgan and Wells Fargo stories is not going to be the primary Q3 outcomes, because the quarterly reporting cycle has already begun. Firms with fiscal quarters ending in August have been releasing ends in latest days, which all get clubbed with the September-quarter reporting tally. By Friday, October 4th, now we have such August-quarter outcomes from 21 S&P 500 members.

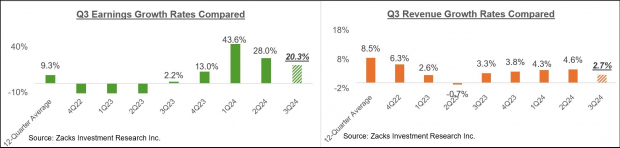

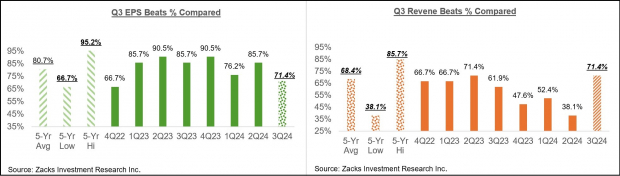

Whole earnings for these 21 index members which have already reported outcomes are up +20.3% from the identical interval final 12 months on +2.7% larger revenues, with 71.4% beating EPS estimates and 71.4% beating income estimates.

The comparability charts beneath put the Q3 earnings and income progress charges in a historic context.

Picture Supply: Zacks Funding Analysis

The comparability charts beneath put the Q3 EPS and income beats percentages in a historic context.

Picture Supply: Zacks Funding Analysis

It’s untimely to establish any developments at this very early stage, however the favorable comparability of the income beats share might be vital if it endures by way of the remainder of the Q3 reporting cycle.

For an in depth have a look at the general earnings image, together with expectations for the approaching intervals, please try our weekly Earnings Tendencies report >>>>Earnings Growth Set to Accelerate

Zacks’ Analysis Chief Names “Inventory Most More likely to Double”

Our group of consultants has simply launched the 5 shares with the best chance of gaining +100% or extra within the coming months. Of these 5, Director of Analysis Sheraz Mian highlights the one inventory set to climb highest.

This prime choose is among the many most progressive monetary corporations. With a fast-growing buyer base (already 50+ million) and a various set of leading edge options, this inventory is poised for large positive factors. After all, all our elite picks aren’t winners however this one may far surpass earlier Zacks’ Shares Set to Double like Nano-X Imaging which shot up +129.6% in little greater than 9 months.

Free: See Our Top Stock And 4 Runners Up

Wells Fargo & Company (WFC) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.