When deciding on dividend-paying shares, one of many first issues that buyers have a look at is, in fact, the annual yield.

However are high-yield shares at all times the very best route for income-focused buyers? Let’s break it down.

Are Excessive-Yield Shares Finest?

At a fast look, a dividend-paying inventory with a steep annual yield certainly looks like a stable funding from an income-focused standpoint. That is notably true from a shorter-term perspective, however it’s not at all times that straightforward and clear-cut.

Dividend yields fluctuate, as they’re a perform of share worth motion. If the inventory goes up, the yield goes down, and vice versa. Traders needs to be absolutely conscious of ‘dividend traps,’ a scenario through which an attractive annual yield has been attributable to poor share efficiency.

The chance to the preliminary funding is commonly larger in these conditions, given the already damaging sentiment inflicting poor worth motion. Keep in mind, shares can at all times go decrease than beforehand thought, and also you don’t need to get trapped in bearish worth motion.

However for individuals who search reliability, concentrating on firms which have a wealthy historical past of accelerating payouts are prime concerns. Dividend Aristocrats mirror these firms, as firms within the membership have upped their dividend payouts for no less than 25 consecutive years and are included within the S&P 500, owing to well-established and profitable enterprise operations.

Just a few firms within the elite membership embrace Johnson & Johnson JNJ, Coca-Cola KO, and Procter & Gamble PG.

Under are charts illustrating these firms’ dividends paid on an annual foundation.

Johnson & Johnson

JNJ shares at the moment yield 3.0% yearly.

Picture Supply: Zacks Funding Analysis

Coca-Cola

KO shares at the moment yield 2.7% yearly.

Picture Supply: Zacks Funding Analysis

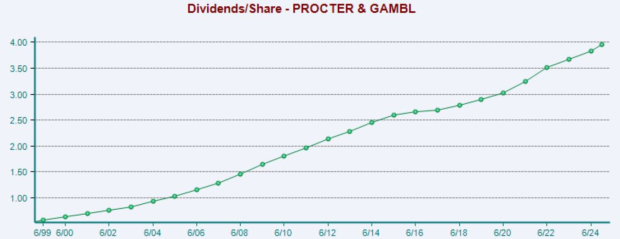

Procter & Gamble

PG shares at the moment yield 2.3% yearly.

Picture Supply: Zacks Funding Analysis

Backside Line

Dividends include many clear advantages, together with a passive revenue stream and a defend in opposition to drawdowns in different positions.

And in relation to consistency, members of the elite Dividend Aristocrat group, which incorporates Johnson & Johnson JNJ, Coca-Cola KO, and Procter & Gamble PG, have all delivered greater payouts for years.

5 Shares Set to Double

Every was handpicked by a Zacks professional because the #1 favourite inventory to realize +100% or extra in 2024. Whereas not all picks could be winners, earlier suggestions have soared +143.0%, +175.9%, +498.3% and +673.0%.

Many of the shares on this report are flying underneath Wall Road radar, which offers a terrific alternative to get in on the bottom flooring.

Today, See These 5 Potential Home Runs >>

CocaCola Company (The) (KO) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Procter & Gamble Company (The) (PG) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.