Trump Tariffs Shake US Inventory Market

Although Donald Trump was merely a civilian on the time (albeit very well-known), he has been voicing considerations about how international locations like Japan, China, and Germany have taken benefit of sentimental U.S. commerce insurance policies for years. Now, in his second presidential time period, Trump is appearing on his instinct and guarantees to his voters to hit international locations again with retaliatory tariffs to cease the move of fentanyl, convey commerce imbalances to an equilibrium, and return America to the manufacturing powerhouse it as soon as was.

To this point, Wall Avenue is taking a dim view of the tariff coverage. The S&P 500 Index ETF (SPY) is down 5% over the previous month, volatility is rising, and intraday headlines from Trump and his financial advisors are inflicting “tape bombs” that swing the market violently intraday. Although the market motion has been ugly in response to the tariffs within the short-term, are buyers overreacting?

Pullbacks are Regular, Even in Bull Markets

The S&P 500 Index has gained ~40% because the bear market backside in October 2022. That stated, skilled buyers perceive that markets don’t transfer in a straight line. As an illustration, there have been a number of 5% corrections over the course of the present bull market and almost 100 since 1950! Maybe buyers have been searching for a cause to promote, and tariffs have been that cause.

Election Seasonality Recommended a Correction was Possible

Over the previous few years, historic seasonality patterns have been one of the vital invaluable and correct technique of predicting the market’s subsequent transfer. Even earlier than the tariffs have been introduced, the post-election seasonality sample instructed that Q1 fairness weak spot was seemingly. The excellent news is that this weak spot sometimes subsides, and markets backside extra typically within the again half of March than another time of 12 months.

Picture Supply: Hirsch Holdings, (@almanactrader)

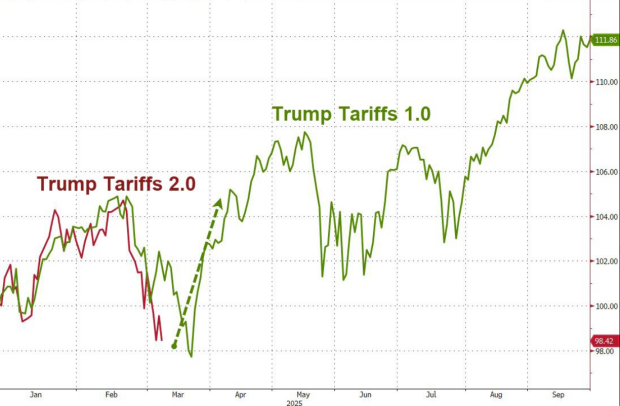

Historic Precedent: Déjà vu?

In the meantime, buyers can depend on historic precedent. In any case, Trump was president and applied tariffs earlier than.

Picture Supply: Zacks Funding Analysis

200-Day Transferring Common

For the reason that 2022 lows, all the bull market has been contained above the 200-day shifting common. Although Nasdaq 100 Index ETF (QQQ) has visited the 200-day a number of instances, every time the market has discovered assist. Will this time be totally different?

Picture Supply: TradingView

Volatility Above the 200-Day MA Can Be Bullish

Ryan Detrick, Chief Market Strategist at Carson Funding Analysis, made an attention-grabbing discovery:

“Traditionally, when the S&P 500 has skilled 5 consecutive days of 1% strikes whereas remaining above its 200-day MA (like it’s now), it has carried out nicely over the next six months, averaging an 11.0% acquire and rising 91.7% of the time.”

Fee Minimize Odds on the Rise

The Trump Administration has been lobbying for decrease rates of interest for months. Although the U.S. Federal Reserve acts independently, current fee minimize odds counsel that the Trump tariffs might drive Fed Chair Jerome Powell’s hand. Fee minimize probabilities for Could are at 54% and climbing.

Potential Tariff Decision

Although Trump says he needs to go away tariffs on completely, I choose to look at for what an individual does slightly than what they are saying. Trump is probably going utilizing tariffs as a bargaining chip to get higher commerce offers for the U.S. In the meantime, indicators of potential resolutions are rising. Earlier, Trump stated:

“After talking with President Claudia Sheinbaum of Mexico, I’ve agreed that Mexico won’t be required to pay tariffs on something that falls underneath the USMCA Settlement. This settlement is till April 2nd. I did this as an lodging and out of respect for President Sheinbaum. Our relationship has been an excellent one, and we’re working laborious collectively on the border, each by way of stopping unlawful aliens from coming into the US and likewise, stopping fentanyl. Thanks, President Sheinbaum, on your laborious work and cooperation!”

The softer rhetoric between rival nations is a welcome signal for buyers.

Decrease Valuations

Buyers have been complaining for years now that tech shares like Tesla (TSLA) and Microsoft (MSFT) have seen valuations get too bloated. Nevertheless, a silver lining is that the current market pullback will result in extra enticing valuations. As an illustration, Nvidia (NVDA) has its lowest P/E ratio because the bull market started.

Picture Supply: Zacks Funding Analysis

Backside Line

The Trump tariffs might have been the spark that triggered a market pullback. Nevertheless, a number of information factors counsel that the market correction could also be short-lived and that tariff considerations are overdone.

Solely $1 to See All Zacks’ Buys and Sells

We’re not kidding.

A number of years in the past, we shocked our members by providing them 30-day entry to all our picks for the whole sum of solely $1. No obligation to spend one other cent.

Hundreds have taken benefit of this chance. Hundreds didn’t – they thought there should be a catch. Sure, we do have a cause. We wish you to get acquainted with our portfolio providers like Shock Dealer, Shares Below $10, Expertise Innovators,and extra, that closed 256 positions with double- and triple-digit beneficial properties in 2024 alone.

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Invesco QQQ (QQQ): ETF Research Reports

SPDR S&P 500 ETF (SPY): ETF Research Reports

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.