Profits period commonly offers a more clear image of instead supplies are underestimated in mix with the support firms can use in their overview.

Right here are 2 top-ranked supplies that seem trading at a discount rate following their solid fourth-quarter records.

Corebridge Financial ( CRBG)

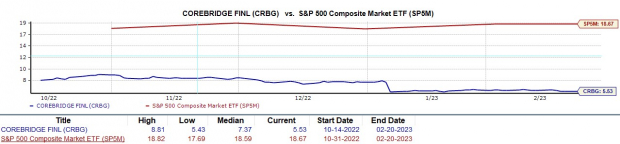

Sporting a Zacks Ranking # 2 (Buy), Corebridge Financials supply makes the debate for trading at a regarded deal following its Q4 record last Friday.

Corebridge remarkably defeated fundamental assumptions by 24% with EPS at $0.88 as well as defeat top-line price quotes by 1% with sales at $5.34 billion. The solid quarterly outcomes are extremely appealing as Corebridge just recently went public last September.

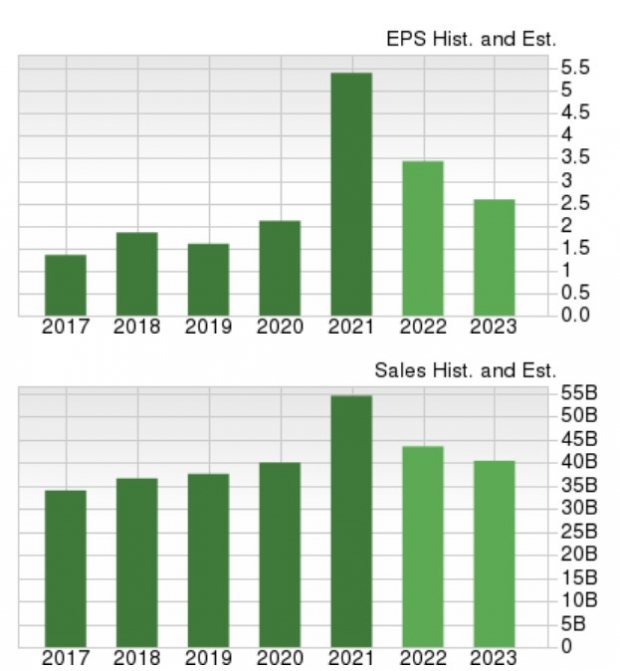

As a service provider of retired life remedies as well as insurance coverage items in the united state, Corebridge’s revenues quote modifications have actually remained to trend greater over the last 60 days. Much more notably, financial 2023 revenues price quotes have actually currently risen following its Q4 outcomes.

Picture Resource: Zacks Financial Investment Research Study

Financial 2023 revenues are currently anticipated to climb up 31% to $3.77 per share contrasted to EPS of $2.87 in 2022. And also, financial 2024 revenues are forecasted to stand out an additional 23% to $4.66 per share, based upon Zacks price quotes.

On the leading line, sales are anticipated to be up 6% in FY23 as well as increase an additional 7% in FY24 to $20.35 billion. Much more remarkable, with 2019 sales at $13.21 billion financial 2024 would certainly stand for 54% development from pre-pandemic degrees.

For a supply trading at simply $20 a share presently, CRBG’s fundamental development is extremely appealing as well as indicate the supply being underestimated. Corebridge supply professions at simply 5.5 X onward revenues which is perfectly listed below its historic high of 8.8 X because going public as well as 25% underneath the typical of 7.3 X.

Picture Resource: Zacks Financial Investment Research Study

Moreover, CRBG professions perfectly listed below the market standard of 10.4 X as well as the S&P 500’s 18.6 X. Corebridge supply sporting activities an “A” Design Ratings quality for Worth as well as a total “A” VGM quality for the mix of Worth, Development, as well as Energy.

Corebridge supply is currently down -2% because its IPO in 2014 to a little underperform the S&P 500’s +2% as well as the Insurance Coverage Multi-Line Markets’ +8% throughout this duration. Year to day, shares of CRBG are up +1% to about match its Zacks Subindustry however route the standard’s +6%. Nonetheless, there might definitely be extra upside in 2023 as well as past complying with Corebridge’s outstanding Q4 outcomes as well as the firm’s profits broadening at an excellent speed.

Vale S.A. ( VALE)

Likewise showing off a Zacks Ranking # 2 (Buy) Vale South America supply still looks appealing following its solid Q4 results last Thursday. The mining firm remarkably defeated fundamental assumptions by 30% with Q4 EPS of $0.82, in spite of this being down -42% year over year. 4th quarter sales defeated assumptions by 4% at $11.94 billion, although this was down -9% YoY.

Picture Resource: Zacks Financial Investment Research Study

Vale is just one of the biggest mining firms worldwide, creating iron ore, iron ore pellets, as well as nickel together with manganese ore, ferroalloys, metallurgical as well as thermal coal, copper, platinum team steels (PGMs), gold, silver, as well as cobalt.

Moreover, the solid Q4 results make it rather possible that revenues quote modifications will certainly remain to climb as Vale needs to remain to take advantage of greater asset costs in relationship with high rising cost of living.

Picture Resource: Zacks Financial Investment Research Study

According to Zacks price quotes, Vale’s financial 2023 revenues are forecasted to decrease -21% at $2.83 per share complying with an additional remarkable year. Keeping that being stated, revenues price quotes have actually risen 13% throughout the quarter. Financial 2024 revenues are anticipated to go down an additional -3% however price quotes have actually risen 6% over the last 90 days.

Sales are anticipated to be down -7% in FY23 as well as drop an additional -5% in FY24 to $38.31 billion. Still, financial 2024 sales would certainly be 2% over pre-pandemic degrees with 2019 sales at $37.57 billion.

Picture Resource: Zacks Financial Investment Research Study

And also, Vale supply continues to be appealing from an appraisal viewpoint showing off an “A” Design Ratings quality for Worth. Shares of VALE profession at $17 per share as well as 6X onward revenues which gets on the same level with the market standard as well as well listed below the S&P 500’s 18.6 X.

Also much better, Vale supply professions 93% listed below its decade-long high of 87.6 X as well as at a small discount rate to the typical of 7.4 X. Much more remarkable, Vale supply is currently up +49% over the last 3 years to greatly outshine the S&P 500’s +22% as well as about match the Mining-Iron Markets solid efficiency.

Profits

Both Corebride (CRBG) as well as Vale S.A. (VALE) supplies do seem deals at their present degrees based upon their evaluations from a price-to-earnings point of view with revenues quote modifications likewise increasing. This validates that their economical supply costs need to be appealing to financiers as well as there might effectively be extra upside for CRBG as well as VALE supply.

Simply Launched: Zacks Top 10 Supplies for 2023

Along with the financial investment suggestions talked about over, would certainly you such as to understand about our 10 leading choices for 2023?

From creation in 2012 with November, the Zacks Top 10 Supplies profile has actually tripled the marketplace, getting an excellent +884.5% versus the S&P 500’s +287.4%. Our Supervisor of Study has actually currently brushed with 4,000 firms covered by the Zacks Ranking as well as handpicked the most effective 10 tickers to get as well as keep in 2023. Do not miss your opportunity to still be amongst the very first to participate these just-released supplies.

VALE S.A. (VALE) : Free Stock Analysis Report

Corebridge Financial, Inc. (CRBG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints shared here are the sights as well as viewpoints of the writer as well as do not always show those of Nasdaq, Inc.