What a difference a rally makes. So far this year, the is up more than 6%. Not bad considering the doom and gloom from Wall Street forecasters at the end of 2022. Recall how strategists in early December were projecting large-cap U.S. stocks to finish 2023 in the red. Naturally, the market did the opposite of what most experts were thinking.

Stocks soared to jumpstart the new year. Many regions notched their best January in decades. What’s more, even the left-for-dead 60% stock-40% bond portfolio is off to its hottest beginning to a year since 1991. Put simply: The pundits have been totally wrong—at least based on the first six weeks of 2023.

Does flipping the page from December to January really make a difference?

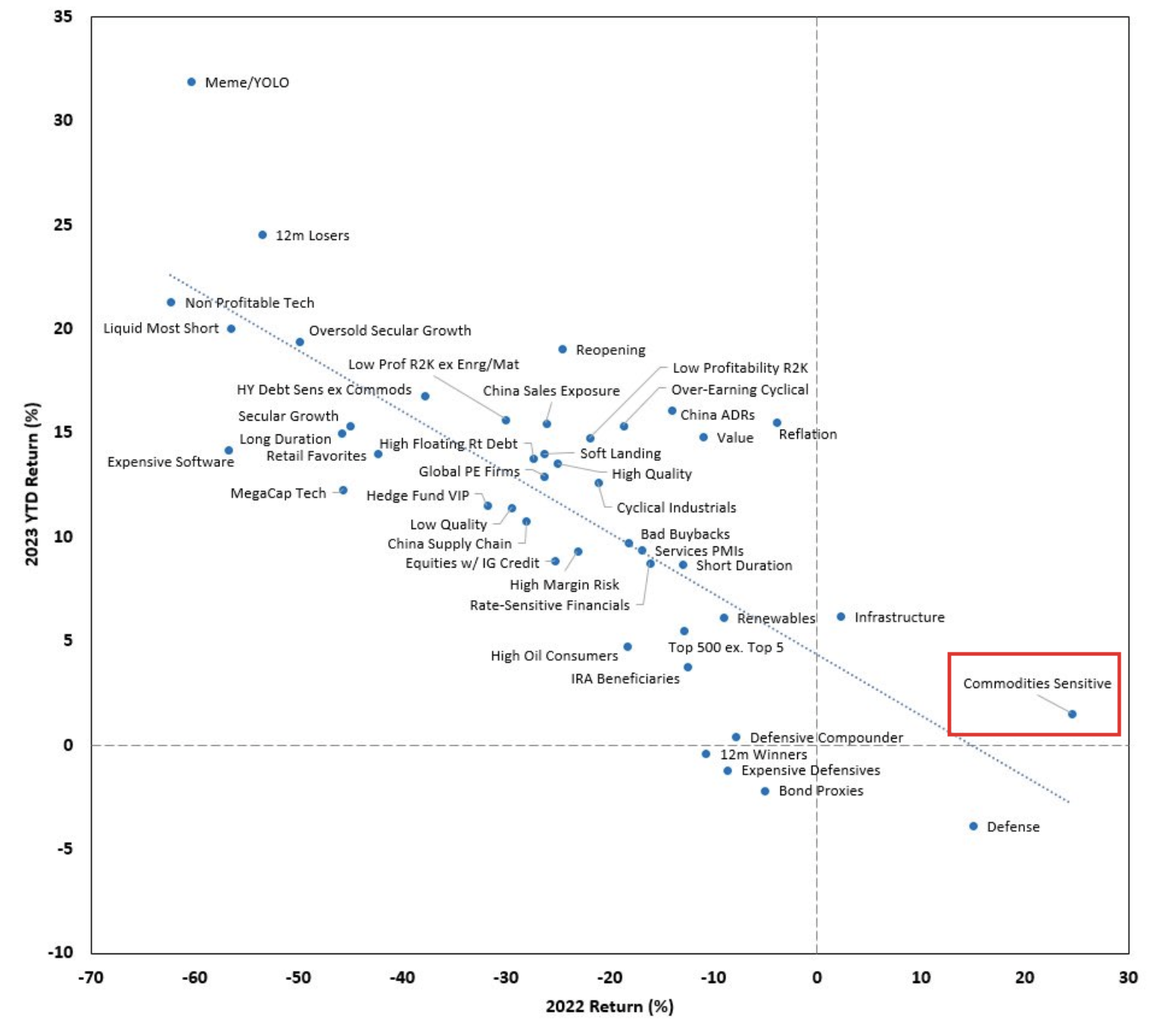

Common sense says no. Still, it’s hard to ignore one fascinating trend: The lousiest assets last year are 2023’s treasures. Goldman Sachs put out a jaw-dropping visual on this quirky relationship. Perhaps the downward pressure on share prices caused by December’s tax-loss selling, coupled with January’s drop in interest rates, set us up for this year’s gains.

Source: Goldman Sachs

The consensus among strategists also called for a first-half recession before a late-year economic recovery. Even that outlook has flipped in just a few weeks. There’s emerging chatter that the U.S. will skirt a recession. January’s report was stellar, while inflation readings since the start of the year have been quite sanguine. We’ll get another read on inflation in Tuesday’s report for January.

Animal spirits are slowly re-emerging. Investors are more upbeat about where things stand, while economists and strategists are walking back their bearish calls made just a handful of weeks ago. It’s yet another instance that underscores the value of ignoring the experts—and sticking with your long-term investment plan.

***

Disclaimer: This article was first published on The Humble Dollar