Capitalists have actually just recently been blown up with financial headings, with a brand-new advancement blinking throughout the display weekly.

Naturally, the insurance coverage originally began with the collapse of Silicon Valley Financial Institution.

And also simply on March 19 th, it was disclosed that Switzerland’s biggest financial institution, UBS UBS, consented to take control of Credit score Suisse CS. Valued at approximately $3.25 billion, the acquisition cost mirrors a considerable price cut.

Currently, First-Citizens BancShares FCNCA remains in the limelight. Why?

On Sunday, the FDIC made a large news–

” The Federal Down Payment Insurance Coverage Company (FDIC) became part of an acquisition and also presumption arrangement for all down payments and also car loans of Silicon Valley Bridge Financial Institution, National Organization, by First– People Financial Institution & & Count On Firm, Raleigh, North Carolina.”

That allows information. And also to little shock, FCNCA shares barked in pre-market trading, opening almost 50% greater.

Complying with the rise, FCNCA shares are up greater than 15% year-to-date, rising it in advance of the S&P 500’s 5% gain.

Photo Resource: Zacks Financial Investment Study

Beginning today, the 17 previous branches of SVB will certainly run under the banner of First-Citizens, with FCNCA presuming all down payments.

In feedback, various other financial supplies, consisting of Western Partnership WAL and also First Republic Count on FRC, likewise discovered purchasers in pre-market trading. Both supplies have actually battled amidst financial issues, underperforming the basic market by broad margins year-to-date.

Photo Resource: Zacks Financial Investment Study

With financiers remaining to absorb these advancements and also the volatility they bring, it’s valuable to take into consideration business seeing their expectations wander greater, such as W.W. Grainger GWW.

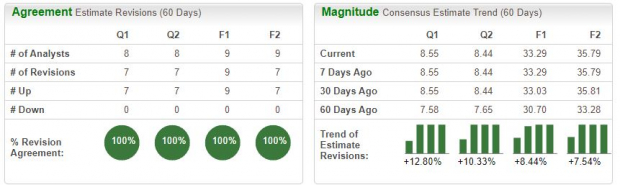

As revealed listed below, experts have actually just recently ended up being favorable on the supply, pressing their fundamental price quotes greater throughout all durations.

Photo Resource: Zacks Financial Investment Study

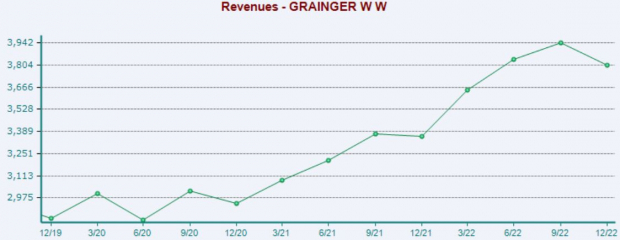

GWW has actually regularly surpassed quarterly price quotes, signing up 6 successive dual beats. In its most recent print, W.W. Grainger published sales 1% over assumptions and also supplied a 2.5% EPS beat.

Photo Resource: Zacks Financial Investment Study

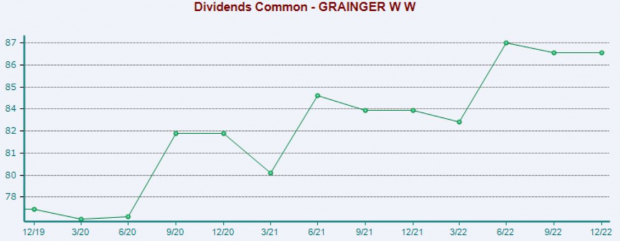

Furthermore, the supply pays a returns, presently producing 1% yearly. While the return isn’t on the high-end, GWW’s 6% five-year annualized returns development price reveals a dedication to significantly awarding its investors.

Photo Resource: Zacks Financial Investment Study

Profits

Capitalists can not capture a break from financial headings, with concerns of transmission complying with advancements within Silicon Valley Financial Institution and also Credit score Suisse taking most of emphasis since late.

Currently, financiers were offered a fresh heading over the weekend break bordering First-Citizens BancShares’ FCNCA acquisition of SVB.

For financiers seeking to avoid from the volatility, targeting supplies with solid expectations, such as W.W. Grainger GWW, can be a terrific factor to consider.

Simply Launched: Zacks Top 10 Supplies for 2023

Along with the financial investment suggestions talked about over, would certainly you such as to learn about our 10 leading choices for 2023?

From creation in 2012 with November, the Zacks Top 10 Supplies profile has actually tripled the marketplace, acquiring an excellent +884.5% versus the S&P 500’s +287.4%. Our Supervisor of Research study has actually currently brushed with 4,000 business covered by the Zacks Ranking and also handpicked the very best 10 tickers to purchase and also keep in 2023. Do not miss your possibility to still be amongst the very first to participate these just-released supplies.

Credit Suisse Group (CS) : Free Stock Analysis Report

UBS Group AG (UBS) : Free Stock Analysis Report

W.W. Grainger, Inc. (GWW) : Free Stock Analysis Report

Western Alliance Bancorporation (WAL) : Free Stock Analysis Report

First Republic Bank (FRC) : Free Stock Analysis Report

First Citizens BancShares, Inc. (FCNCA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also point of views revealed here are the sights and also point of views of the writer and also do not always show those of Nasdaq, Inc.