AMN Healthcare Companies, Inc. AMN nonetheless can’t discover the underside within the healthcare staffing market. This Zacks Rank #5 (Robust Promote) is predicted to see earnings fall 62.4% this 12 months with no rebound anticipated in 2025.

AMN Healthcare gives whole expertise options for healthcare organizations throughout the US. Its companies embody direct staffing, vendor-neutral and managed companies packages, scientific and interim healthcare leaders, momentary staffing, everlasting placement, government search, vendor administration techniques, recruitment course of outsourcing, predictive modeling, language companies, income cycle options and different companies.

Purchasers embody acute-care hospitals, group well being facilities and clinics, doctor follow teams, retail and pressing care facilities, dwelling well being amenities, colleges and different healthcare settings.

AMN Healthcare Beat Once more for the Third Quarter 2024

On Nov 7, 2024, AMN Healthcare Companies reported its third quarter 2024 outcomes and beat on the Zacks Consensus Estimate by $0.03. Earnings have been $0.61 versus the Consensus of $0.58.

It’s particularly spectacular as a result of AMN Healthcare Companies has an ideal 5-year earnings shock observe document. Few corporations made it by the COVID pandemic unscathed within the earnings beat class, particularly one so intricately concerned in healthcare.

However even thought it beat; the corporate nonetheless has not seen the underside but within the post-COVID correction. Demand for medical professionals, particularly nurses, was in any respect time highs throughout the pandemic. However business situations stay difficult.

Income fell 19% to $687.5 million and was additionally down 7% in comparison with the prior quarter, however the firm mentioned this was higher than anticipated.

A giant hit got here within the Nurse and Allied Options section which fell 30% year-over-year to $399 million. It was additionally down 10% simply from the prior quarter.

Journey nurse staffing, which boomed throughout the pandemic, fell 37% year-over-year and 12% sequentially. Allied division income additionally declined 16% year-over-year.

AMN Healthcare has $31 million in money and money equivalents as of Sep 30, 2024. It additionally had whole debt of $1.135 billion.

Analysts Reduce AMN Healthcare’s Earnings Estimates Once more

The corporate’s fourth quarter steering was not encouraging {that a} backside was coming quickly.

The analysts are bearish. 3 have minimize for 2024 and 4 have minimize their earnings estimates for 2025 within the final 30 days.

The 2024 Zacks Consensus Estimate has fallen to $3.09 from $3.15 in that interval. That’s a decline of 62.4% as the corporate made $8.21 final 12 months.

2025 is grim as properly. The Zacks Consensus has fallen to $1.92 from $2.93 within the final month. That’s one other earnings decline of 38.1%.

That is what it seems like on the value and consensus chart.

Picture Supply: Zacks Funding Analysis

AMN Healthcare Companies at 5-Yr Lows: Worth or Lure?

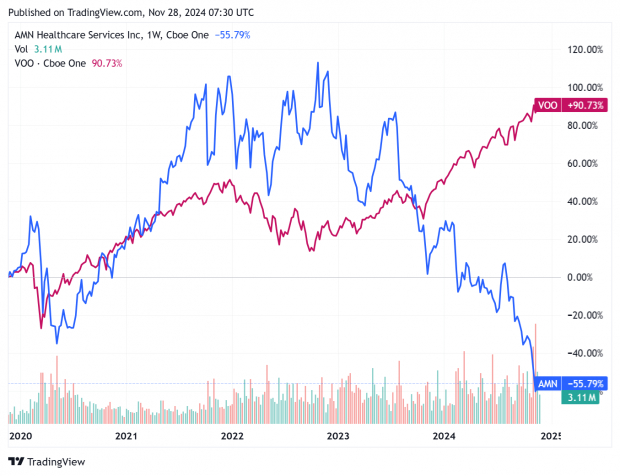

Shares of AMN Healthcare Companies rallied massive throughout the pandemic when the corporate was seeing document income. However they’ve plunged over the previous few years and are actually at new 5-year lows.

Picture Supply: Zacks Funding Analysis

For the 12 months, shares are down 66%.

AMN Healthcare Companies seems to be low-cost, with a ahead price-to-earnings (P/E) ratio of 8.5.

However with these earnings estimates nonetheless being slashed, even for subsequent 12 months, and earnings development nonetheless anticipated to take a dive, AMN Healthcare will not be a worth, however a entice.

For these traders within the staffing corporations, it may be greatest to nonetheless be on the sidelines.

Free As we speak: Cashing in on The Future’s Brightest Vitality Supply

The demand for electrical energy is rising exponentially. On the identical time, we’re working to cut back our dependence on fossil fuels like oil and pure fuel. Nuclear power is a perfect substitute.

Leaders from the US and 21 different international locations lately dedicated to TRIPLING the world’s nuclear power capacities. This aggressive transition may imply great income for nuclear-related shares – and traders who get in on the motion early sufficient.

Our pressing report, Atomic Alternative: Nuclear Vitality’s Comeback, explores the important thing gamers and applied sciences driving this chance, together with 3 standout shares poised to learn probably the most.

Download Atomic Opportunity: Nuclear Energy’s Comeback free today.

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.