The Zacks Constructing Merchandise-Miscellaneous Trade is presently within the backside 19% of 246 Zacks industries, and Arcosa ACA could also be a inventory to keep away from specifically. Having a Zacks Rank #5 (Robust Promote), Arcosa lands the Bear of the Day.

Compounding harder market situations, the producer of infrastructure-related services is going through operational points. Notably, the Indiana Division of Environmental Administration (IDEM) has warned its aggregates division (Arcosa Light-weight) of potential emissions violations.

Arcosa’s Subpar This fall Outcomes

Reporting fourth-quarter leads to early February, Arcosa’s This fall gross sales rose 14% to $666.2 million however missed estimates of $694.2 million by 4%.

Extra regarding, Arcosa reported a internet earnings lack of $7.7 million in comparison with a revenue of $27.1 million in This fall 2023. Adjusted This fall EPS was at $0.46, though this dropped from $0.68 a yr in the past and missed expectations of $0.79 by 42%.

Picture Supply: Zacks Funding Analysis

Declining EPS Revisions & P/E Valuation

Taking away from Arcosa’s interesting progress trajectory is that fiscal 2025 EPS estimates have dropped 13% during the last 30 days from $4.81 to $4.56. Sadly, a development of declining earnings estimate revisions may proceed following the corporate’s eye-catching earnings miss.

Picture Supply: Zacks Funding Analysis

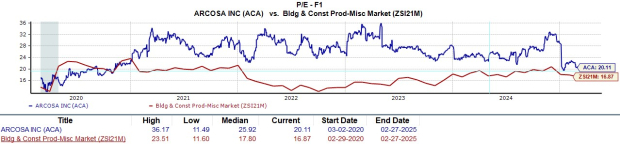

Moreover, whereas Arcosa’s inventory trades at an inexpensive 20.1X ahead earnings a number of, it is noteworthy that that is above the business common of 16.8X with a few of its notable friends within the house being CRH plc CRH and TopBuild BLD.

Picture Supply: Zacks Funding Analysis

Backside Line

As of now, it is unclear if Arcosa can fulfill its lofty earnings expectations with double-digit EPS progress anticipated in FY25. Until after all, earnings estimate revisions maintain declining, which might sign extra draw back danger for ACA shares.

Simply Launched: Zacks Prime 10 Shares for 2025

Hurry – you’ll be able to nonetheless get in early on our 10 prime tickers for 2025. Handpicked by Zacks Director of Analysis Sheraz Mian, this portfolio has been stunningly and persistently profitable. From inception in 2012 by means of November, 2024, the Zacks Prime 10 Shares gained +2,112.6%, greater than QUADRUPLING the S&P 500’s +475.6%. Sheraz has combed by means of 4,400 firms coated by the Zacks Rank and handpicked the perfect 10 to purchase and maintain in 2025. You possibly can nonetheless be among the many first to see these just-released shares with huge potential.

Arcosa, Inc. (ACA) : Free Stock Analysis Report

TopBuild Corp. (BLD) : Free Stock Analysis Report

CRH PLC (CRH) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.