Touchdown a Zacks Rank #5 (Robust Promote) and the Bear of the Day, a decline in earnings estimate revisions is beginning to make it clear why buyers might wish to keep away from Bally’s BALY inventory.

Rising over +20% in 2024, it might be time to take any income in Bally’s inventory because the on line casino and resort operator is a methods away from being worthwhile regardless of this yr’s optimism. Moreover, BALY remains to be down 50% within the final three years and the return to draw back threat has resurfaced after its very subpar Q3 ends in November.

Picture Supply: Zacks Funding Analysis

Excessive Working Bills Result in Weak Q3 Outcomes

Seeing its working bills improve by 20% yr over yr, Bally’s reported a Q3 web lack of $247.86 million or -$1.99 a share. This broadly missed Zacks estimates which known as for a Q3 adjusted lack of -$0.25 a share whereas contracting from EPS of -$1.15 within the comparative quarter.

On the highest line, Q3 gross sales of $629.97 million dipped from $632.48 million a yr in the past and missed estimates of $650.63 million by -3%. Extra regarding is that Bally’s has missed earnings expectations in three of its final 4 quarterly studies and has been in need of gross sales estimates for six consecutive quarters.

Picture Supply: Zacks Funding Analysis

Trade Weak point & Regulatory Scrutiny

Working in a aggressive panorama, Bally’s will not be alone in what has been difficult market situations because the Zacks Inns and Motels Trade is within the backside 23% out of 250 Zacks industries. For hotel-casino operators particularly, regulatory scrutiny has been a problem because it’s additionally noteworthy that there have been ongoing investigations and inquiries into Bally’s accounting practices by the SEC.

Declining EPS Estimates

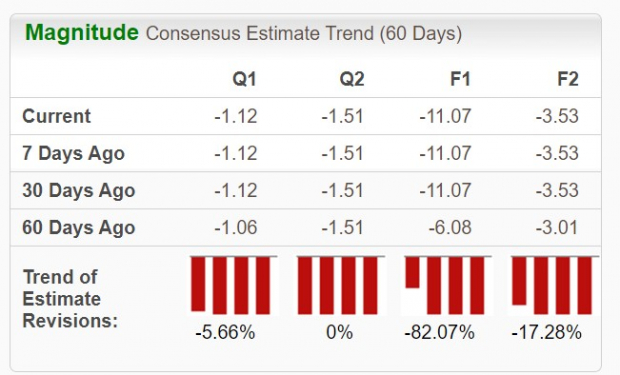

Including gasoline to the hearth after Bally’s current earnings miss is that fiscal 2024 EPS estimates had already plummeted over the past 60 days from expectations of an adjusted lack of -$6.08 a share to -$11.07. Plus, FY25 EPS is now projected at a lack of -$3.53 in comparison with -$3.01 two months in the past.

Picture Supply: Zacks Funding Analysis

Lackluster Prime Line Trajectory

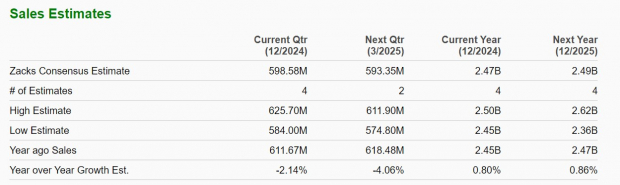

What might begin to bitter investor sentiment for Bally’s future earnings potential is that the corporate is anticipating lower than 1% gross sales progress in FY24 and FY25 with projections remaining close to $2.4 billion.

Picture Supply: Zacks Funding Analysis

Backside Line

Contemplating there are accounting probes into Bally’s monetary practices it is easy to see how buyers could also be inclined to look away from BALY. To that time, the development of declining EPS estimates may be very regarding as Bally’s stays properly beneath the profitability line.

Solely $1 to See All Zacks’ Buys and Sells

We’re not kidding.

A number of years in the past, we shocked our members by providing them 30-day entry to all our picks for the whole sum of solely $1. No obligation to spend one other cent.

1000’s have taken benefit of this chance. 1000’s didn’t – they thought there have to be a catch. Sure, we do have a cause. We wish you to get acquainted with our portfolio companies like Shock Dealer, Shares Beneath $10, Know-how Innovators,and extra, that closed 228 positions with double- and triple-digit positive aspects in 2023 alone.

Bally’s Corporation (BALY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.