Brunswick (BC) is a number one world producer and marketer of leisure marine merchandise, identified for its portfolio of well-regarded manufacturers in boating, engines, and marine know-how. Its merchandise vary from boats and marine engines to superior navigation methods, catering to each leisure {and professional} boating lovers.

Whereas Brunswick stays a pacesetter in its respective trade, the boating trade just isn’t anticipated to do properly within the close to future, with gross sales and earnings projected to stagnate. Reflecting this actuality, Brunswick has a Zacks Rank #5 (Sturdy Promote) ranking, whereas its inventory and the sector extra broadly have carried out poorly year-to-date.

Additional growing the dangers of proudly owning the inventory are a valuation that continues to be properly above its historic averages. Thus, based mostly on this unfavorable setup, I feel traders ought to keep away from Brunswick inventory and search different alternatives till the information improves.

Picture Supply: Zacks Funding Analysis

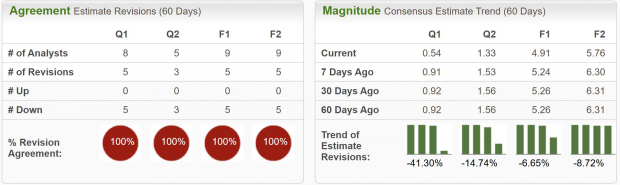

Brunswick Earnings Estimates Crater

The leisure boating trade just isn’t anticipated to do properly over the following yr, because it appears years of purchases have been introduced ahead following the post-Covid increase. Present quarter earnings estimates have been revised decrease by 41.3% and are anticipated to fall 62.7% YoY, whereas FY24 estimates have declined by 6.7% and are projected to fall 44.2% YoY.

Brunswick’s Earnings ESP is very regarding, with the indicator forecasting earnings on the subsequent quarterly report back to miss estimates by a whopping 45.56%. Over the past 4 earnings reviews, BC has missed earnings estimates by a median of 4.88%.

Picture Supply: Zacks Funding Analysis

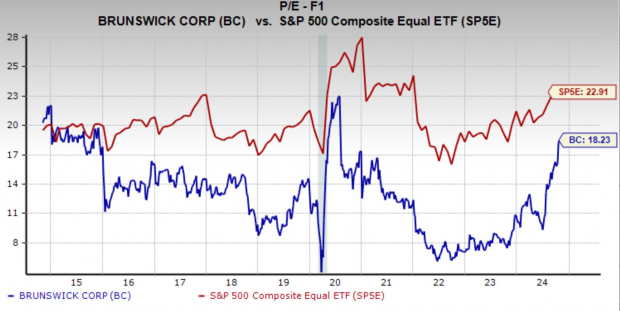

But BC Nonetheless has a Premium Valuation

Even with the falling inventory value and poor outlook, Brunswick nonetheless has a premium valuation. In the present day, it’s buying and selling at a one yr ahead earnings a number of of 18.2x, which is under the market common, however properly above its 10-year median of 13.1x.

With each gross sales and earnings anticipated to fall this yr, a premium valuation like this will increase the draw back danger of proudly owning the inventory.

Picture Supply: Zacks Funding Analysis

Ought to Traders Purchase Brunswick Shares?

Given the numerous downward revisions in earnings estimates and a excessive valuation relative to its historic averages, Brunswick presents appreciable danger to traders. The post-COVID demand surge seems to have pulled ahead boat purchases, leaving the trade with stagnant progress prospects within the close to time period. Brunswick’s Zacks Rank #5 (Sturdy Promote) underscores this difficult outlook, with earnings anticipated to say no considerably year-over-year.

Till trade fundamentals present indicators of restoration and Brunswick’s valuation aligns with its progress outlook, it could be clever for traders to hunt various alternatives in additional resilient sectors.

Zacks Names #1 Semiconductor Inventory

It is just one/9,000th the scale of NVIDIA which skyrocketed greater than +800% since we really helpful it. NVIDIA remains to be robust, however our new high chip inventory has far more room to increase.

With robust earnings progress and an increasing buyer base, it is positioned to feed the rampant demand for Synthetic Intelligence, Machine Studying, and Web of Issues. International semiconductor manufacturing is projected to blow up from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Brunswick Corporation (BC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.