Builders FirstSource, Inc. (BLDR) is a constructing merchandise provider large struggling by means of a tough patch following a increase run between 2020 and 2022, pushed by hovering demand for dwelling and multi-family development and renovations.

Builders FirstSource’s earnings outlook is fading because the housing development market normalizes.

BLDR Inventory Fundamentals

Builders First Supply is among the largest suppliers of constructing merchandise, prefabricated elements, and providers to the skilled marketplace for new residential development and transforming. Builders First Supply works with giant and small clients through its roughly 570 distribution and manufacturing areas across the nation.

Picture Supply: Zacks Funding Analysis

Builders First Supply boasts that it really works in 90 of the highest 100 Metropolitan Statistical Areas.

BLDR grew its gross sales by 18% in 2020 after which posted a mind-blowing 132% YoY gross sales growth in 2021, climbing from $8.56 billion to roughly $20 billion. Builder First Supply adopted that surge up with one other 14% gross sales development in 2022.

Picture Supply: Zacks Funding Analysis

Builders First Supply’s spectacular run was pushed by the housing increase across the U.S., in addition to some acquisitions. The housing development market has cooled and its 2023 gross sales fell 25%, with income set to slide about 3.5% in 2024. BLDR is projected to bounce again with 6% development in 2025 and it stays miles above its pre-Covid income totals.

Backside Line on BLDR Inventory Proper Now

BLDR final quarter mentioned that its revenue margin slipped on the again of “ongoing Multi-Household and core natural normalization.” Builders First Supply stays an excellent firm and the housing scarcity offers wind at its sails over the lengthy haul.

Within the quick run, Builders First Supply’s adjusted earnings are projected to dive 21% in FY24 following a giant pullback in 2023.

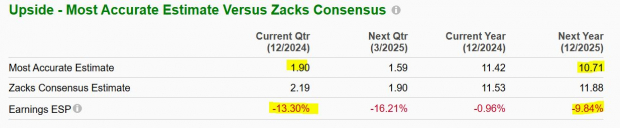

On high of that, its earnings outlook has tanked and its Most Correct estimate for 2025 got here in 10% beneath its beaten-down consensus. Builders First Supply lands a Zacks Rank #5 (Sturdy Promote) proper now. On high of that, its Constructing Merchandise – Retail house sits within the backside 22% of over 250 Zacks industries.

Buyers keen on Builder First Supply would possibly need to look ahead to it to report its This autumn outcomes and supply steerage on February 20 earlier than they leap in.

Zacks’ Analysis Chief Names “Inventory Most More likely to Double”

Our staff of specialists has simply launched the 5 shares with the best likelihood of gaining +100% or extra within the coming months. Of these 5, Director of Analysis Sheraz Mian highlights the one inventory set to climb highest.

This high choose is among the many most revolutionary monetary corporations. With a fast-growing buyer base (already 50+ million) and a various set of innovative options, this inventory is poised for large good points. In fact, all our elite picks aren’t winners however this one may far surpass earlier Zacks’ Shares Set to Double like Nano-X Imaging which shot up +129.6% in little greater than 9 months.

Free: See Our Top Stock And 4 Runners Up

Builders FirstSource, Inc. (BLDR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.