DocuSign, Inc. ( DOCU) markets software program offerings highlighted by e-signature, record generation, agreement lifecycle monitoring, as well as a lot more.

DocuSign supply obtained overheated along with several various other pandemic high-flyers, as well as it presently trades around 80% listed below its heights as Wall surface Road continues to be worried regarding reducing development as well as enhanced competitors from Adobe as well as others. As well as a few of DocuSign’s incomes modifications are trending in the incorrect instructions.

Decreasing

DocuSign supplies different systems for e-signature, record generation, agreement lifecycle monitoring, as well as past. DocuSign markets market as well as department-specific options, as well as it has pre-built assimilations within various other heavyweights in company software program.

DocuSign’s income expanded as even more of the economic situation relocates to the electronic globe. Home loan papers, lots of lawful contracts, as well as a lot more currently frequently reside in digital layout. DOCU’s income skyrocketed following its 2018 IPO, consisting of four-straight years of in between approximately 35% to 45% development. Nonetheless, the firm reported its full-year monetary 2023 cause very early March that revealed income just climbed up 19%.

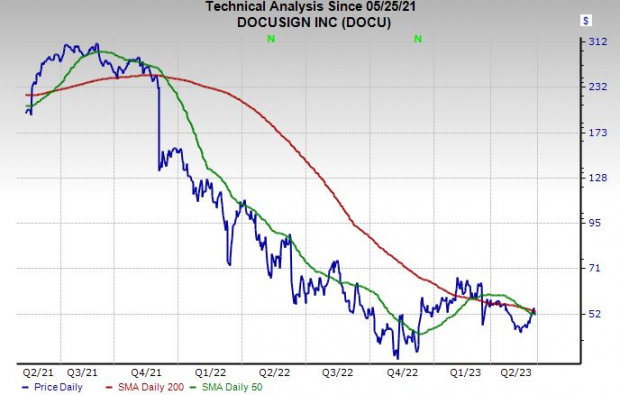

Photo Resource: Zacks Financial Investment Research Study

Zacks approximates ask for DocuSign’s income to climb up 7.3% this year as well as 8% following year. The slowing down income development comes as DOCU deals with a difficult-to-compete-against stretch, a reducing economic situation, as well as expanding competitors from the similarity Adobe ADBE as well as various other huge, a lot more varied technology firms.

DocuSign’s incomes overview has just recently dipped a little for following year. In addition to that, one of the most precise (newest) EPS quote for following year is available in 7% listed below the existing Zacks agreement to assist it land a Zacks Ranking # 5 (Solid Market) right now.

Photo Resource: Zacks Financial Investment Research Study

Profits

DocuSign still runs a strong company, as well as Zacks approximates ask for it to upload 15% modified incomes development this year as well as 10% greater EPS next year. As well as DOCU is trying to reduce expenses to enhance its profits as well as assistance offset reducing income development.

However Wall Surface Road as well as the rate activity are informing capitalists to keep away from DocuSign today. DOCU is still down 34% in the in 2015 as well as it has actually slid around 4% YTD. DOCU’s technological graph shows up a little uneasy too. And also, DocuSign is resting a little over neutral RSI degrees, which suggests it would certainly take much more offering to obtain it near oversold region.

Till there is a worldly modification in its assistance or customers lastly begin to appear in waves to acquire the beaten-down DocuSign, capitalists may intend to consider various other technology supplies that have actually improved their incomes assistance as well as took part a lot more greatly in the 2023 return.

DocuSign will certainly have an opportunity to begin transforming the hearts as well as minds of Wall surface Road when it reports its initial quarter monetary 2024 outcomes on Thursday, June 8.

5 Supplies Ready To Dual

Each was handpicked by a Zacks specialist as the # 1 preferred supply to acquire +100% or even more in 2021. Previous suggestions have actually skyrocketed +143.0%, +175.9%, +498.3% as well as +673.0%.

A lot of the supplies in this record are flying under Wall surface Road radar, which supplies a terrific chance to participate the very beginning.

Today, See These 5 Potential Home Runs >>

Adobe Inc. (ADBE) : Free Stock Analysis Report

DocuSign (DOCU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints shared here are the sights as well as viewpoints of the writer as well as do not always show those of Nasdaq, Inc.